Discover 3 German Stocks Estimated To Be Below Intrinsic Value

Reviewed by Simply Wall St

As the German economy faces a forecasted contraction for a second consecutive year and declining factory orders, investors are increasingly looking for opportunities in undervalued stocks within the market. With Germany's DAX index recently gaining ground amid hopes of economic stimulus, identifying stocks that may be trading below their intrinsic value could present potential opportunities in these uncertain times. A good stock to consider in such conditions is one that demonstrates strong fundamentals and resilience despite broader economic challenges.

Top 10 Undervalued Stocks Based On Cash Flows In Germany

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| technotrans (XTRA:TTR1) | €16.85 | €30.92 | 45.5% |

| init innovation in traffic systems (XTRA:IXX) | €35.40 | €52.02 | 31.9% |

| 2G Energy (XTRA:2GB) | €22.35 | €41.13 | 45.7% |

| Formycon (XTRA:FYB) | €51.30 | €81.83 | 37.3% |

| CeoTronics (DB:CEK) | €5.55 | €10.08 | 45% |

| Gerresheimer (XTRA:GXI) | €81.00 | €111.23 | 27.2% |

| Schweizer Electronic (XTRA:SCE) | €3.78 | €7.19 | 47.5% |

| Your Family Entertainment (DB:RTV) | €2.42 | €4.33 | 44.2% |

| MTU Aero Engines (XTRA:MTX) | €286.00 | €565.49 | 49.4% |

| Basler (XTRA:BSL) | €8.68 | €12.62 | 31.2% |

Let's dive into some prime choices out of the screener.

2G Energy (XTRA:2GB)

Overview: 2G Energy AG, with a market cap of €400.96 million, manufactures systems for decentralized energy supply through its subsidiaries.

Operations: The company generates revenue from its Electric Equipment segment, amounting to €360.90 million.

