- Germany

- /

- Auto Components

- /

- XTRA:NVM

Novem Group S.A. (ETR:NVM) Released Earnings Last Week And Analysts Lifted Their Price Target To €16.17

Last week saw the newest quarterly earnings release from Novem Group S.A. (ETR:NVM), an important milestone in the company's journey to build a stronger business. Revenues came in 3.2% below expectations, at €167m. Statutory earnings per share were relatively better off, with a per-share profit of €1.02 being roughly in line with analyst estimates. Earnings are an important time for investors, as they can track a company's performance, look at what the analysts are forecasting for next year, and see if there's been a change in sentiment towards the company. With this in mind, we've gathered the latest statutory forecasts to see what the analysts are expecting for next year.

View our latest analysis for Novem Group

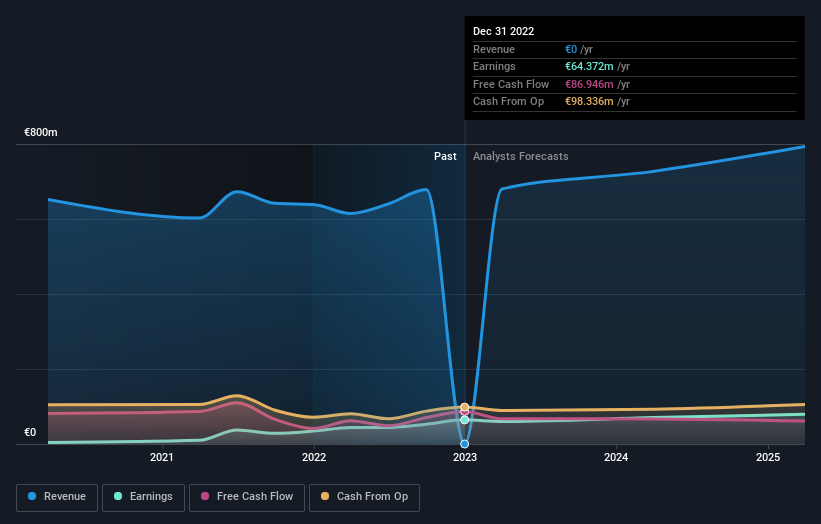

After the latest results, the four analysts covering Novem Group are now predicting revenues of €720.7m in 2024. If met, this would reflect a credible 5.1% improvement in sales compared to the last 12 months. Statutory earnings per share are predicted to rise 9.6% to €1.64. Before this earnings report, the analysts had been forecasting revenues of €740.3m and earnings per share (EPS) of €1.82 in 2024. The analysts are less bullish than they were before these results, given the reduced revenue forecasts and the minor downgrade to earnings per share expectations.

The average price target climbed 44% to €16.17despite the reduced earnings forecasts, suggesting that this earnings impact could be a positive for the stock, once it passes. The consensus price target is just an average of individual analyst targets, so - it could be handy to see how wide the range of underlying estimates is. Currently, the most bullish analyst values Novem Group at €26.00 per share, while the most bearish prices it at €9.50. With such a wide range in price targets, analysts are almost certainly betting on widely divergent outcomes in the underlying business. With this in mind, we wouldn't rely too heavily the consensus price target, as it is just an average and analysts clearly have some deeply divergent views on the business.

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. The analysts are definitely expecting Novem Group's growth to accelerate, with the forecast 4.1% annualised growth to the end of 2024 ranking favourably alongside historical growth of 1.7% per annum over the past three years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to grow their revenue at 5.8% per year. It seems obvious that, while the future growth outlook is brighter than the recent past, Novem Group is expected to grow slower than the wider industry.

The Bottom Line

The most important thing to take away is that the analysts downgraded their earnings per share estimates, showing that there has been a clear decline in sentiment following these results. On the negative side, they also downgraded their revenue estimates, and forecasts imply revenues will perform worse than the wider industry. There was also a nice increase in the price target, with the analysts clearly feeling that the intrinsic value of the business is improving.

With that in mind, we wouldn't be too quick to come to a conclusion on Novem Group. Long-term earnings power is much more important than next year's profits. At Simply Wall St, we have a full range of analyst estimates for Novem Group going out to 2025, and you can see them free on our platform here..

We don't want to rain on the parade too much, but we did also find 2 warning signs for Novem Group that you need to be mindful of.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Novem Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:NVM

Novem Group

Develops and supplies trim elements and decorative function elements for car interiors in the automotive industry.

Undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Positioned to Win as the Streaming Wars Settle

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion