Risks Still Elevated At These Prices As Lordos United Public Ltd (CSE:LPL) Shares Dive 28%

Lordos United Public Ltd (CSE:LPL) shares have had a horrible month, losing 28% after a relatively good period beforehand. Indeed, the recent drop has reduced its annual gain to a relatively sedate 3.0% over the last twelve months.

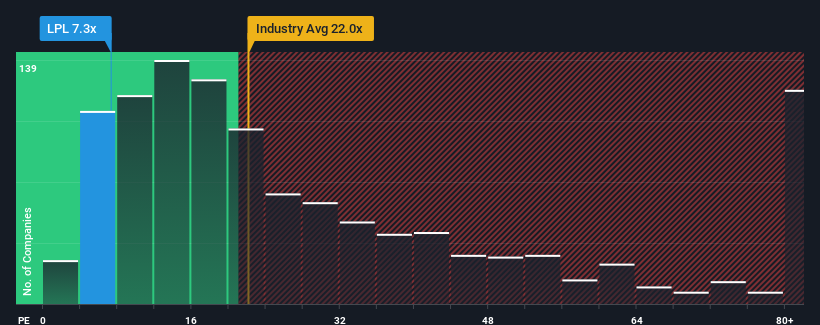

Although its price has dipped substantially, you could still be forgiven for feeling indifferent about Lordos United's P/E ratio of 7.3x, since the median price-to-earnings (or "P/E") ratio in Cyprus is also close to 6x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Lordos United certainly has been doing a great job lately as it's been growing earnings at a really rapid pace. It might be that many expect the strong earnings performance to wane, which has kept the P/E from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

View our latest analysis for Lordos United

Is There Some Growth For Lordos United?

The only time you'd be comfortable seeing a P/E like Lordos United's is when the company's growth is tracking the market closely.

Retrospectively, the last year delivered an exceptional 115% gain to the company's bottom line. Still, EPS has barely risen at all from three years ago in total, which is not ideal. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 25% shows it's noticeably less attractive on an annualised basis.

In light of this, it's curious that Lordos United's P/E sits in line with the majority of other companies. Apparently many investors in the company are less bearish than recent times would indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as a continuation of recent earnings trends is likely to weigh down the shares eventually.

The Final Word

With its share price falling into a hole, the P/E for Lordos United looks quite average now. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Lordos United revealed its three-year earnings trends aren't impacting its P/E as much as we would have predicted, given they look worse than current market expectations. Right now we are uncomfortable with the P/E as this earnings performance isn't likely to support a more positive sentiment for long. Unless the recent medium-term conditions improve, it's challenging to accept these prices as being reasonable.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Lordos United, and understanding these should be part of your investment process.

If you're unsure about the strength of Lordos United's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About CSE:LPL

Solid track record and good value.

Market Insights

Community Narratives