Is There Still Opportunity in Commerzbank After Shares Jumped 98% in 2024?

Reviewed by Bailey Pemberton

If you’ve found yourself weighing the next move on Commerzbank, you’re certainly not alone. Whether you’ve been tracking its meteoric rise or you’re just scoping out opportunities, there’s no denying that Commerzbank’s stock has given investors plenty to talk about. While the past week and month nudged slightly lower with small pullbacks of -2.9% and -3.1% respectively, the bigger story is the staggering growth over the longer term. Year to date, shares are up nearly 98%. If you zoom out to three and five years, the returns are nothing short of phenomenal, at 315% and 646% gains, painting a vivid picture of renewed optimism and expanding risk appetite in the European banking sector.

Driving these moves are several evolving market trends, from a strengthening eurozone economy to changes in monetary policy and renewed interest in financial stocks. The recent momentum isn’t just a product of market sentiment; it reflects a real shift in how investors are valuing banks like Commerzbank amid changing risk profiles. Of course, with runs like these, the big question is not just “how high can it go?” but “does the stock’s price still reflect what it’s truly worth?”

That’s where a focused look at valuation comes in. Based on the most common investing yardsticks, Commerzbank is undervalued in 3 out of 6 checks, giving it a value score of 3. But standard valuation tools only tell part of the story. Let’s break down what each approach really says, then dive into a smarter way to read the numbers.

Approach 1: Commerzbank Excess Returns Analysis

The Excess Returns method evaluates how much value a company generates above the minimum return required by investors, focusing on the profit achieved from invested capital beyond the cost of equity. This approach highlights not just how much Commerzbank earns but also how effectively it reinvests those earnings to generate additional value for shareholders.

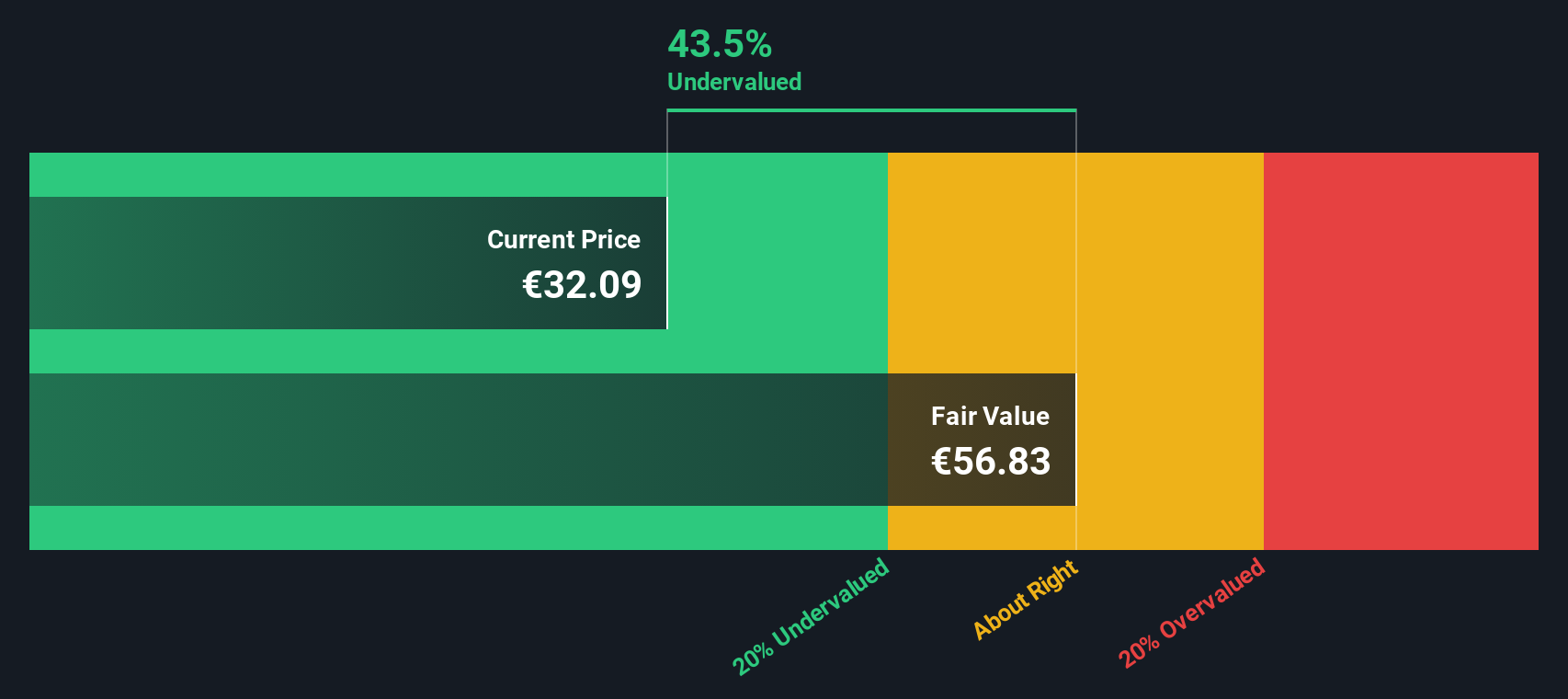

Looking at the data, Commerzbank’s Book Value stands at €30.01 per share, with a Stable Earnings Per Share (EPS) of €3.04, based on projections from 12 analysts. The cost of equity is €1.79 per share, meaning the bank produces an Excess Return of €1.25 per share. The average Return on Equity is 10.30%, which is a robust sign within the industry. Projections see the Stable Book Value at €29.50 per share, drawn from consensus estimates by 6 analysts.

Given these metrics and the current market conditions, the Excess Returns model estimates an intrinsic fair value that is 45.2% above the current price. In plain language, the stock appears significantly undervalued based on how efficiently Commerzbank turns shareholder capital into profit above what the market requires as a minimum.

Result: UNDERVALUED

Our Excess Returns analysis suggests Commerzbank is undervalued by 45.2%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Commerzbank Price vs Earnings

