Bayerische Motoren Werke (XTRA:BMW) has been quietly grinding higher, with the stock up about 9% over the past month and roughly 28% in the past year. This performance is prompting a fresh look at its valuation.

See our latest analysis for Bayerische Motoren Werke.

With the share price now at $89.18 and a solid 1 year total shareholder return of about 28%, BMW has shifted from recovery mode to building momentum, as investors warm to its earnings resilience and transition strategy.

If BMW’s recent climb has you rethinking opportunities in autos, this could be a good moment to explore other auto manufacturers that might be setting up for similar moves.

But with the shares now trading close to analyst targets, yet still appearing undervalued on some intrinsic metrics, investors are left with a key question: is this a genuine buying opportunity, or is the market already pricing in BMW’s future growth?

Most Popular Narrative Narrative: 0.7% Overvalued

Compared to Bayerische Motoren Werke's last close near €89, the most widely followed narrative sees fair value almost exactly at today’s trading range.

The strong pipeline of new premium and ultra premium products including the high margin electric iX3 (Neue Klasse) and expanded Rolls Royce/ALPINA individualized offerings positions BMW to capture growing demand from the rising global luxury consumer base, supporting both revenue growth and higher average selling prices.

Curious how modest revenue growth, higher margins, and a lower future earnings multiple can still justify today’s price? The narrative’s math may surprise you.

Result: Fair Value of $88.59 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent margin pressure from tariffs and intensifying EV competition in Europe could undermine BMW’s pricing power and the premium-led growth story.

Find out about the key risks to this Bayerische Motoren Werke narrative.

Another Angle on Value

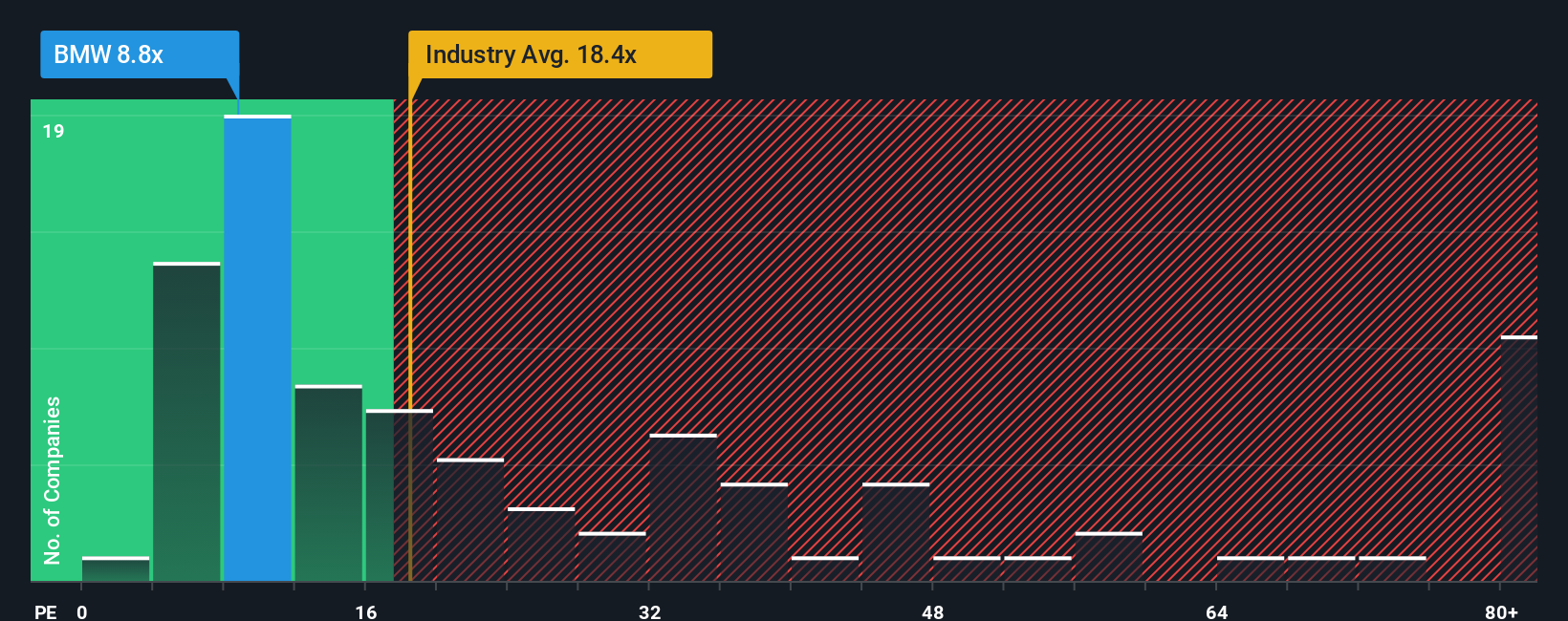

Analysts call BMW roughly fairly priced, but our earnings based comparison paints a different picture. At 7.8 times earnings versus 18.2 times for the global auto sector, peers at 18.5 times, and a fair ratio of 12.1 times, the discount looks like a real opportunity, not a rounding error. Could sentiment eventually close that gap?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Bayerische Motoren Werke Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom view in minutes with Do it your way.

A great starting point for your Bayerische Motoren Werke research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for your next smart investing move?

Do not stop at a single stock when you can line up your next opportunities quickly. Use these focused ideas to stay a step ahead of the market.

- Target stable cash flow potential by checking out these 14 dividend stocks with yields > 3% that can strengthen your portfolio with reliable income.

- Ride the next wave of innovation by reviewing these 30 healthcare AI stocks transforming diagnostics, treatment, and patient outcomes.

- Capitalize on long term growth potential by scanning these 919 undervalued stocks based on cash flows that the market has not fully recognized yet.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bayerische Motoren Werke might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:BMW

Bayerische Motoren Werke

Develops, manufactures, and sells automobiles and motorcycles, spare parts, and accessories worldwide.

Undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026