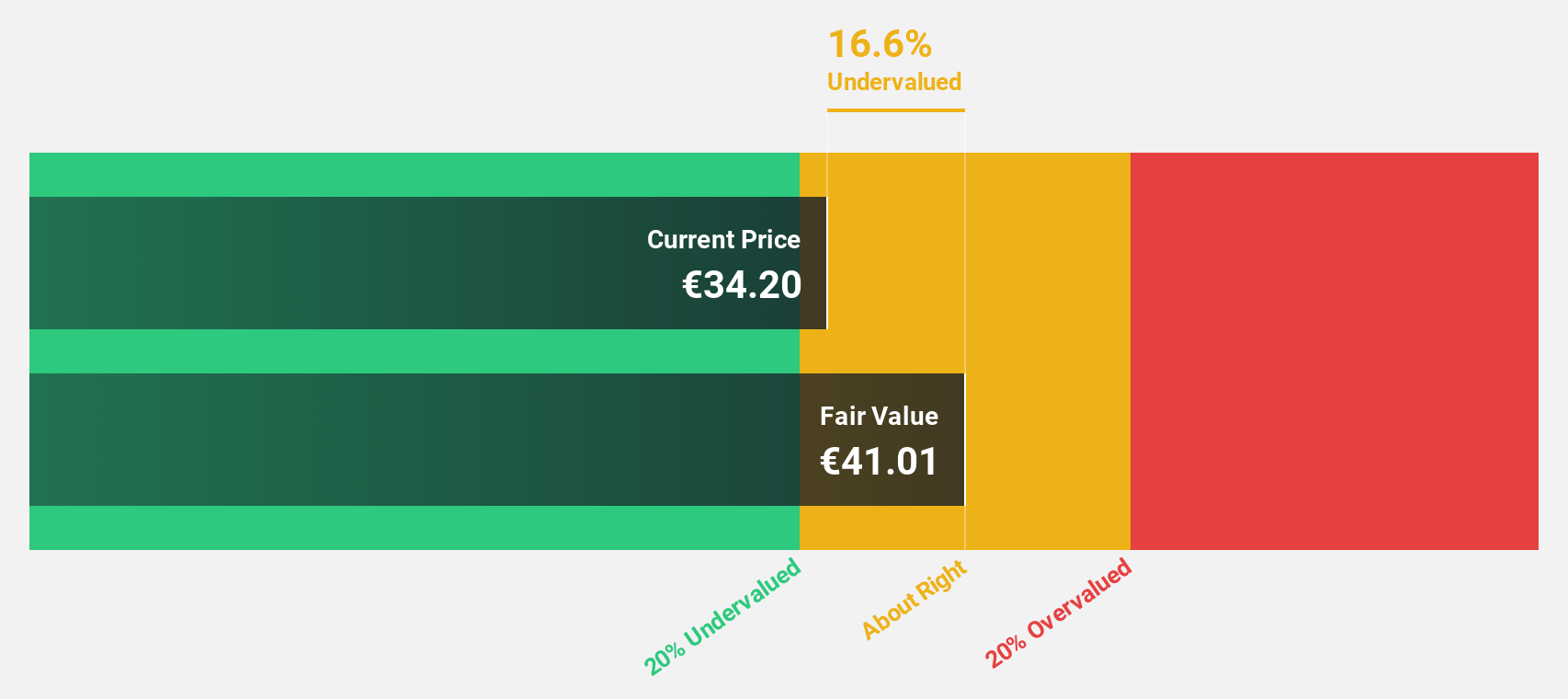

Estimated Discount To Fair Value: 45.7%

2G Energy is trading at €22.35, significantly below its estimated fair value of €41.13, suggesting it may be undervalued based on cash flows. Despite a slight decline in revenue to €152.43 million for the first half of 2024, net income rose to €2.7 million from the previous year. Analysts forecast earnings growth of over 20% annually and expect revenues to grow faster than the German market average, indicating potential for future appreciation.

- Insights from our recent growth report point to a promising forecast for 2G Energy's business outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of 2G Energy.

LPKF Laser & Electronics (XTRA:LPK)

Overview: LPKF Laser & Electronics SE, with a market cap of €232.52 million, develops, manufactures, and sells laser-based solutions for the technology industry worldwide.

Operations: The company's revenue segments include Solar (€48.90 million), Welding (€23.70 million), Development (€28.80 million), and Electronics (€32.40 million).

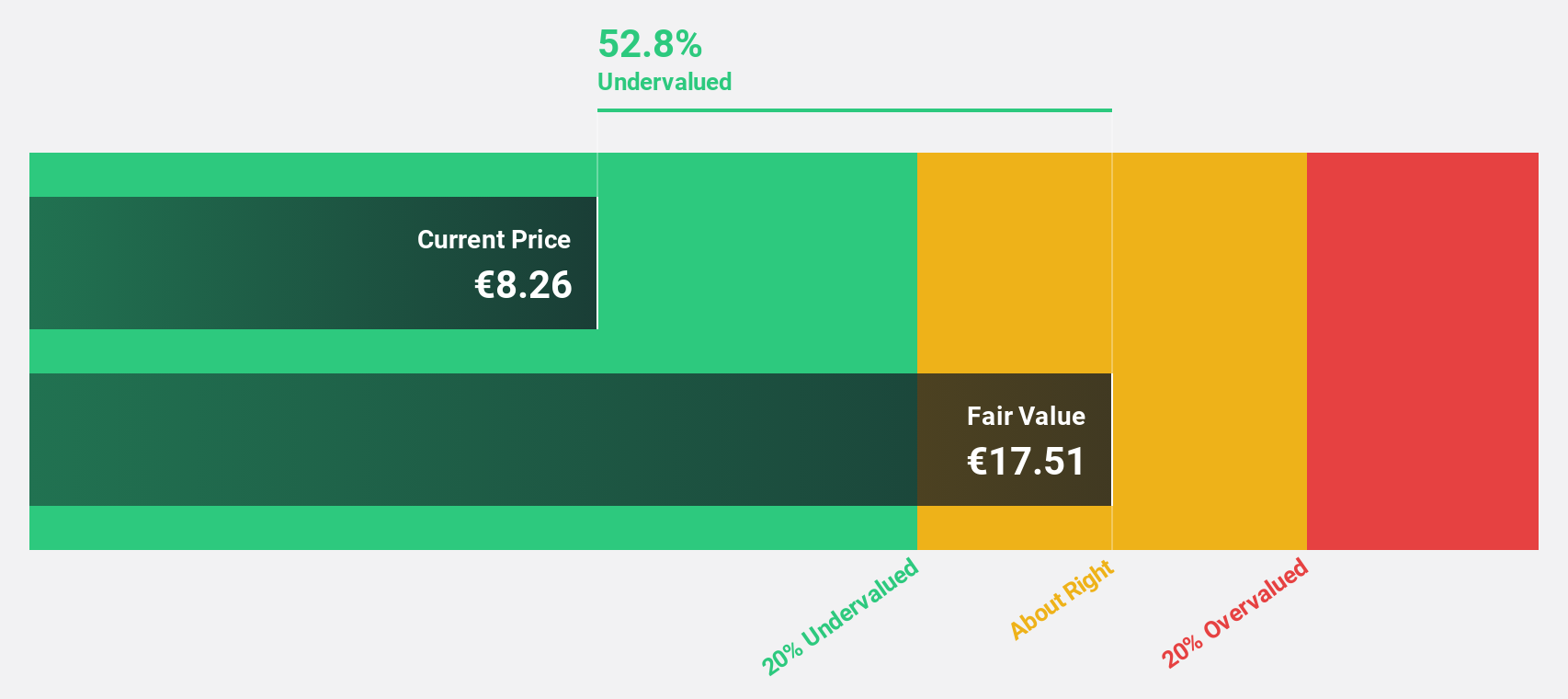

Estimated Discount To Fair Value: 23.5%

LPKF Laser & Electronics is currently trading at €9.5, below its estimated fair value of €12.42, highlighting potential undervaluation based on cash flows. The company became profitable this year and is expected to see significant annual earnings growth of 68.8% over the next three years, outpacing the German market's average growth rate. However, recent financial results showed a net loss for the second quarter despite increased sales compared to last year.

- Our growth report here indicates LPKF Laser & Electronics may be poised for an improving outlook.

- Navigate through the intricacies of LPKF Laser & Electronics with our comprehensive financial health report here.

SAP (XTRA:SAP)

Overview: SAP SE, along with its subsidiaries, offers applications, technology, and services globally and has a market capitalization of approximately €242.68 billion.

Operations: SAP's revenue primarily comes from its Applications, Technology & Services segment, which generated €32.54 billion.

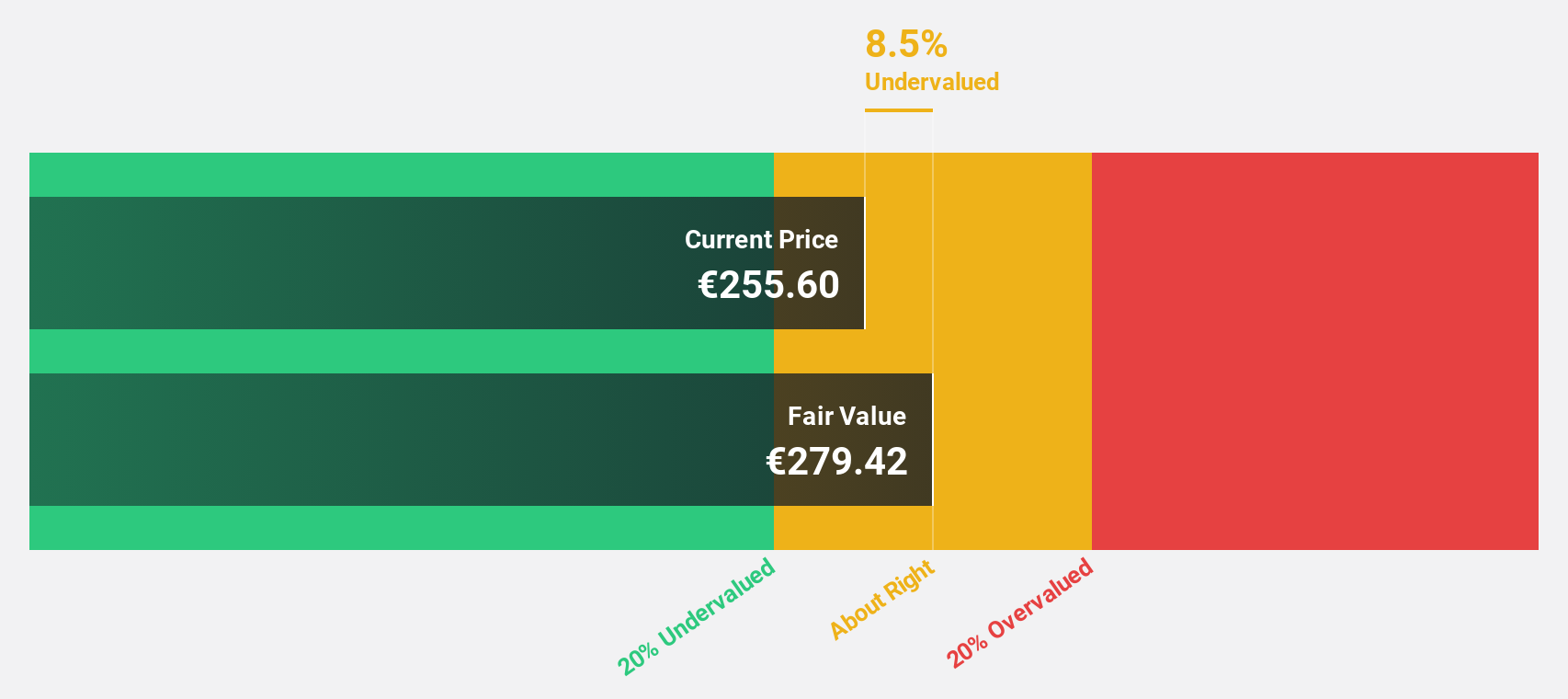

Estimated Discount To Fair Value: 24.1%

SAP is trading at €208.6, significantly below its fair value estimate of €274.83, suggesting potential undervaluation based on cash flows. Earnings are forecast to grow significantly at 37.94% annually, surpassing the German market's growth rate. However, revenue growth is slower than earnings and return on equity remains modest at 16.4%. Recent AI innovations, including Joule enhancements and the SAP Knowledge Graph, highlight strategic advancements in business AI capabilities that could drive future efficiencies and value creation.

- Upon reviewing our latest growth report, SAP's projected financial performance appears quite optimistic.

- Click here to discover the nuances of SAP with our detailed financial health report.

Turning Ideas Into Actions

- Discover the full array of 20 Undervalued German Stocks Based On Cash Flows right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:LPK

LPKF Laser & Electronics

Develops, manufactures, and sells laser-based solutions for the technology industry worldwide.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives