- China

- /

- Renewable Energy

- /

- SZSE:001258

More Unpleasant Surprises Could Be In Store For Xinjiang Lixin Energy Co., LTD.'s (SZSE:001258) Shares After Tumbling 25%

Xinjiang Lixin Energy Co., LTD. (SZSE:001258) shares have had a horrible month, losing 25% after a relatively good period beforehand. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 11% share price drop.

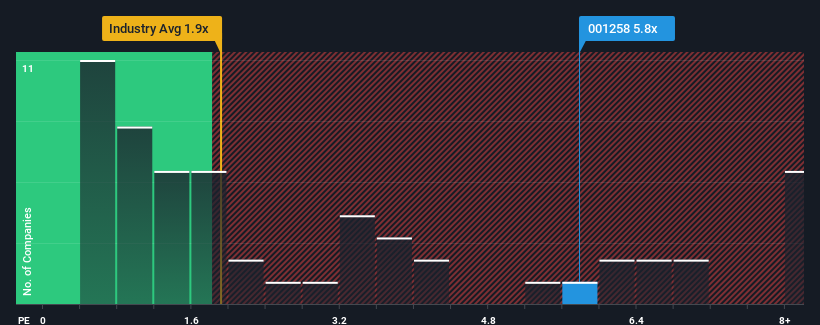

Although its price has dipped substantially, when almost half of the companies in China's Renewable Energy industry have price-to-sales ratios (or "P/S") below 1.9x, you may still consider Xinjiang Lixin Energy as a stock not worth researching with its 5.8x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

Check out our latest analysis for Xinjiang Lixin Energy

How Has Xinjiang Lixin Energy Performed Recently?

The recent revenue growth at Xinjiang Lixin Energy would have to be considered satisfactory if not spectacular. Perhaps the market believes the recent revenue performance is strong enough to outperform the industry, which has inflated the P/S ratio. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Xinjiang Lixin Energy's earnings, revenue and cash flow.How Is Xinjiang Lixin Energy's Revenue Growth Trending?

Xinjiang Lixin Energy's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Retrospectively, the last year delivered a decent 6.1% gain to the company's revenues. The latest three year period has also seen a 24% overall rise in revenue, aided somewhat by its short-term performance. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Weighing that recent medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 7.3% shows it's about the same on an annualised basis.

In light of this, it's curious that Xinjiang Lixin Energy's P/S sits above the majority of other companies. It seems most investors are ignoring the fairly average recent growth rates and are willing to pay up for exposure to the stock. Although, additional gains will be difficult to achieve as a continuation of recent revenue trends would weigh down the share price eventually.

The Final Word

Xinjiang Lixin Energy's shares may have suffered, but its P/S remains high. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We didn't expect to see Xinjiang Lixin Energy trade at such a high P/S considering its last three-year revenue growth has only been on par with the rest of the industry. When we see average revenue with industry-like growth combined with a high P/S, we suspect the share price is at risk of declining, bringing the P/S back in line with the industry too. Unless the recent medium-term conditions improve, it's challenging to accept these prices as being reasonable.

Plus, you should also learn about these 4 warning signs we've spotted with Xinjiang Lixin Energy (including 3 which make us uncomfortable).

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:001258

Xinjiang Lixin Energy

Develops and converts renewable energy such as wind energy and solar energy into electricity in the People’s Republic of China.

Very low risk with poor track record.

Market Insights

Community Narratives