- China

- /

- Gas Utilities

- /

- SHSE:603053

3 Dividend Stocks To Consider With Yields Starting At 3%

Reviewed by Simply Wall St

As global markets experience broad-based gains, with U.S. indexes nearing record highs and positive economic indicators such as declining jobless claims and rising home sales, investors are increasingly looking for stable income sources amid geopolitical uncertainties and fluctuating interest rates. In this environment, dividend stocks offering yields starting at 3% can provide a reliable income stream, making them an attractive option for those seeking to balance growth with stability in their portfolios.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.17% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.97% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.25% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.57% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.32% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.72% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.51% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.81% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.37% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.83% | ★★★★★★ |

Click here to see the full list of 1943 stocks from our Top Dividend Stocks screener.

We'll examine a selection from our screener results.

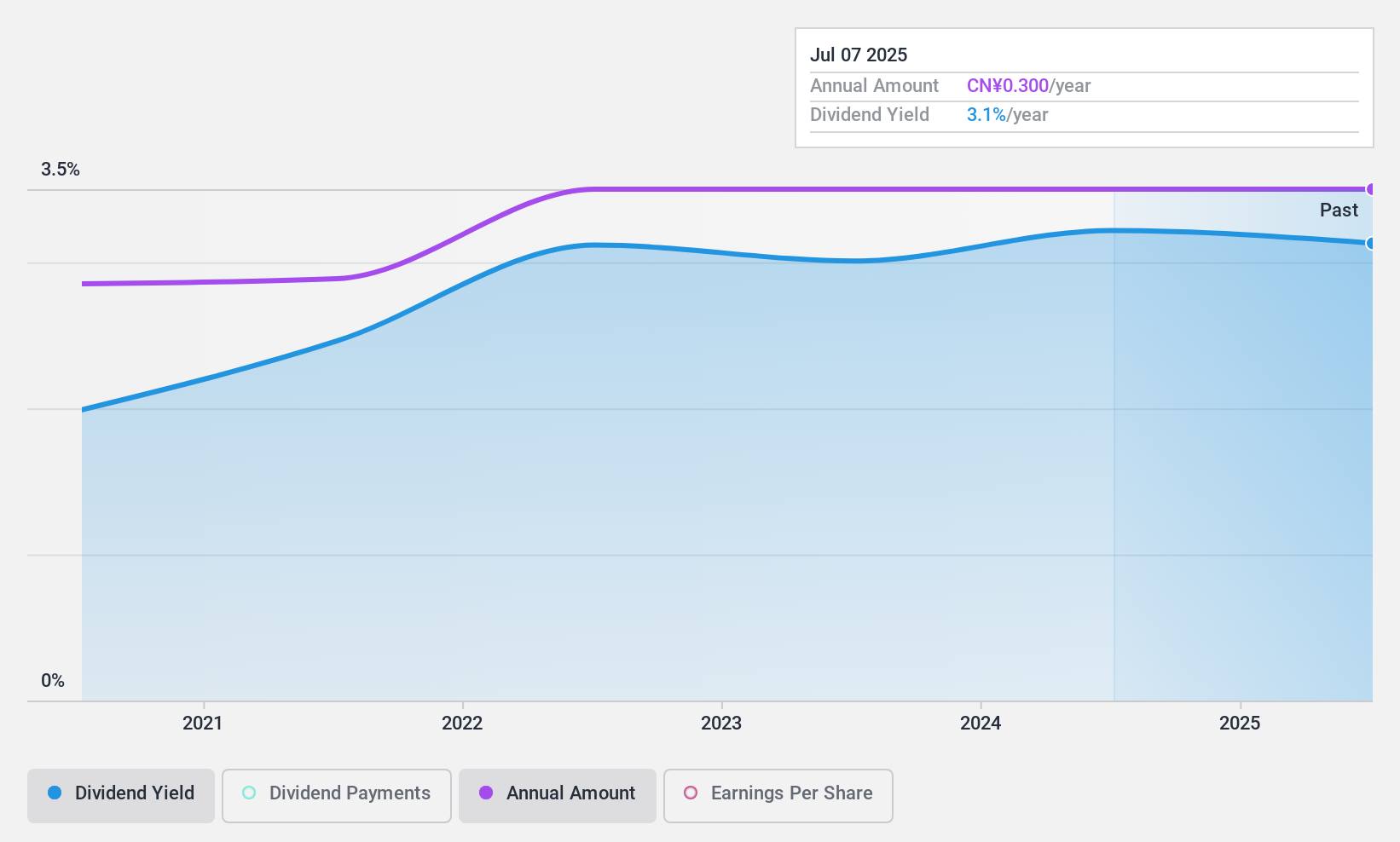

Chengdu Gas Group (SHSE:603053)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Chengdu Gas Group Corporation Ltd. operates in the urban gas supply business in China with a market cap of CN¥8.85 billion.

Operations: Chengdu Gas Group Corporation Ltd. generates revenue through its operations in the urban gas supply sector within China.

Dividend Yield: 3%

Chengdu Gas Group's dividends are well-supported by earnings and cash flows, with a payout ratio of 52.6% and a cash payout ratio of 39.9%. Although dividends have been paid for only four years, they show growth and stability. The dividend yield is competitive at 3.01%, placing it in the top quartile in China. Despite recent earnings showing slight declines, the stock trades below its estimated fair value, potentially offering good value for investors seeking dividends.

- Click to explore a detailed breakdown of our findings in Chengdu Gas Group's dividend report.

- Our comprehensive valuation report raises the possibility that Chengdu Gas Group is priced higher than what may be justified by its financials.

