- China

- /

- Renewable Energy

- /

- SZSE:002039

We Think GuiZhou QianYuan Power (SZSE:002039) Can Stay On Top Of Its Debt

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We note that GuiZhou QianYuan Power Co., Ltd. (SZSE:002039) does have debt on its balance sheet. But the real question is whether this debt is making the company risky.

Why Does Debt Bring Risk?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for GuiZhou QianYuan Power

What Is GuiZhou QianYuan Power's Net Debt?

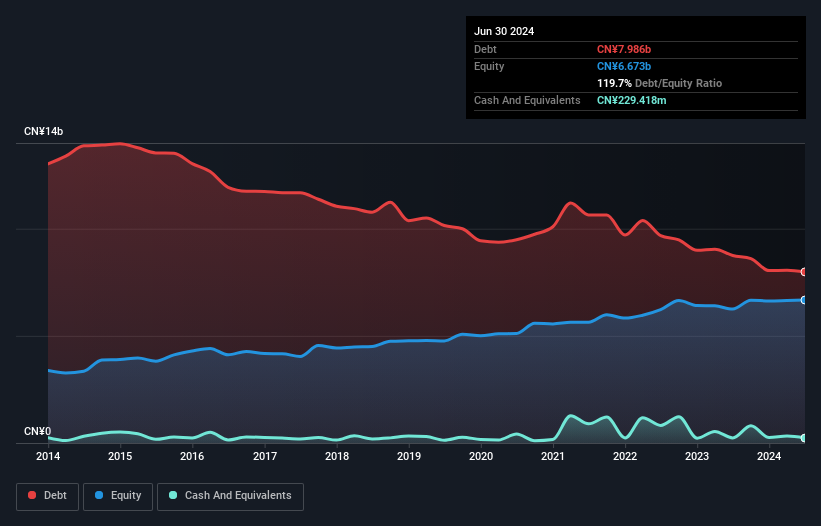

You can click the graphic below for the historical numbers, but it shows that GuiZhou QianYuan Power had CN¥7.99b of debt in June 2024, down from CN¥8.75b, one year before. However, it does have CN¥229.4m in cash offsetting this, leading to net debt of about CN¥7.76b.

How Healthy Is GuiZhou QianYuan Power's Balance Sheet?

We can see from the most recent balance sheet that GuiZhou QianYuan Power had liabilities of CN¥3.50b falling due within a year, and liabilities of CN¥5.84b due beyond that. Offsetting this, it had CN¥229.4m in cash and CN¥492.7m in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by CN¥8.62b.

When you consider that this deficiency exceeds the company's CN¥7.10b market capitalization, you might well be inclined to review the balance sheet intently. In the scenario where the company had to clean up its balance sheet quickly, it seems likely shareholders would suffer extensive dilution.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

GuiZhou QianYuan Power has a debt to EBITDA ratio of 4.8 and its EBIT covered its interest expense 3.3 times. Taken together this implies that, while we wouldn't want to see debt levels rise, we think it can handle its current leverage. Looking on the bright side, GuiZhou QianYuan Power boosted its EBIT by a silky 48% in the last year. Like the milk of human kindness that sort of growth increases resilience, making the company more capable of managing debt. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine GuiZhou QianYuan Power's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Over the last three years, GuiZhou QianYuan Power actually produced more free cash flow than EBIT. That sort of strong cash conversion gets us as excited as the crowd when the beat drops at a Daft Punk concert.

Our View

GuiZhou QianYuan Power's conversion of EBIT to free cash flow was a real positive on this analysis, as was its EBIT growth rate. In contrast, our confidence was undermined by its apparent struggle to handle its total liabilities. Looking at all this data makes us feel a little cautious about GuiZhou QianYuan Power's debt levels. While we appreciate debt can enhance returns on equity, we'd suggest that shareholders keep close watch on its debt levels, lest they increase. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. Be aware that GuiZhou QianYuan Power is showing 2 warning signs in our investment analysis , and 1 of those is significant...

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002039

GuiZhou QianYuan Power

Engages in the development, operation, and management of hydropower and photovoltaic power stations in China.

Good value with proven track record.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026