- China

- /

- Gas Utilities

- /

- SZSE:300332

Top Resource Energy Co., Ltd.'s (SZSE:300332) Stock Has Seen Strong Momentum: Does That Call For Deeper Study Of Its Financial Prospects?

Top Resource Energy's (SZSE:300332) stock is up by a considerable 32% over the past three months. We wonder if and what role the company's financials play in that price change as a company's long-term fundamentals usually dictate market outcomes. Specifically, we decided to study Top Resource Energy's ROE in this article.

Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors’ money. Put another way, it reveals the company's success at turning shareholder investments into profits.

Check out our latest analysis for Top Resource Energy

How Do You Calculate Return On Equity?

The formula for return on equity is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Top Resource Energy is:

2.4% = CN¥104m ÷ CN¥4.4b (Based on the trailing twelve months to September 2024).

The 'return' is the amount earned after tax over the last twelve months. Another way to think of that is that for every CN¥1 worth of equity, the company was able to earn CN¥0.02 in profit.

What Is The Relationship Between ROE And Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

Top Resource Energy's Earnings Growth And 2.4% ROE

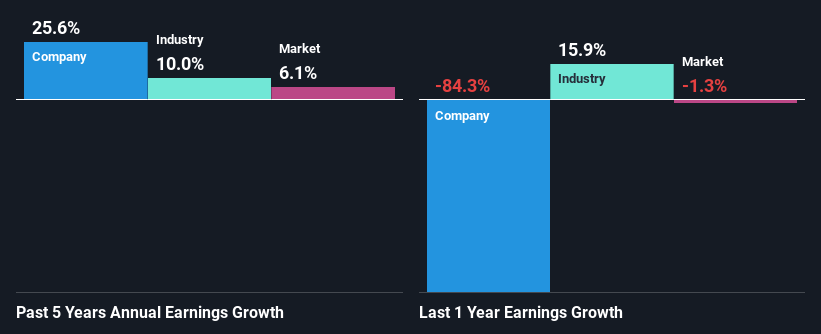

As you can see, Top Resource Energy's ROE looks pretty weak. Not just that, even compared to the industry average of 9.3%, the company's ROE is entirely unremarkable. Despite this, surprisingly, Top Resource Energy saw an exceptional 26% net income growth over the past five years. We reckon that there could be other factors at play here. For example, it is possible that the company's management has made some good strategic decisions, or that the company has a low payout ratio.

We then compared Top Resource Energy's net income growth with the industry and we're pleased to see that the company's growth figure is higher when compared with the industry which has a growth rate of 10.0% in the same 5-year period.

Earnings growth is a huge factor in stock valuation. It’s important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. One good indicator of expected earnings growth is the P/E ratio which determines the price the market is willing to pay for a stock based on its earnings prospects. So, you may want to check if Top Resource Energy is trading on a high P/E or a low P/E, relative to its industry.

Is Top Resource Energy Using Its Retained Earnings Effectively?

Top Resource Energy has a really low three-year median payout ratio of 18%, meaning that it has the remaining 82% left over to reinvest into its business. So it looks like Top Resource Energy is reinvesting profits heavily to grow its business, which shows in its earnings growth.

Additionally, Top Resource Energy has paid dividends over a period of at least ten years which means that the company is pretty serious about sharing its profits with shareholders.

Summary

On the whole, we do feel that Top Resource Energy has some positive attributes. Despite its low rate of return, the fact that the company reinvests a very high portion of its profits into its business, no doubt contributed to its high earnings growth. That being so, the latest analyst forecasts show that the company will continue to see an expansion in its earnings. To know more about the latest analysts predictions for the company, check out this visualization of analyst forecasts for the company.

Valuation is complex, but we're here to simplify it.

Discover if Top Resource Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300332

Top Resource Energy

Engages in the trading and sale of natural gas, pipeline transportation, urban gas transmission and distribution, gas engineering design, and technical services.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives