- Germany

- /

- Electrical

- /

- XTRA:2GB

2G Energy (ETR:2GB) jumps 12% this week, though earnings growth is still tracking behind one-year shareholder returns

2G Energy AG (ETR:2GB) shareholders might be concerned after seeing the share price drop 21% in the last quarter. But that doesn't change the fact that the returns over the last year have been pleasing. After all, the share price is up a market-beating 38% in that time.

Since it's been a strong week for 2G Energy shareholders, let's have a look at trend of the longer term fundamentals.

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

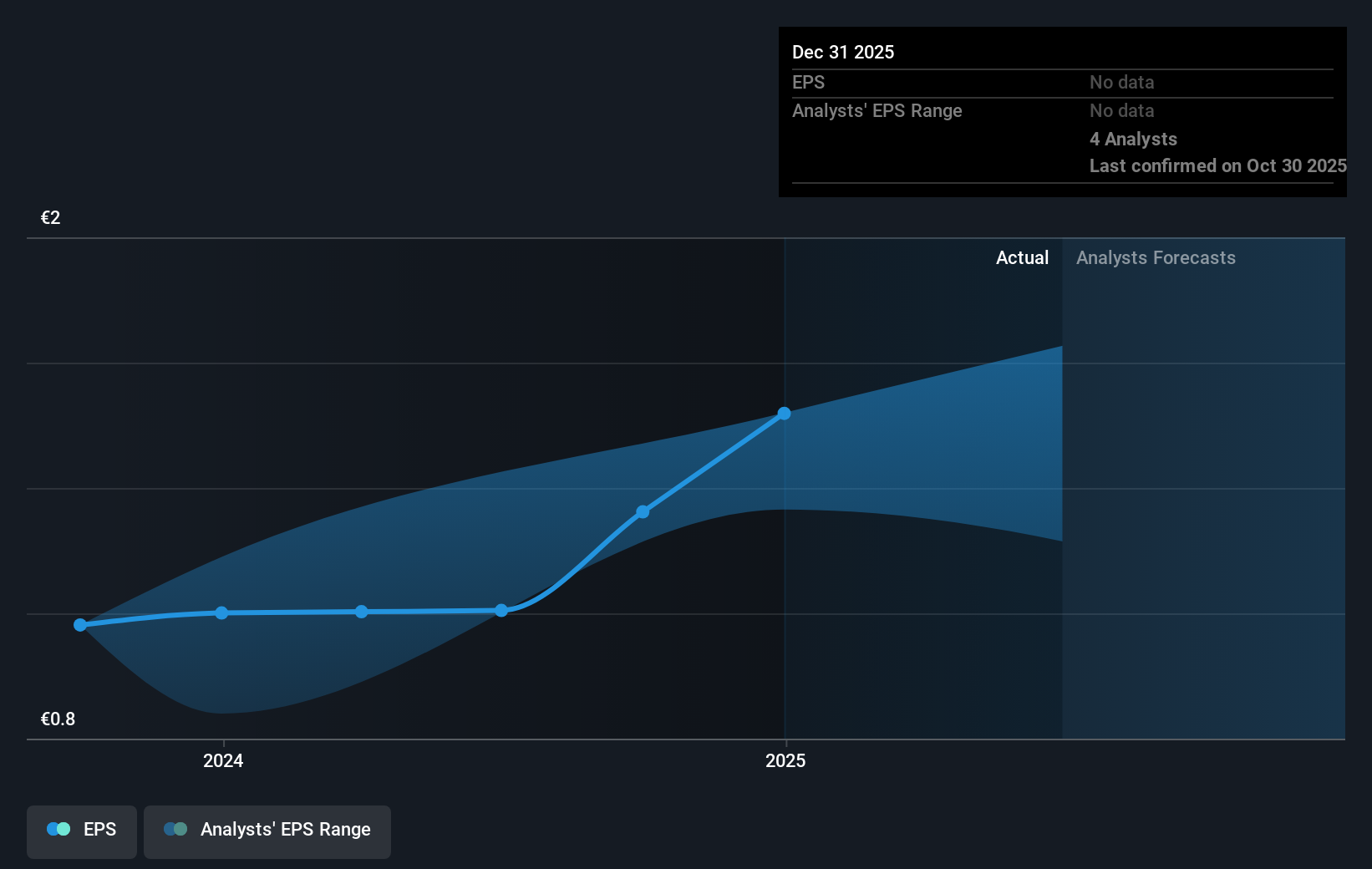

2G Energy was able to grow EPS by 32% in the last twelve months. We note that the earnings per share growth isn't far from the share price growth (of 38%). This makes us think the market hasn't really changed its sentiment around the company, in the last year. It looks like the share price is responding to the EPS.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

We know that 2G Energy has improved its bottom line lately, but is it going to grow revenue? You could check out this free report showing analyst revenue forecasts.

A Different Perspective

We're pleased to report that 2G Energy shareholders have received a total shareholder return of 39% over one year. And that does include the dividend. That gain is better than the annual TSR over five years, which is 7%. Therefore it seems like sentiment around the company has been positive lately. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. Is 2G Energy cheap compared to other companies? These 3 valuation measures might help you decide.

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on German exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:2GB

2G Energy

Manufactures systems for decentralized energy supply in Germany and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success