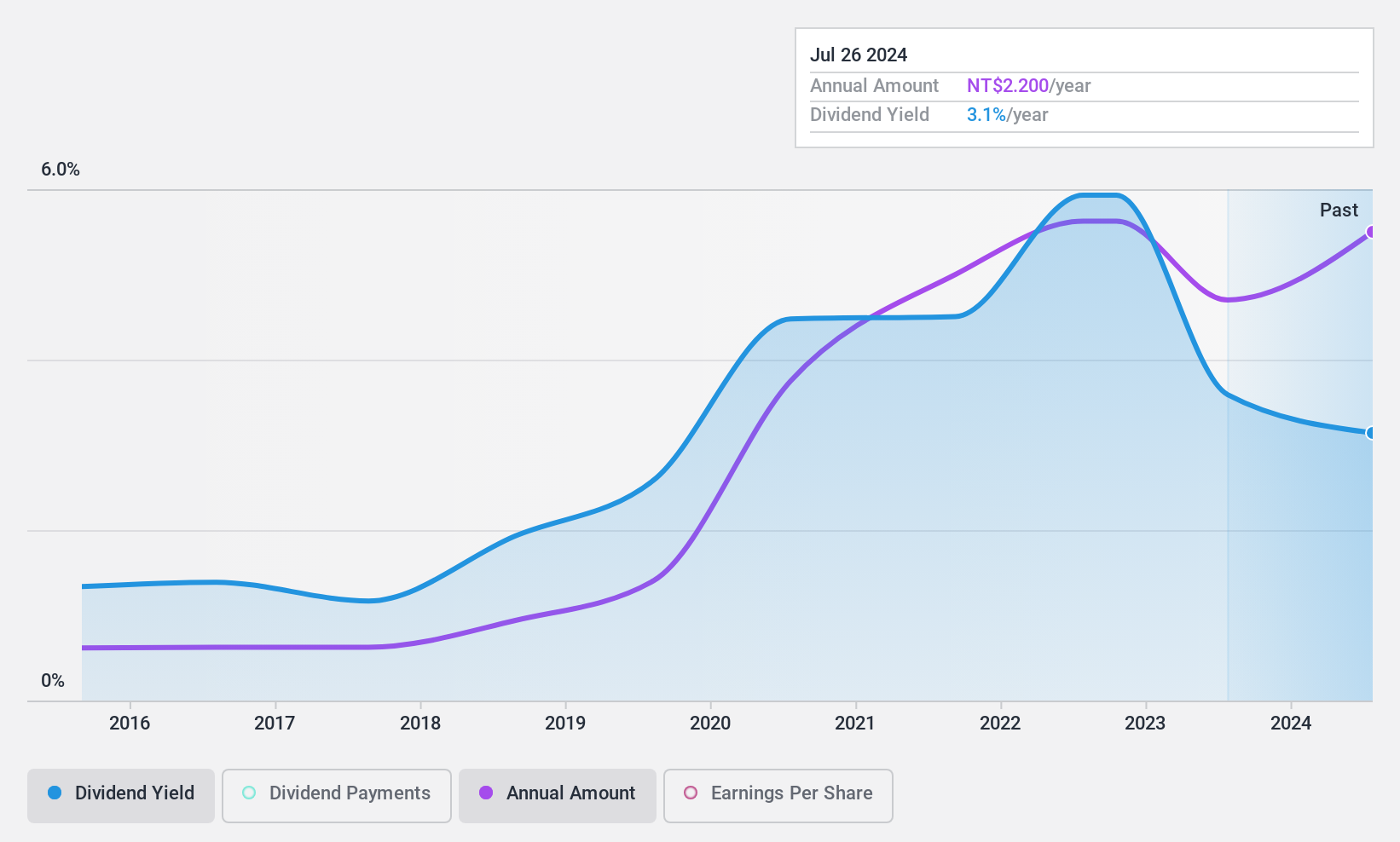

Jiin Yeeh Ding Enterprises (TPEX:8390)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Jiin Yeeh Ding Enterprises Corp. is a professional electronic waste recycling and treatment company offering e-waste disposal services to technology companies in Taiwan, with a market cap of NT$6.97 billion.

Operations: Jiin Yeeh Ding Enterprises Corp. generates its revenue primarily from providing electronic waste recycling and treatment services to technology companies in Taiwan.

Dividend Yield: 3%

Jiin Yeeh Ding Enterprises has maintained stable and growing dividends over the past decade, though its 3.03% yield is below Taiwan's top quartile. While dividends are covered by earnings with a payout ratio of 51.3%, they aren't well-supported by cash flows, indicated by a high cash payout ratio of 117.6%. Recent earnings show increased sales and net income for Q3, but overall nine-month profits have declined compared to last year.

- Unlock comprehensive insights into our analysis of Jiin Yeeh Ding Enterprises stock in this dividend report.

- Our valuation report here indicates Jiin Yeeh Ding Enterprises may be overvalued.

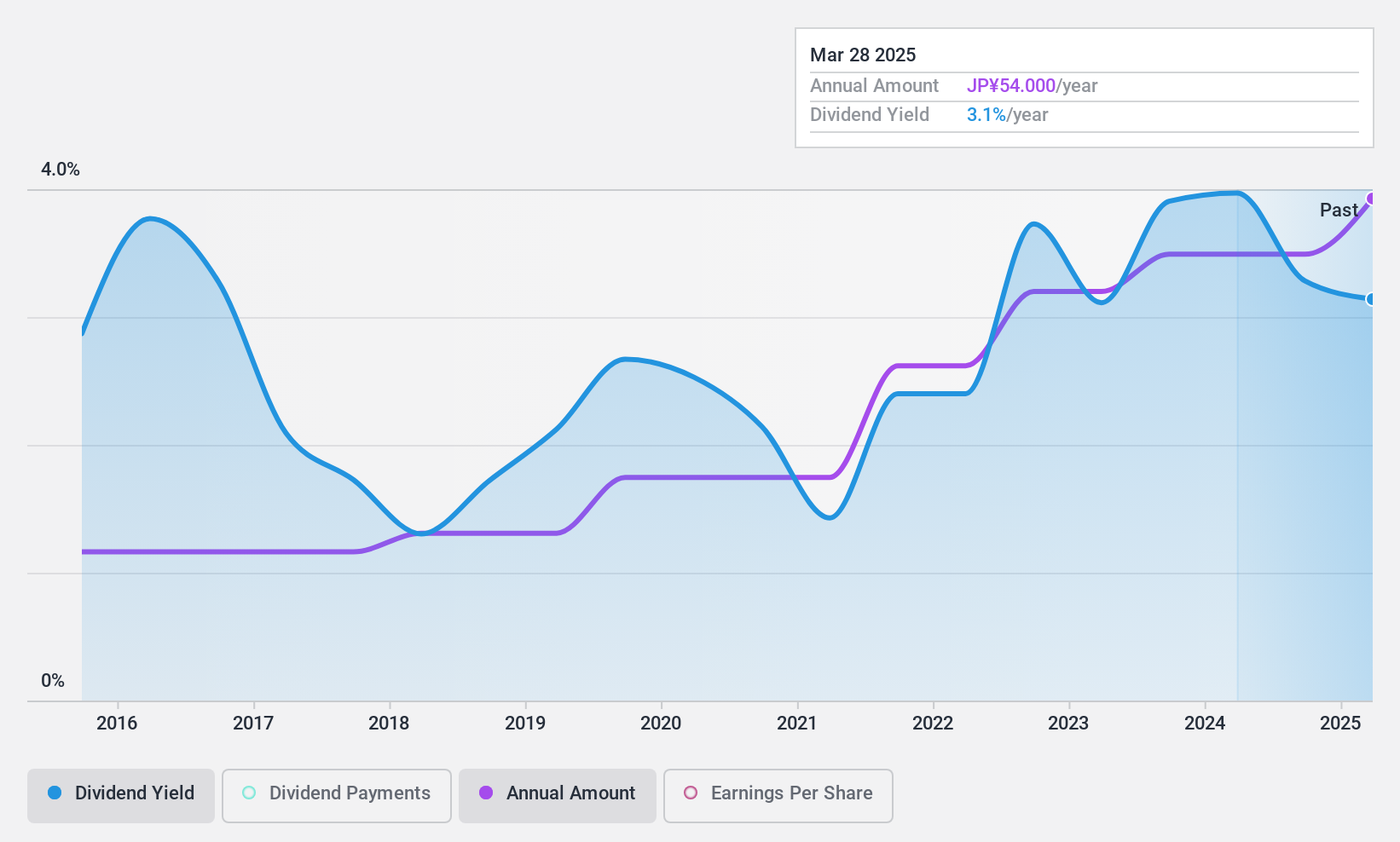

Tsugami (TSE:6101)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Tsugami Corporation, along with its subsidiaries, manufactures and sells precision machine tools in Japan and has a market cap of ¥67.56 billion.

Operations: Tsugami Corporation generates revenue from various regions, including ¥75.84 billion from China, ¥5.22 billion from India, ¥30.09 billion from Japan, and ¥1.88 billion from Korea.

Dividend Yield: 3.4%

Tsugami offers a reliable dividend yield of 3.39%, though slightly below Japan's top quartile. Its dividends are well-supported, with a low payout ratio of 14.2% and a cash payout ratio of 45.6%. Over the past decade, dividends have been stable and growing, supported by strong earnings growth of 42.4% last year. Recent share buybacks totaling ¥564.53 million indicate effective capital management, enhancing shareholder value amidst evolving business conditions.

- Delve into the full analysis dividend report here for a deeper understanding of Tsugami.

- In light of our recent valuation report, it seems possible that Tsugami is trading beyond its estimated value.

Seize The Opportunity

- Investigate our full lineup of 1943 Top Dividend Stocks right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603053

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives