- Cyprus

- /

- Oil and Gas

- /

- CSE:PHL

Petrolina (Holdings)'s (CSE:PHL) one-year decline in earnings translates into losses for shareholders

Petrolina (Holdings) Public Ltd (CSE:PHL) shareholders should be happy to see the share price up 19% in the last quarter. But that doesn't change the reality of under-performance over the last twelve months. After all, the share price is down 14% in the last year, significantly under-performing the market.

While the last year has been tough for Petrolina (Holdings) shareholders, this past week has shown signs of promise. So let's look at the longer term fundamentals and see if they've been the driver of the negative returns.

Check out our latest analysis for Petrolina (Holdings)

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

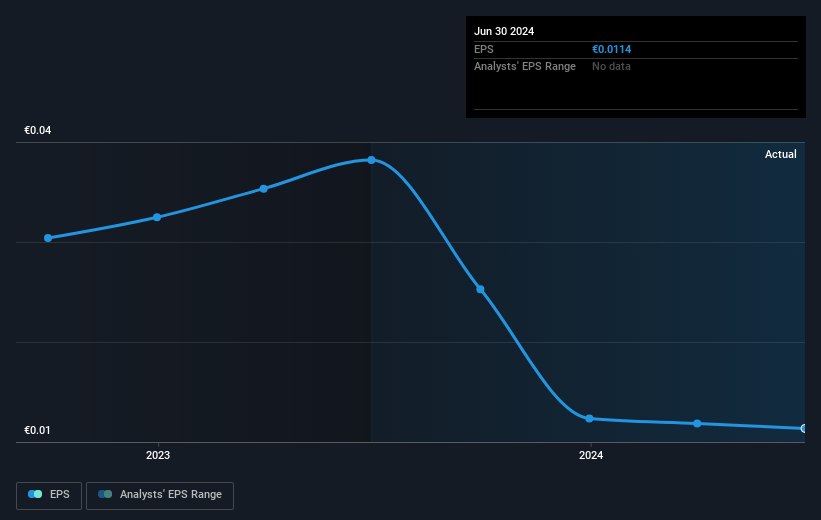

Unhappily, Petrolina (Holdings) had to report a 70% decline in EPS over the last year. The share price fall of 14% isn't as bad as the reduction in earnings per share. So the market may not be too worried about the EPS figure, at the moment -- or it may have expected earnings to drop faster. Indeed, with a P/E ratio of 83.65 there is obviously some real optimism that earnings will bounce back.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

It might be well worthwhile taking a look at our free report on Petrolina (Holdings)'s earnings, revenue and cash flow.

A Different Perspective

Investors in Petrolina (Holdings) had a tough year, with a total loss of 13% (including dividends), against a market gain of about 59%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Longer term investors wouldn't be so upset, since they would have made 2%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 5 warning signs for Petrolina (Holdings) (2 are concerning) that you should be aware of.

Of course Petrolina (Holdings) may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Cypriot exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About CSE:PHL

Petrolina (Holdings)

Engages in the import and marketing of petroleum products in Cyprus.

Moderate unattractive dividend payer.