Is It Too Late to Consider VW After Its 32.5% Surge and EV Momentum?

Reviewed by Bailey Pemberton

- Wondering if Volkswagen is still a value play after its recent run up, or if you are late to the party? Let us break down what the market is really pricing in and where the upside or downside might be hiding.

- Volkswagen's share price has climbed 5.6% over the last week, 13.4% over the past month, and is now up 22.3% year to date and 32.5% over the last year, which suggests investors are warming back up to the stock after a muted few years.

- Much of this momentum reflects renewed optimism around Volkswagen's push into electric vehicles and software defined cars, alongside strategic partnerships aimed at improving margins and competitiveness. At the same time, headlines about regulatory pressure in Europe and intensifying competition from Chinese automakers are reminding investors that this is still a high stakes transition story.

- On our checks, Volkswagen scores a solid 5 out of 6 on valuation, suggesting the market may still be underestimating parts of the business. In the rest of this article we will walk through the different valuation approaches behind that score and, toward the end, explore an even more powerful way to make sense of what Volkswagen might really be worth.

Approach 1: Volkswagen Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow, or DCF, model estimates what a business is worth today by projecting its future cash flows and then discounting them back into today’s euros using a required rate of return.

For Volkswagen, the latest twelve month Free Cash Flow is negative at about €11.0 billion, reflecting heavy investment and cyclical pressures. Analysts then expect cash flows to recover sharply, with projections rising to roughly €3.7 billion in 2026 and €14.2 billion by 2029. Beyond those analyst years, Simply Wall St extrapolates out to 2035, with Free Cash Flow expected to continue growing into the tens of billions of euros.

When all of these future cash flows are discounted back to today and combined with a terminal value, the DCF model arrives at an estimated intrinsic value of about €486 per share. Compared with the current market price, this implies Volkswagen is trading at a roughly 78.0% discount. This suggests the share price is embedding a lot of pessimism about the long term outlook.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Volkswagen is undervalued by 78.0%. Track this in your watchlist or portfolio, or discover 903 more undervalued stocks based on cash flows.

Approach 2: Volkswagen Price vs Earnings

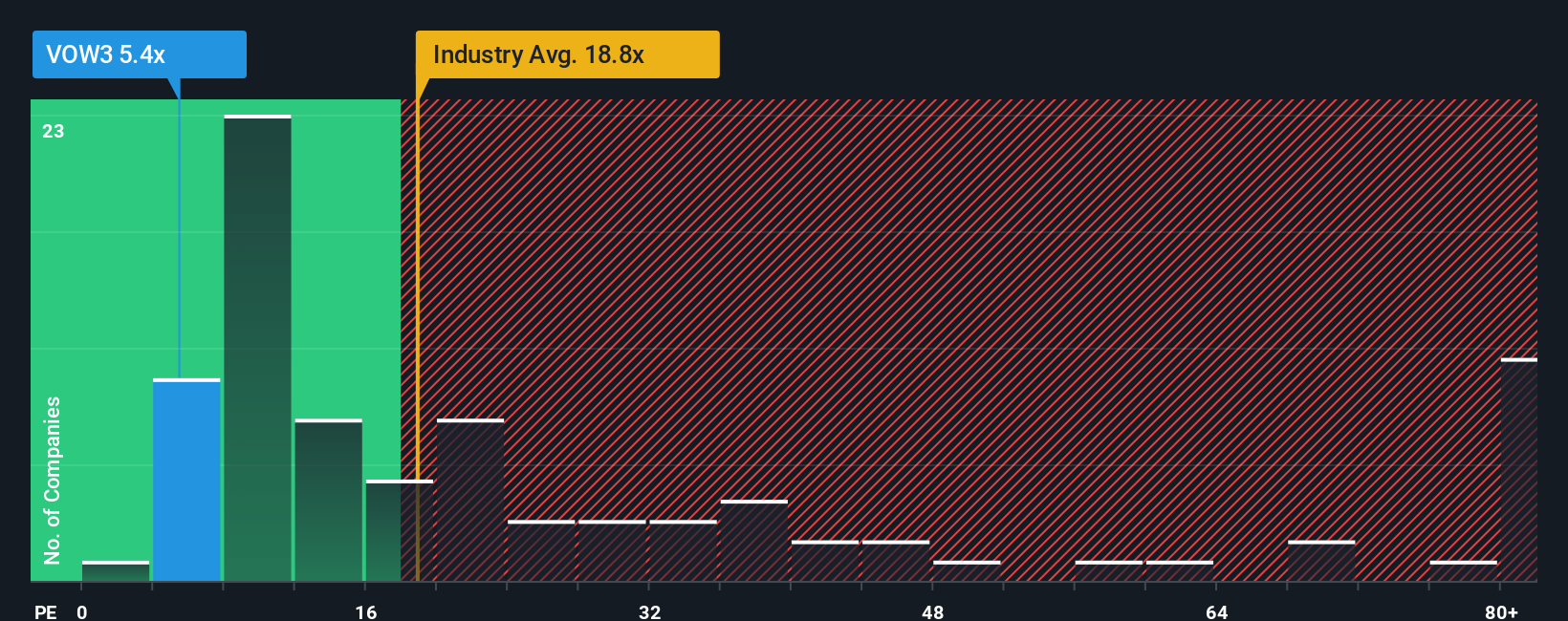

For a mature, profitable manufacturer like Volkswagen, the Price to Earnings (PE) ratio is a sensible way to think about valuation because it relates what investors are paying directly to the profits the business is generating today.

In general, faster growing, lower risk companies tend to have higher PE multiples. Slower growing or riskier businesses tend to trade on lower PE ratios. That makes context crucial when deciding whether a given PE looks cheap or expensive.

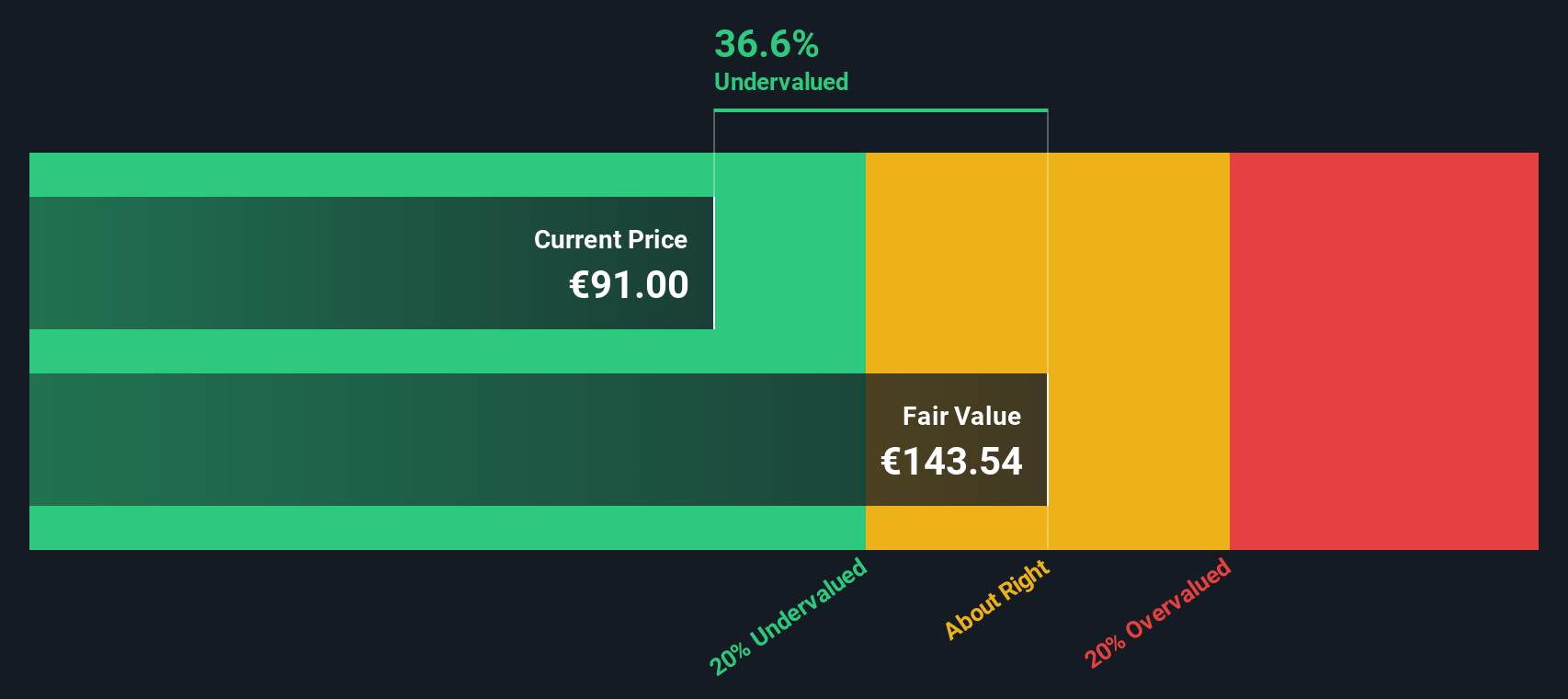

Volkswagen currently trades on a PE of about 8.0x, which is well below both the auto industry average of roughly 18.7x and a broader peer group around 19.5x. Simply Wall St’s Fair Ratio for Volkswagen is 15.95x, a proprietary estimate of what its PE should be once factors like expected earnings, profitability, industry, market cap and specific risks are accounted for. This Fair Ratio is more tailored than a simple industry or peer comparison because it adjusts for the unique mix of Volkswagen’s opportunities and challenges rather than assuming all automakers deserve the same multiple. Comparing 8.0x to the 15.95x Fair Ratio suggests the market is still applying a steep discount.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1450 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Volkswagen Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple framework that lets you put a story behind the numbers by spelling out how you think Volkswagen’s revenue, earnings and margins will evolve. You can then link that story to a detailed forecast and a Fair Value estimate you can compare against today’s share price to decide whether to buy, hold or sell. On Simply Wall St’s Community page, used by millions of investors, Narratives are easy to build and update, and they automatically refresh when new information arrives, such as earnings releases or major news, so your view stays current without you needing to rebuild your model from scratch. For example, one Volkswagen Narrative on the platform assumes a cautious path, with modest 1.0 percent revenue growth, 2.0 percent profit margins and a Fair Value of about €68 per share. Another, more optimistic Narrative expects close to 3.0 percent revenue growth, margins above 4.4 percent and a Fair Value around €112. This shows how different, clearly defined perspectives can coexist and be tracked in real time.

For Volkswagen however we'll make it really easy for you with previews of two leading Volkswagen Narratives:

Fair Value: €111.60

Implied Undervaluation vs Last Close (€106.85): 4.3%

Revenue Growth Assumption: 3.0%

- Sees steady 2.8% to 3.0% annual revenue growth and margin expansion to around 4.5%, driven by electrified vehicles, premium mix and cost restructuring.

- Views localised production, partnerships like Rivian and software, subscription and mobility services as key drivers of higher, more resilient profitability.

- Accepts risks from tariffs, BEV competition, luxury brand softness and high capex, but still concludes the current price leaves upside toward an analyst based fair value near €112.

Fair Value: €68.40

Implied Overvaluation vs Last Close (€106.85): 56.2%

Revenue Growth Assumption: 1.0%

- Argues that after years of comfortable dominance at home, Volkswagen faces eroding profitability, stagnant international share and only modest growth guidance.

- Highlights strategic missteps including the emissions scandal, a slow EV transition and heavy reliance on China and Mexico just as tariff and geopolitical risks rise.

- Points to delayed margin targets and execution doubts, concluding that new value EV models will take time to help, leaving the stock looking expensive relative to its challenges.

Do you think there's more to the story for Volkswagen? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:VOW3

Volkswagen

Manufactures and sells automobiles in Germany, other European countries, North America, South America, the Asia-Pacific, and internationally.

Undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026