- China

- /

- Electric Utilities

- /

- SZSE:000037

Shenzhen Nanshan Power (SZSE:000037 investor five-year losses grow to 35% as the stock sheds CN¥380m this past week

In order to justify the effort of selecting individual stocks, it's worth striving to beat the returns from a market index fund. But in any portfolio, there will be mixed results between individual stocks. So we wouldn't blame long term Shenzhen Nanshan Power Co., Ltd. (SZSE:000037) shareholders for doubting their decision to hold, with the stock down 35% over a half decade. More recently, the share price has dropped a further 13% in a month.

Since Shenzhen Nanshan Power has shed CN¥380m from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

View our latest analysis for Shenzhen Nanshan Power

Shenzhen Nanshan Power isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually desire strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over half a decade Shenzhen Nanshan Power reduced its trailing twelve month revenue by 18% for each year. That's definitely a weaker result than most pre-profit companies report. It seems pretty reasonable to us that the share price dipped 6% per year in that time. This loss means the stock shareholders are probably pretty annoyed. It is possible for businesses to bounce back but as Buffett says, 'turnarounds seldom turn'.

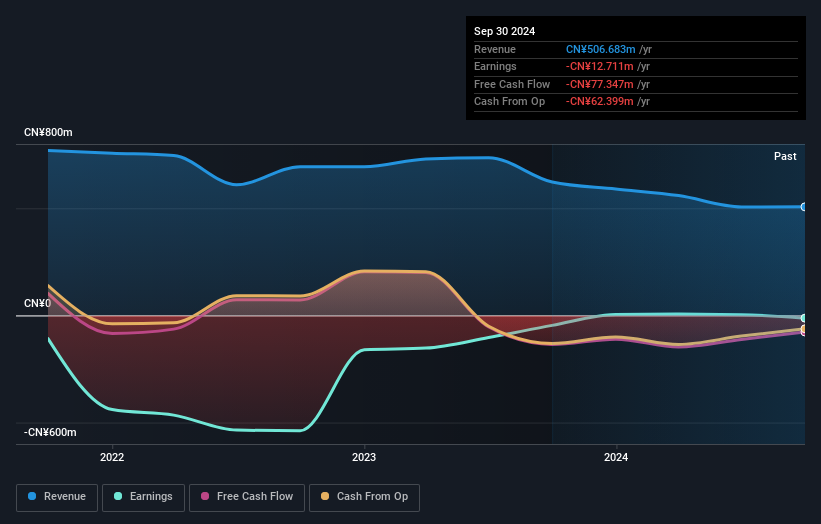

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Take a more thorough look at Shenzhen Nanshan Power's financial health with this free report on its balance sheet.

A Different Perspective

Shenzhen Nanshan Power shareholders are up 2.3% for the year. Unfortunately this falls short of the market return. On the bright side, that's still a gain, and it is certainly better than the yearly loss of about 6% endured over half a decade. So this might be a sign the business has turned its fortunes around. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider risks, for instance. Every company has them, and we've spotted 1 warning sign for Shenzhen Nanshan Power you should know about.

We will like Shenzhen Nanshan Power better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000037

Adequate balance sheet with questionable track record.

Market Insights

Community Narratives