- China

- /

- Water Utilities

- /

- SZSE:000692

Shenyang Huitian Thermal PowerLtd's (SZSE:000692) underlying earnings growth outpaced the return generated for shareholders over the past five years

It's been a soft week for Shenyang Huitian Thermal Power Co.,Ltd (SZSE:000692) shares, which are down 11%. On the other hand the returns over the last half decade have not been bad. After all, the stock has performed better than the market (26%) in that time, and is up 27%.

While the stock has fallen 11% this week, it's worth focusing on the longer term and seeing if the stocks historical returns have been driven by the underlying fundamentals.

Check out our latest analysis for Shenyang Huitian Thermal PowerLtd

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

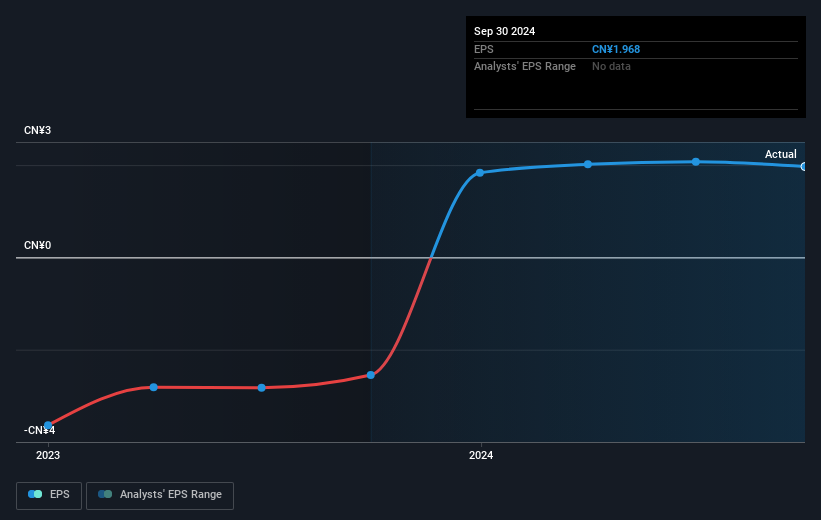

During the five years of share price growth, Shenyang Huitian Thermal PowerLtd moved from a loss to profitability. That's generally thought to be a genuine positive, so investors may expect to see an increasing share price.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

A Different Perspective

It's good to see that Shenyang Huitian Thermal PowerLtd has rewarded shareholders with a total shareholder return of 25% in the last twelve months. That's better than the annualised return of 5% over half a decade, implying that the company is doing better recently. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Like risks, for instance. Every company has them, and we've spotted 3 warning signs for Shenyang Huitian Thermal PowerLtd (of which 1 doesn't sit too well with us!) you should know about.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000692

Shenyang Huitian Thermal PowerLtd

Provides heating and steam supply, and engineering services for residents and non-residents in China.

Good value low.