- China

- /

- Water Utilities

- /

- SZSE:300055

Market Might Still Lack Some Conviction On Beijing Water Business Doctor Co., Ltd. (SZSE:300055) Even After 52% Share Price Boost

The Beijing Water Business Doctor Co., Ltd. (SZSE:300055) share price has done very well over the last month, posting an excellent gain of 52%. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 16% over that time.

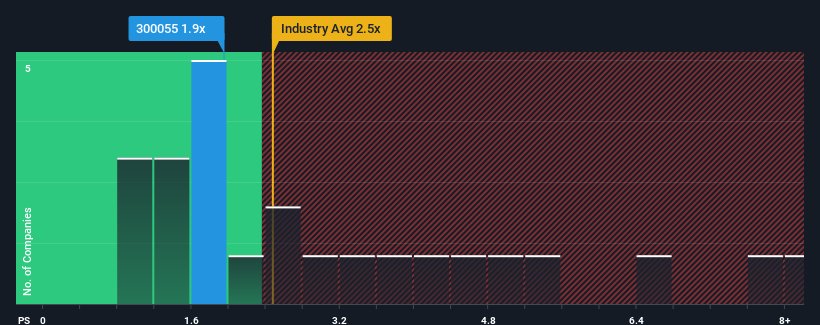

Although its price has surged higher, Beijing Water Business Doctor may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 1.9x, considering almost half of all companies in the Water Utilities industry in China have P/S ratios greater than 2.5x and even P/S higher than 5x aren't out of the ordinary. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Beijing Water Business Doctor

What Does Beijing Water Business Doctor's P/S Mean For Shareholders?

For instance, Beijing Water Business Doctor's receding revenue in recent times would have to be some food for thought. One possibility is that the P/S is low because investors think the company won't do enough to avoid underperforming the broader industry in the near future. Those who are bullish on Beijing Water Business Doctor will be hoping that this isn't the case so that they can pick up the stock at a lower valuation.

Although there are no analyst estimates available for Beijing Water Business Doctor, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Beijing Water Business Doctor's Revenue Growth Trending?

Beijing Water Business Doctor's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 18%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 119% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

When compared to the industry's one-year growth forecast of 9.3%, the most recent medium-term revenue trajectory is noticeably more alluring

With this in mind, we find it intriguing that Beijing Water Business Doctor's P/S isn't as high compared to that of its industry peers. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

The Bottom Line On Beijing Water Business Doctor's P/S

Despite Beijing Water Business Doctor's share price climbing recently, its P/S still lags most other companies. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Beijing Water Business Doctor revealed its three-year revenue trends aren't boosting its P/S anywhere near as much as we would have predicted, given they look better than current industry expectations. When we see robust revenue growth that outpaces the industry, we presume that there are notable underlying risks to the company's future performance, which is exerting downward pressure on the P/S ratio. It appears many are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

The company's balance sheet is another key area for risk analysis. You can assess many of the main risks through our free balance sheet analysis for Beijing Water Business Doctor with six simple checks.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Beijing Water Business Doctor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300055

Beijing Water Business Doctor

Engages in water engineering and operation, hazardous and solid waste treatment, environmental protection, and equipment manufacturing businesses in China.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives