- Cyprus

- /

- Hospitality

- /

- CSE:CBH

Constantinou Bros Hotels Public Company Limited's (CSE:CBH) Share Price Boosted 34% But Its Business Prospects Need A Lift Too

Constantinou Bros Hotels Public Company Limited (CSE:CBH) shares have continued their recent momentum with a 34% gain in the last month alone. Looking back a bit further, it's encouraging to see the stock is up 86% in the last year.

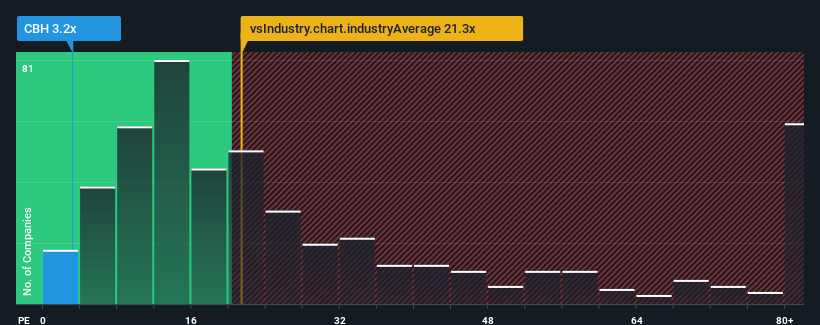

Even after such a large jump in price, given about half the companies in Cyprus have price-to-earnings ratios (or "P/E's") above 8x, you may still consider Constantinou Bros Hotels as an attractive investment with its 3.2x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

We've discovered 3 warning signs about Constantinou Bros Hotels. View them for free.Earnings have risen at a steady rate over the last year for Constantinou Bros Hotels, which is generally not a bad outcome. It might be that many expect the respectable earnings performance to degrade, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for Constantinou Bros Hotels

How Is Constantinou Bros Hotels' Growth Trending?

In order to justify its P/E ratio, Constantinou Bros Hotels would need to produce sluggish growth that's trailing the market.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 4.1% last year. Although, the latest three year period in total hasn't been as good as it didn't manage to provide any growth at all. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 20% shows it's noticeably less attractive on an annualised basis.

With this information, we can see why Constantinou Bros Hotels is trading at a P/E lower than the market. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

The Final Word

Despite Constantinou Bros Hotels' shares building up a head of steam, its P/E still lags most other companies. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Constantinou Bros Hotels revealed its three-year earnings trends are contributing to its low P/E, given they look worse than current market expectations. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. If recent medium-term earnings trends continue, it's hard to see the share price rising strongly in the near future under these circumstances.

You need to take note of risks, for example - Constantinou Bros Hotels has 3 warning signs (and 2 which are a bit unpleasant) we think you should know about.

Of course, you might also be able to find a better stock than Constantinou Bros Hotels. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About CSE:CBH

Constantinou Bros Hotels

Engages in the operation and management of hotels in Cyprus.

Good value with proven track record.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.