- China

- /

- Water Utilities

- /

- SHSE:605028

The Market Doesn't Like What It Sees From Ningbo Shimao Energy Co.,Ltd's (SHSE:605028) Earnings Yet As Shares Tumble 31%

The Ningbo Shimao Energy Co.,Ltd (SHSE:605028) share price has softened a substantial 31% over the previous 30 days, handing back much of the gains the stock has made lately. The recent drop has obliterated the annual return, with the share price now down 8.3% over that longer period.

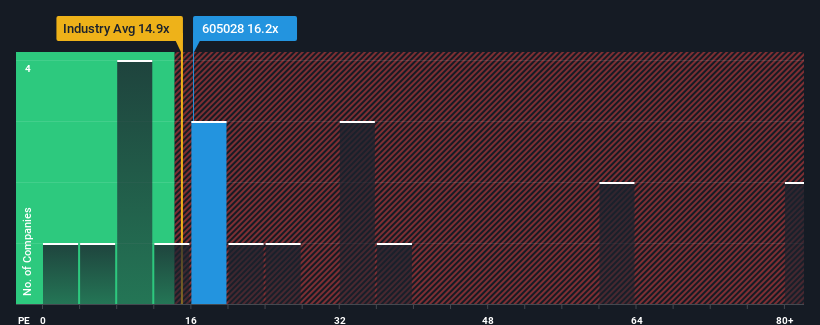

Even after such a large drop in price, given about half the companies in China have price-to-earnings ratios (or "P/E's") above 37x, you may still consider Ningbo Shimao EnergyLtd as a highly attractive investment with its 16.2x P/E ratio. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

For example, consider that Ningbo Shimao EnergyLtd's financial performance has been poor lately as its earnings have been in decline. One possibility is that the P/E is low because investors think the company won't do enough to avoid underperforming the broader market in the near future. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

See our latest analysis for Ningbo Shimao EnergyLtd

Does Growth Match The Low P/E?

In order to justify its P/E ratio, Ningbo Shimao EnergyLtd would need to produce anemic growth that's substantially trailing the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 16%. The last three years don't look nice either as the company has shrunk EPS by 27% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Weighing that medium-term earnings trajectory against the broader market's one-year forecast for expansion of 38% shows it's an unpleasant look.

In light of this, it's understandable that Ningbo Shimao EnergyLtd's P/E would sit below the majority of other companies. However, we think shrinking earnings are unlikely to lead to a stable P/E over the longer term, which could set up shareholders for future disappointment. Even just maintaining these prices could be difficult to achieve as recent earnings trends are already weighing down the shares.

The Final Word

Ningbo Shimao EnergyLtd's P/E looks about as weak as its stock price lately. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

As we suspected, our examination of Ningbo Shimao EnergyLtd revealed its shrinking earnings over the medium-term are contributing to its low P/E, given the market is set to grow. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. If recent medium-term earnings trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

Having said that, be aware Ningbo Shimao EnergyLtd is showing 1 warning sign in our investment analysis, you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Ningbo Shimao EnergyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:605028

Flawless balance sheet with acceptable track record.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026