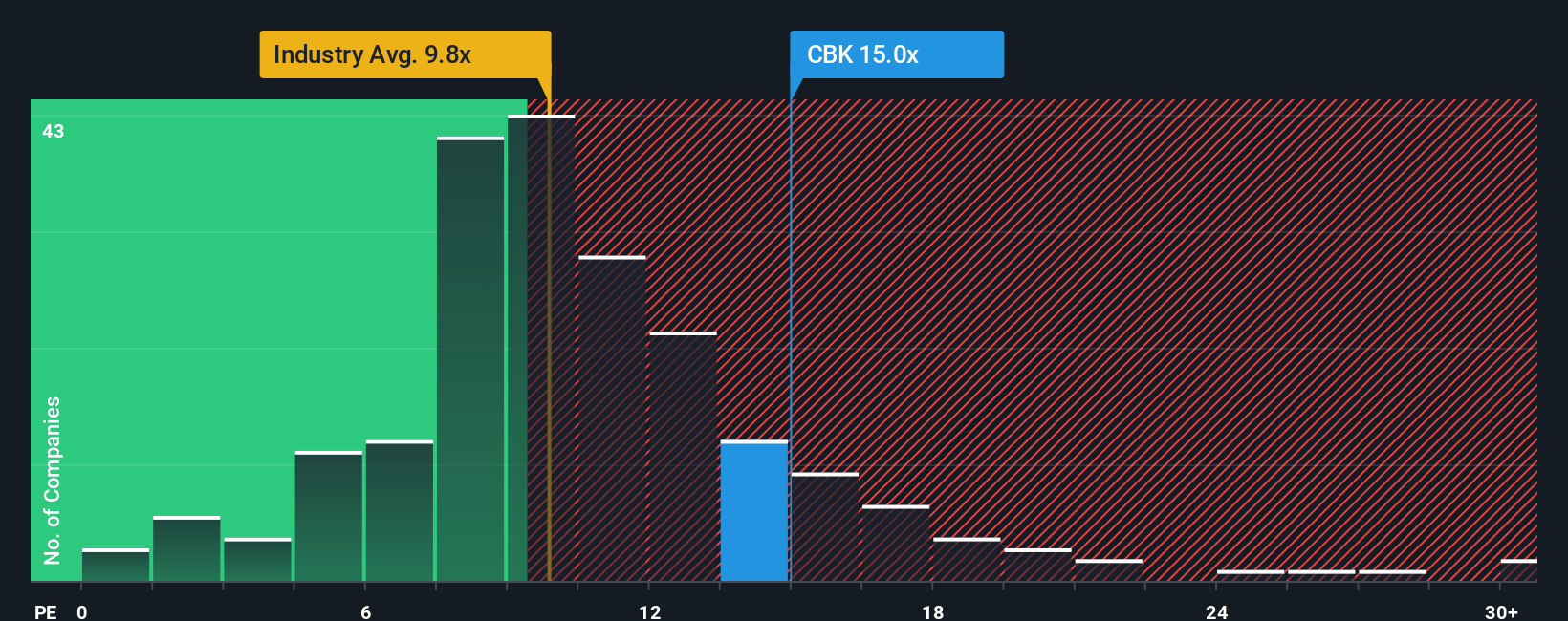

The price-to-earnings (PE) ratio is a popular and practical valuation metric for profitable companies because it directly relates a firm’s share price to its underlying earnings. For banks like Commerzbank, the PE ratio offers a straightforward way for investors to gauge how the market is valuing current profitability and overall growth expectations.

Not all PE ratios are created equal. Higher ratios often suggest the market expects strong future growth or lower risk, while lower ratios could indicate dampened expectations or heightened uncertainty. Factors such as profit margins, risk profiles, and broader banking sector trends can have a significant influence on what counts as a “normal” PE for a given company.

Currently, Commerzbank trades at a PE ratio of 14.34x. This puts it notably above the industry average of 10.16x and the peer group average of 10.32x. At first glance, this premium might suggest overvaluation. However, Simply Wall St’s proprietary Fair Ratio model provides more nuance. The Fair Ratio for Commerzbank is calculated at 14.40x, which takes into account growth prospects, sector dynamics, profit margins, the company’s risk profile, and its size within the market. Unlike standard peer or industry comparisons, the Fair Ratio draws on a richer set of data, giving a more tailored and accurate valuation window. Comparing Commerzbank’s actual PE ratio to its Fair Ratio, they are nearly identical, indicating the stock’s valuation is closely aligned with its fundamental backdrop.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Commerzbank Narrative

Earlier we mentioned there is a better way to understand valuation, so let’s introduce you to Narratives, an intuitive approach that goes beyond numbers by allowing you to capture the story you believe about a company and link it directly to financial forecasts and a fair value estimate.

With Narratives, you can easily express your outlook or thesis on Commerzbank, such as how digital transformation, ESG leadership, or market risks might drive future performance, by outlining your assumptions for growth rates, profit margins, and target multiples.

This story is then translated into a financial forecast, automatically producing a fair value so you can instantly compare that to today’s share price and decide if it aligns with your investment view.

Narratives are interactive, update dynamically as new news and earnings arrive, and are available to all investors on the Simply Wall St Community page, where millions share and debate perspectives.

For example, among current Narratives about Commerzbank, some investors estimate a fair value as high as €36.10, expecting robust digital transformation and sustainable finance tailwinds, while others are more cautious, seeing as low as €21.00 due to regulatory and macroeconomic risks. This underscores how a Narrative brings your unique investment view to life right alongside the most current data.

Narratives empower you to make smarter and more personal investment decisions, easily and continuously, by connecting your story directly to the numbers.

Do you think there's more to the story for Commerzbank? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:CBK

Commerzbank

Provides banking and capital market products and services to private and small business customers, corporate, financial service providers, and institutional clients in Germany, rest of Europe, the Americas, Asia, and internationally.

Excellent balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives