Zhejiang Huangma TechnologyLtd And 2 Promising Small Caps With Strong Potential

Reviewed by Simply Wall St

In the wake of recent U.S. election results, markets have reacted with optimism, pushing major indices like the small-cap Russell 2000 Index to notable gains despite remaining below record highs. This buoyant market sentiment, fueled by expectations of economic growth and regulatory changes, presents a fertile ground for identifying promising small-cap stocks that could capitalize on these shifts. In this context, uncovering potential in lesser-known companies such as Zhejiang Huangma Technology Ltd and other small caps becomes particularly appealing as investors seek opportunities that align with current economic dynamics and market trends.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Parker Drilling | 46.25% | -0.33% | 53.04% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Industrias del Cobre Sociedad Anónima | NA | 19.63% | 22.92% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 9.68% | 28.34% | ★★★★★☆ |

| Arab Banking Corporation (B.S.C.) | 190.18% | 16.52% | 21.58% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Zhejiang Huangma TechnologyLtd (SHSE:603181)

Simply Wall St Value Rating: ★★★★★☆

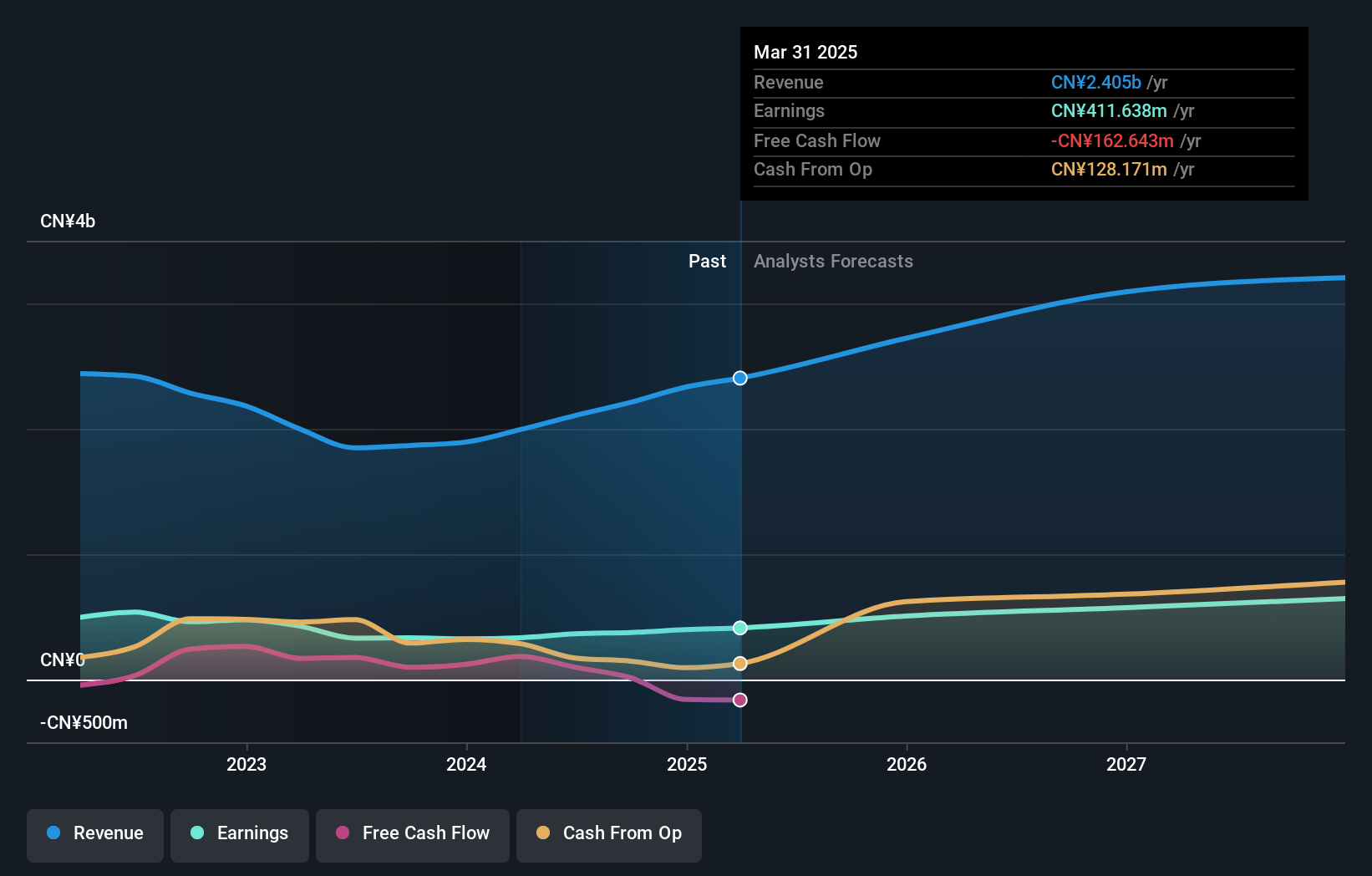

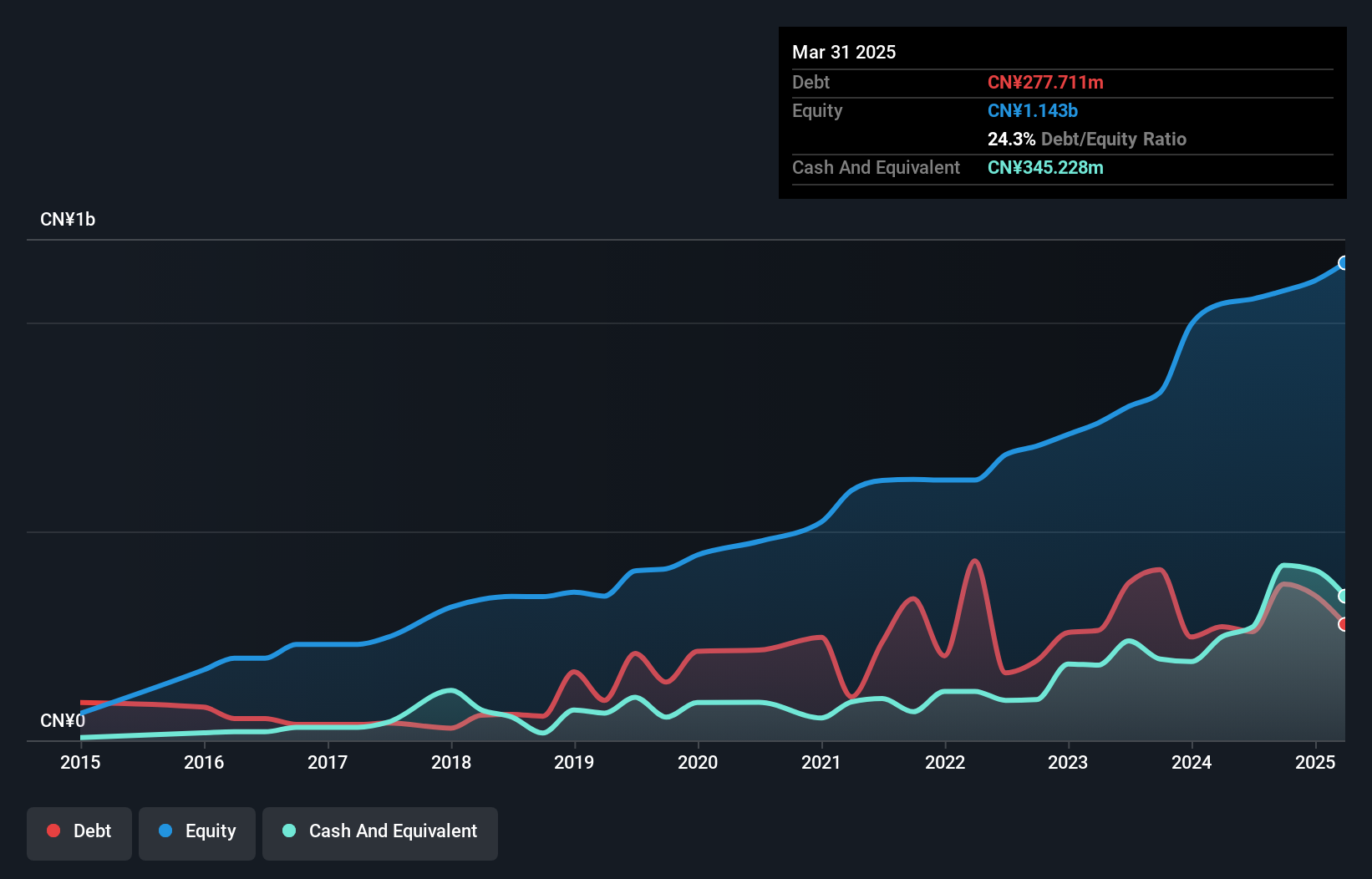

Overview: Zhejiang Huangma Technology Co., Ltd engages in the research, development, production, and sale of surfactants and related products both domestically and internationally, with a market capitalization of CN¥6.62 billion.

Operations: Huangma Technology generates revenue primarily from its specialty chemicals segment, which reported CN¥2.21 billion. The company's financial performance can be analyzed through its net profit margin, which reflects the profitability after accounting for all expenses.

Zhejiang Huangma Technology, a dynamic player in the chemicals sector, has demonstrated impressive earnings growth of 12.7% over the past year, outpacing the industry average of -5.3%. The company's debt-to-equity ratio has risen to 13.2% from zero over five years, indicating strategic leverage use while maintaining more cash than total debt. Recent financials show sales climbing to CNY 1.72 billion for nine months ending September 2024 from CNY 1.41 billion a year prior, with net income increasing to CNY 285.58 million from CNY 234.69 million and basic EPS at CNY 0.51 compared to last year's CNY 0.41.

Pan Asian Microvent Tech (Jiangsu) (SHSE:688386)

Simply Wall St Value Rating: ★★★★★★

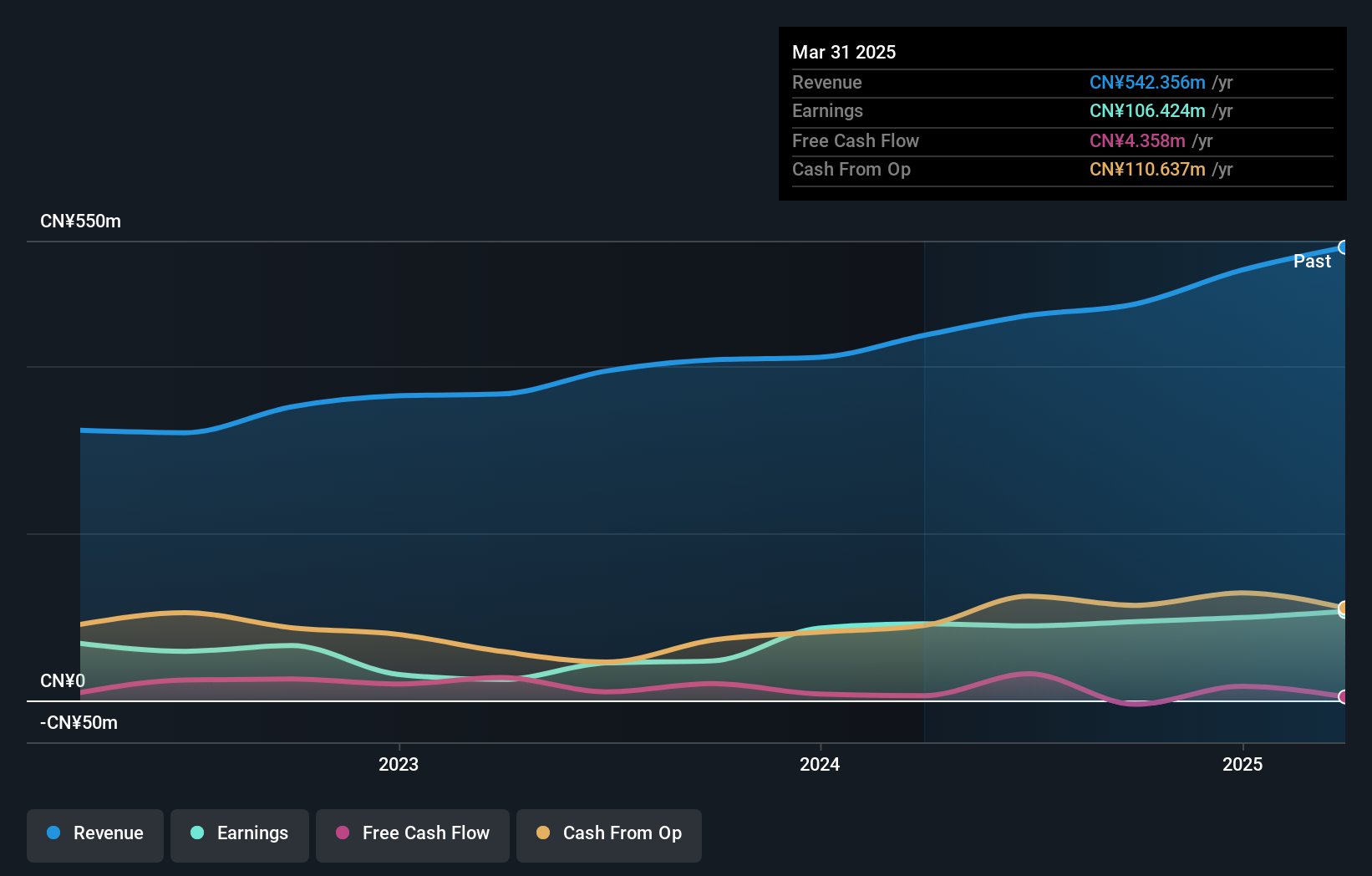

Overview: Pan Asian Microvent Tech (Jiangsu) Corporation specializes in supplying micro permeable polymer and membrane components for automotive, packaging, and protective air ventilation sectors both in China and globally, with a market cap of CN¥2.51 billion.

Operations: The company's primary revenue stream is from its industrial conglomerate segment, generating CN¥474.31 million.

Pan Asian Microvent Tech (Jiangsu) seems to be on a solid path, with its earnings for the past nine months reaching CNY 66.61 million, up from CNY 58.83 million last year. The company reported sales of CNY 352.35 million compared to CNY 288.59 million a year ago, indicating robust growth in revenue and net income. Its price-to-earnings ratio stands at a favorable 26.6x against the broader CN market's 36.3x, suggesting potential value for investors seeking opportunities in smaller companies within the chemicals sector where its earnings growth has outpaced industry averages by a significant margin of nearly 99%.

- Navigate through the intricacies of Pan Asian Microvent Tech (Jiangsu) with our comprehensive health report here.

Understand Pan Asian Microvent Tech (Jiangsu)'s track record by examining our Past report.

Jiangxi Bestoo EnergyLtd (SZSE:001376)

Simply Wall St Value Rating: ★★★★★☆

Overview: Jiangxi Bestoo Energy Co., Ltd. offers centralized heating services to industrial parks and downstream industrial customers in China, with a market cap of CN¥6.94 billion.

Operations: Jiangxi Bestoo Energy Co., Ltd. generates revenue primarily from providing centralized heating services to industrial parks and downstream industrial customers in China. The company's cost structure involves expenses related to the operation and maintenance of its heating infrastructure. Notably, it has a net profit margin of 15%, reflecting its ability to manage costs effectively relative to its revenue generation.

Jiangxi Bestoo Energy, a relatively under-the-radar player, has shown promising growth with earnings rising by 39.7% over the past year, outpacing the Water Utilities industry's 0.8%. The company reported net income of CNY 149 million for the nine months ending September 2024, up from CNY 100 million a year ago. Basic earnings per share increased to CNY 0.32 from CNY 0.24 in the same period last year. Despite an increase in its debt-to-equity ratio from 33.9% to 34.7% over five years, it holds more cash than total debt and efficiently covers interest payments with profits, indicating robust financial health and potential for continued performance improvement within its sector context.

Summing It All Up

- Get an in-depth perspective on all 4664 Undiscovered Gems With Strong Fundamentals by using our screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Huangma TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603181

Zhejiang Huangma TechnologyLtd

Researches, develops, produces, and sells surfactants in China and internationally.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives