Commerzbank (XTRA:CBK): Exploring Valuation After Recent Gains and Future Growth Potential

Reviewed by Simply Wall St

Commerzbank (XTRA:CBK) shares have caught the eye of investors after recent trading sessions saw modest short-term moves. The German bank’s stock has had a mixed month, which has led many to revisit its long-term performance and valuation story.

See our latest analysis for Commerzbank.

Commerzbank’s 1-month share price return of 13.08% suggests momentum has picked up lately, even as the recent pullback takes a little shine off the rally. Looking at the bigger picture, the stock’s total shareholder return over the past year stands at 111.12% and a remarkable 343.92% over three years. This clearly shows why long-term holders are closely watching its valuation and future growth potential.

If the momentum in banking stocks interests you, now is a great time to broaden your horizons and discover fast growing stocks with high insider ownership

With strong price gains and profitability on the rise, the key question now is whether Commerzbank’s recent run still leaves room for further upside or if the stock’s growth is fully reflected in today’s price.

Most Popular Narrative: 4% Overvalued

Commerzbank’s narrative fair value of €32.25 sits just below the latest close at €33.54, underscoring a tight premium and a market closely watching future earnings catalysts.

Accelerating digital capabilities, such as enhancements to Commerzbank's trading platform, the rollout of AI-driven solutions, and robust fintech adoption, are positioning the bank to lower operating costs, expand fee-based revenues, and attract younger, digital-first customers. These factors may support margin and revenue growth over the coming years.

Want to know which bold financial forecasts are powering this near-the-money valuation? The real catalyst is a digital strategy promising future growth. Find out which levers analysts believe can lift margins and profits beyond the status quo. Dive into the full narrative to decode the ambitious assumptions behind this razor-thin price premium.

Result: Fair Value of €32.25 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, such as delays in digital transformation or economic headwinds. Either of these factors could pressure Commerzbank’s growth trajectory and profitability.

Find out about the key risks to this Commerzbank narrative.

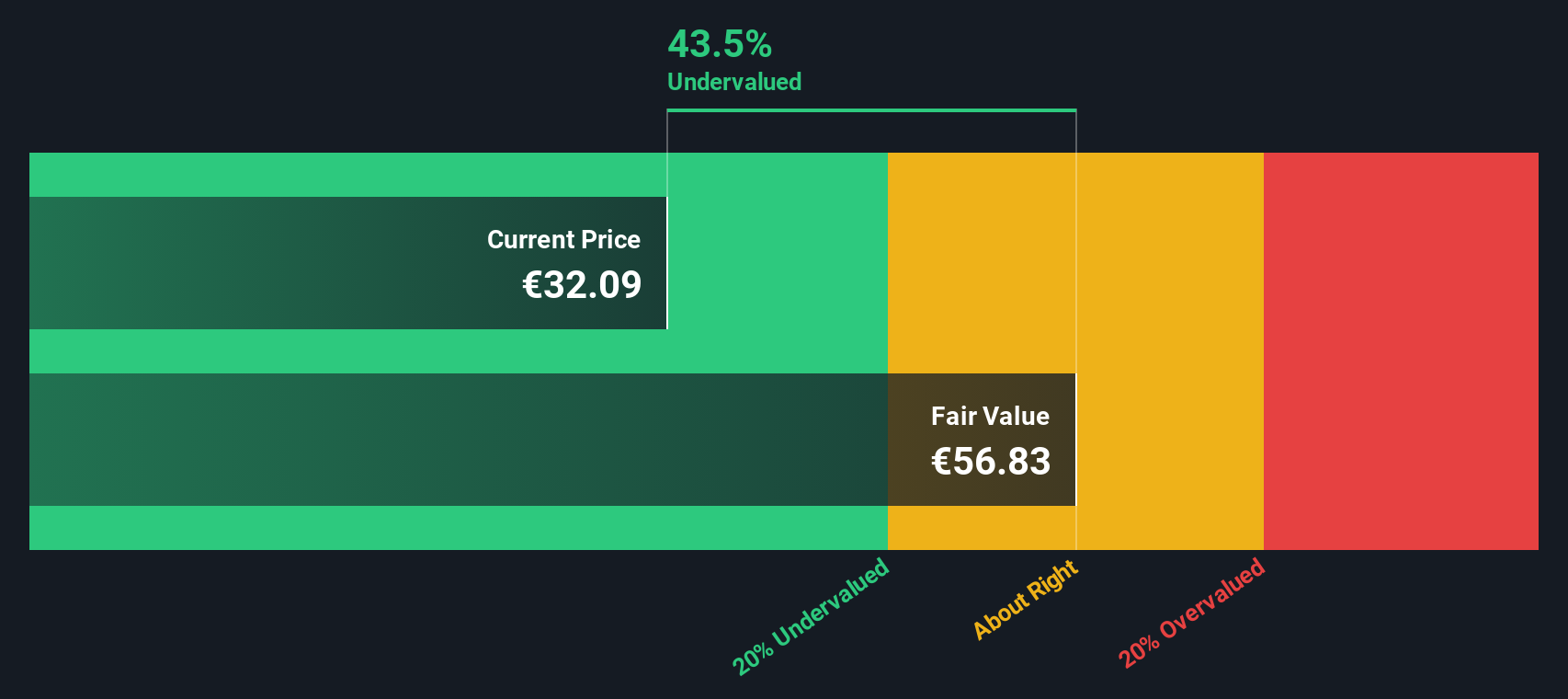

Another View: SWS DCF Model Signals Undervaluation

While recent narratives suggest Commerzbank is slightly overvalued, our SWS DCF model provides a very different perspective. It estimates the fair value at €58.46, which indicates the stock could be trading well below its true worth. Is the current market missing a deeper story on future cash flows?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Commerzbank for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 897 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Commerzbank Narrative

If you think there’s more to the story or want to review the numbers firsthand, assembling your own narrative is fast and easy. Do it your way

A great starting point for your Commerzbank research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for More Smart Investing Moves?

Don’t let the best opportunities pass you by. Supercharge your research with unique stock ideas that match your strategy and goals using these powerful tools:

- Find fresh rewards in markets that are flying under the radar by checking out these 3580 penny stocks with strong financials with proven financial strength.

- Capitalize on the surge of artificial intelligence by exploring these 25 AI penny stocks gaining buzz for their breakthroughs and future potential.

- Boost your income with these 16 dividend stocks with yields > 3% that offer attractive yields and add a strong dividend stream to your portfolio today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:CBK

Commerzbank

Provides banking and capital market products and services to private and small business customers, corporate, financial service providers, and institutional clients in Germany, rest of Europe, the Americas, Asia, and internationally.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives