- Germany

- /

- Auto Components

- /

- XTRA:PGN

If You Had Bought paragon GmbH KGaA's (ETR:PGN) Shares Three Years Ago You Would Be Down 86%

Every investor on earth makes bad calls sometimes. But really bad investments should be rare. So consider, for a moment, the misfortune of paragon GmbH & Co. KGaA (ETR:PGN) investors who have held the stock for three years as it declined a whopping 86%. That'd be enough to cause even the strongest minds some disquiet. And over the last year the share price fell 25%, so we doubt many shareholders are delighted. The good news is that the stock is up 1.6% in the last week.

We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

View our latest analysis for paragon GmbH KGaA

Given that paragon GmbH KGaA didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over three years, paragon GmbH KGaA grew revenue at 12% per year. That's a fairly respectable growth rate. So it seems unlikely the 23% share price drop (each year) is entirely about the revenue. It could be that the losses were much larger than expected. If you buy into companies that lose money then you always risk losing money yourself. Just don't lose the lesson.

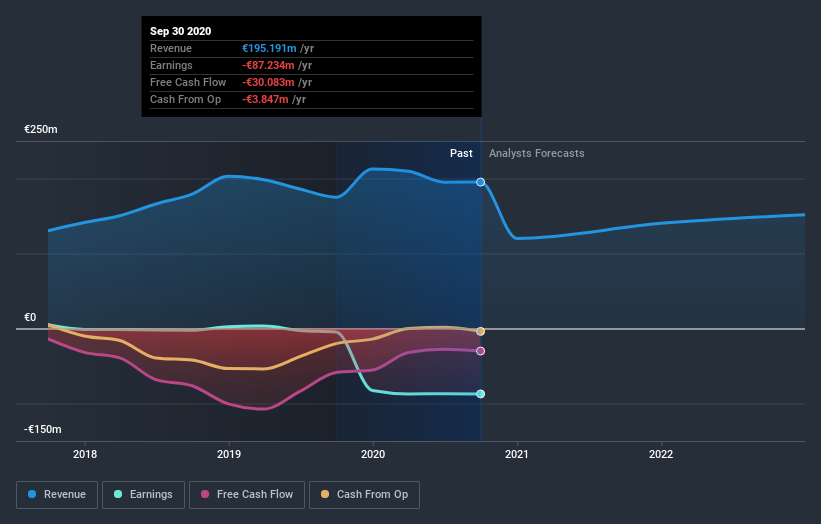

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

paragon GmbH KGaA shareholders are down 25% for the year, but the market itself is up 25%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 10% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - paragon GmbH KGaA has 3 warning signs (and 2 which are concerning) we think you should know about.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on DE exchanges.

If you’re looking to trade paragon GmbH KGaA, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About XTRA:PGN

paragon GmbH KGaA

Develops, produces, and distributes automotive electronics, body kinematics, and e-mobility solutions for the automotive industry in Germany, European Union, and internationally.

Good value with low risk.

Market Insights

Community Narratives