When LEONI AG (ETR:LEO) reported its results to December 2020 its auditors, Deloitte & Touche LLP could not be sure that it would be able to continue as a going concern in the next year. Thus we can say that, based on the results to that date, the company should raise capital or otherwise raise cash, without much delay.

If the company does have to issue more shares, potential investors will be sure to consider how desperate it is for capital. So it is suddenly extremely important to consider whether the company is taking too much risk on its balance sheet. The biggest concern we would have is the company's debt, since its lenders might force the company into administration if it cannot repay them.

Check out our latest analysis for LEONI

What Is LEONI's Net Debt?

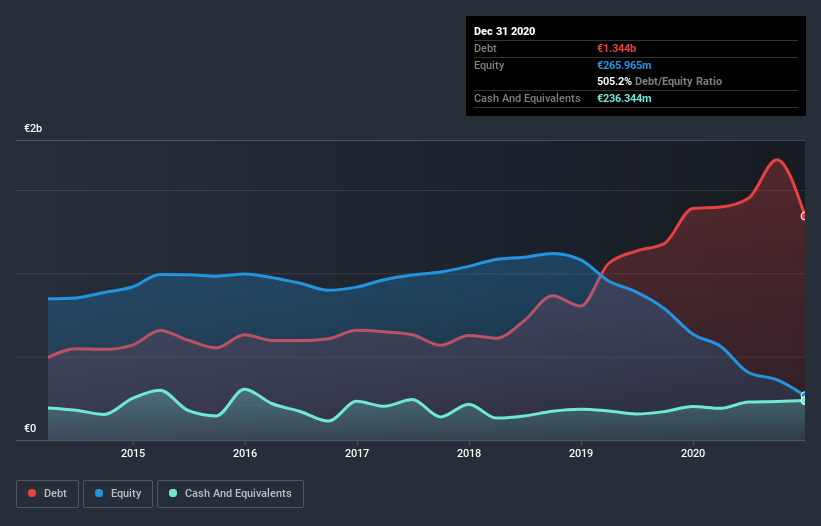

The chart below, which you can click on for greater detail, shows that LEONI had €1.34b in debt in December 2020; about the same as the year before. However, it does have €236.3m in cash offsetting this, leading to net debt of about €1.11b.

How Healthy Is LEONI's Balance Sheet?

According to the last reported balance sheet, LEONI had liabilities of €1.32b due within 12 months, and liabilities of €1.91b due beyond 12 months. Offsetting this, it had €236.3m in cash and €732.7m in receivables that were due within 12 months. So its liabilities total €2.26b more than the combination of its cash and short-term receivables.

This deficit casts a shadow over the €399.9m company, like a colossus towering over mere mortals. So we'd watch its balance sheet closely, without a doubt. After all, LEONI would likely require a major re-capitalisation if it had to pay its creditors today. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if LEONI can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Over 12 months, LEONI made a loss at the EBIT level, and saw its revenue drop to €4.1b, which is a fall of 15%. We would much prefer see growth.

Caveat Emptor

While LEONI's falling revenue is about as heartwarming as a wet blanket, arguably its earnings before interest and tax (EBIT) loss is even less appealing. Indeed, it lost a very considerable €287m at the EBIT level. If you consider the significant liabilities mentioned above, we are extremely wary of this investment. Of course, it may be able to improve its situation with a bit of luck and good execution. But we think that is unlikely, given it is low on liquid assets, and burned through €142m in the last year. So we consider this a high risk stock and we wouldn't be at all surprised if the company asks shareholders for money before long. We're too cautious to want to invest in a company after an auditor has expressed doubts about its ability to continue as a going concern. That's because we find it more comfortable to invest in companies that always keep the balance sheet reasonably strong. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. For instance, we've identified 1 warning sign for LEONI that you should be aware of.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

When trading LEONI or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About XTRA:LEO

LEONI

LEONI AG, together with its subsidiaries, provides products, solutions, and services for energy and data management in the automotive sector and other industries worldwide.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)