3 Stocks That May Be Priced Below Their Estimated Worth In January 2025

Reviewed by Simply Wall St

As global markets continue to navigate the early days of President Trump's administration, U.S. stocks have been buoyed by optimism surrounding potential trade deals and AI infrastructure investments, with major indices reaching new highs. Amidst these developments, investors are increasingly focusing on identifying undervalued stocks that may offer opportunities for growth in a market characterized by fluctuating tariffs and economic shifts. In such an environment, a good stock is often one that demonstrates strong fundamentals yet remains priced below its estimated worth due to broader market conditions or temporary setbacks.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Türkiye Sise Ve Cam Fabrikalari (IBSE:SISE) | TRY38.86 | TRY77.57 | 49.9% |

| Fevertree Drinks (AIM:FEVR) | £6.58 | £13.12 | 49.9% |

| Atea (OB:ATEA) | NOK139.40 | NOK278.37 | 49.9% |

| PDS (NSEI:PDSL) | ₹492.20 | ₹983.09 | 49.9% |

| East Side Games Group (TSX:EAGR) | CA$0.57 | CA$1.14 | 50% |

| Kinaxis (TSX:KXS) | CA$170.04 | CA$339.70 | 49.9% |

| GemPharmatech (SHSE:688046) | CN¥13.06 | CN¥26.03 | 49.8% |

| IDP Education (ASX:IEL) | A$13.18 | A$26.30 | 49.9% |

| Shinko Electric Industries (TSE:6967) | ¥5856.00 | ¥11685.73 | 49.9% |

| Cavotec (OM:CCC) | SEK20.00 | SEK39.88 | 49.8% |

Below we spotlight a couple of our favorites from our exclusive screener.

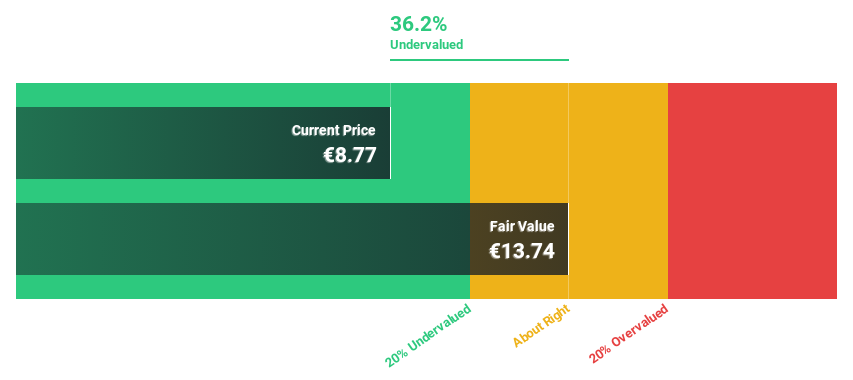

Bankinter (BME:BKT)

Overview: Bankinter, S.A. offers a range of banking products and services to individuals, corporate customers, and small- and medium-sized enterprises in Spain with a market cap of €7.56 billion.

Operations: The company's revenue segments include EVO Banco (€80.84 million), Avantmoney (€103.14 million), BK Portugal (€346.21 million), Capital Markets (€343.80 million), Corporate Banking (€1.20 billion), Bankinter Consumer Finance Group (€323.48 million), and Wealth Management and Retail Banking (€1.25 billion).

Estimated Discount To Fair Value: 42.1%

Bankinter is trading at €8.41, significantly below its estimated fair value of €14.51, indicating it is undervalued based on discounted cash flow analysis. The bank's revenue and earnings are forecast to grow substantially faster than the Spanish market at 37.4% and 34.9% annually, respectively. However, it maintains a high level of bad loans at 2.2%, which may pose risks despite its strong growth prospects and recent increase in net income to €221.92 million for 2024 from €160.11 million in the previous year.

- Our earnings growth report unveils the potential for significant increases in Bankinter's future results.

- Take a closer look at Bankinter's balance sheet health here in our report.

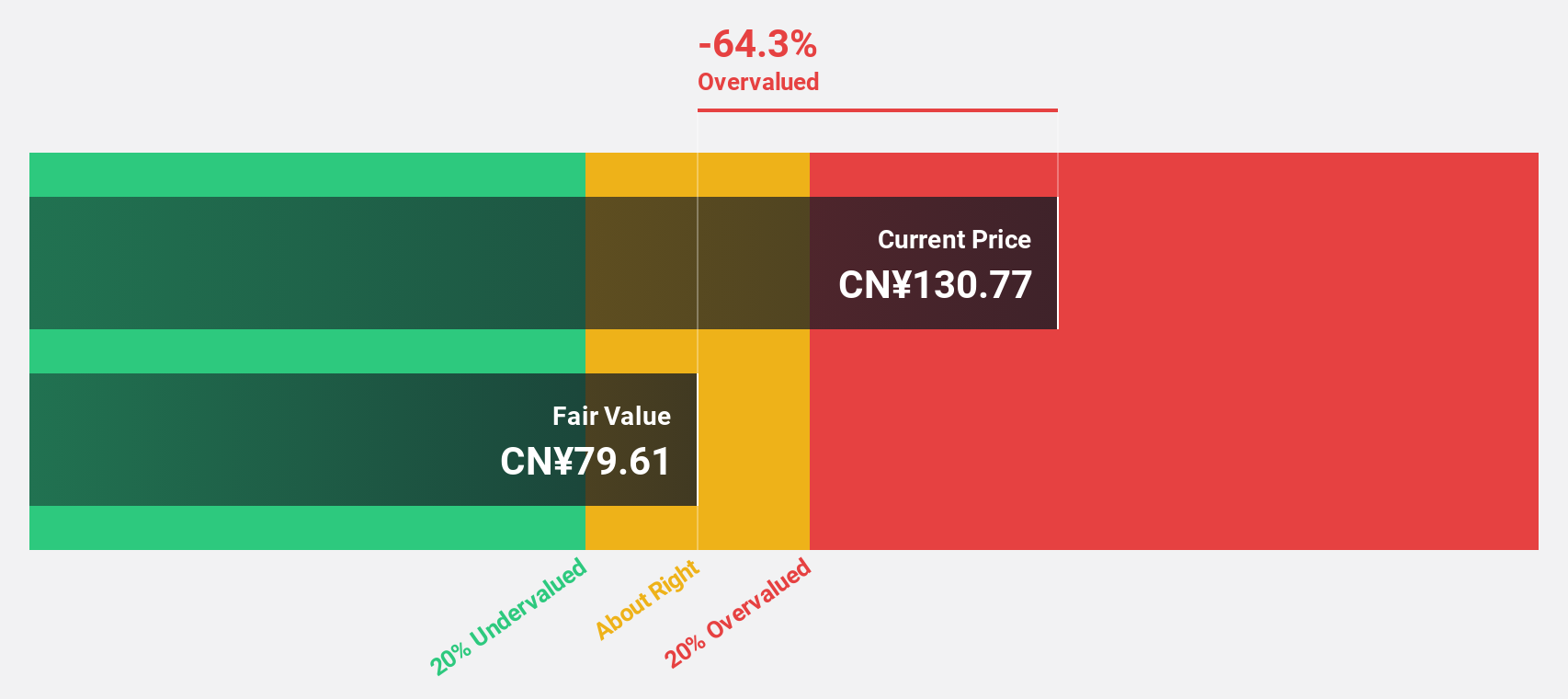

Seres GroupLtd (SHSE:601127)

Overview: Seres Group Co., Ltd. is involved in the research, development, manufacturing, sales, and supply of automobiles and auto parts in China with a market cap of CN¥199.97 billion.

Operations: The company's revenue from the automobile industry segment amounts to CN¥125.79 billion.

Estimated Discount To Fair Value: 19.3%

Seres Group Ltd. is trading at CN¥132.79, which is 19.3% below its estimated fair value of CN¥164.49, suggesting undervaluation based on cash flow analysis. The company recently turned profitable, reporting a net income of CN¥4.04 billion for the first nine months of 2024 compared to a net loss last year and was added to the SSE 180 Index in December 2024, reflecting improved market perception and potential growth prospects.

- Upon reviewing our latest growth report, Seres GroupLtd's projected financial performance appears quite optimistic.

- Unlock comprehensive insights into our analysis of Seres GroupLtd stock in this financial health report.

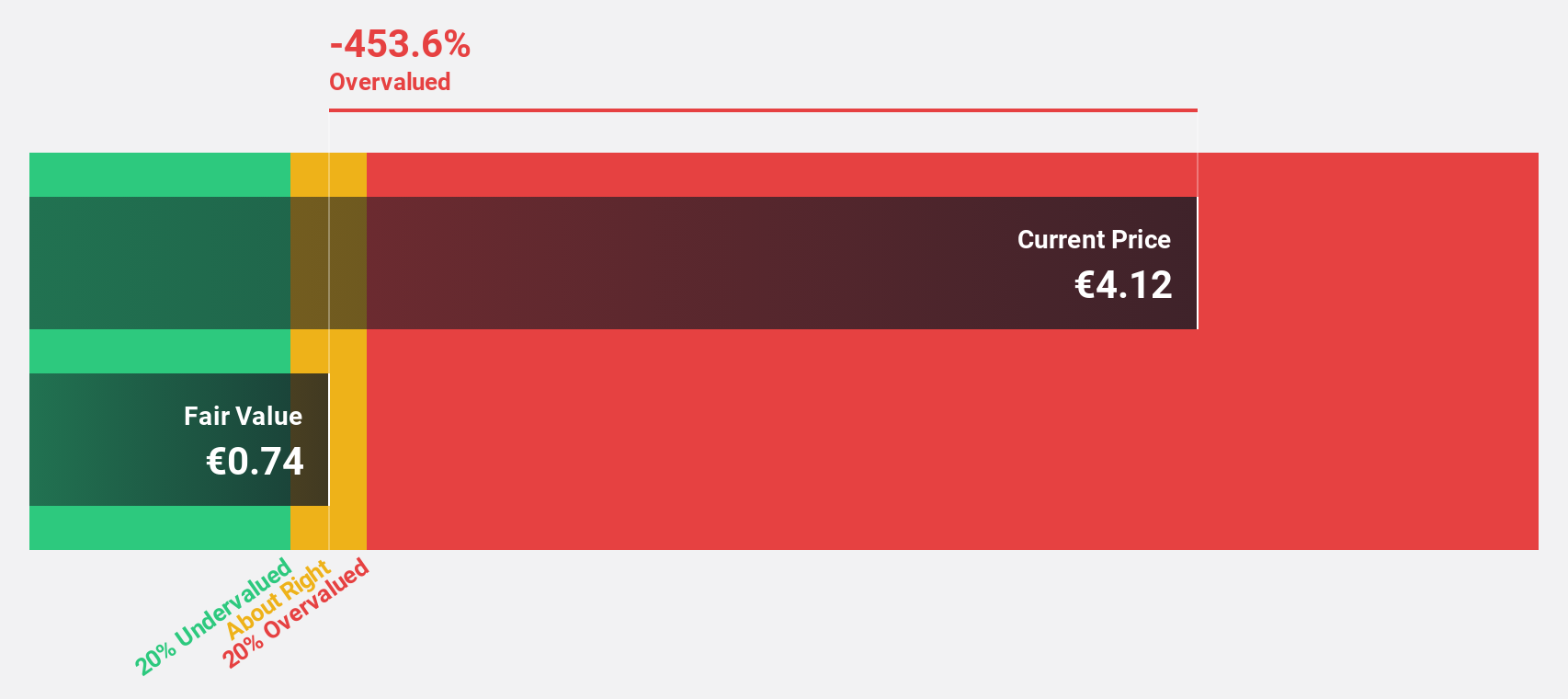

Schaeffler (XTRA:SHA0)

Overview: Schaeffler AG, along with its subsidiaries, develops, manufactures, and sells components and systems for industrial applications across Europe, the Americas, China, and the Asia Pacific; it has a market cap of €3.93 billion.

Operations: The company's revenue segments are comprised of €9.73 billion from Automotive Technologies, €2.50 billion from Vehicle Lifetime Solutions, and €3.99 billion from Bearings & Industrial Solutions.

Estimated Discount To Fair Value: 44%

Schaeffler is currently trading at €4.16, significantly below its estimated fair value of €7.43, highlighting potential undervaluation based on cash flows. Despite a forecasted earnings growth of 63.5% annually, recent financial performance shows challenges with a net loss of €13 million in Q3 2024 compared to a profit last year and declining sales figures. Additionally, the company's dividend yield is not well supported by earnings or free cash flow, indicating financial strain.

- Insights from our recent growth report point to a promising forecast for Schaeffler's business outlook.

- Navigate through the intricacies of Schaeffler with our comprehensive financial health report here.

Summing It All Up

- Access the full spectrum of 893 Undervalued Stocks Based On Cash Flows by clicking on this link.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:601127

Seres GroupLtd

Engages in the research and development, production, sales, and servicing of new energy vehicles and components in China and internationally.

Outstanding track record with excellent balance sheet.

Market Insights

Community Narratives