- China

- /

- Water Utilities

- /

- SHSE:600864

The 24% return delivered to Harbin Hatou InvestmentLtd's (SHSE:600864) shareholders actually lagged YoY earnings growth

One simple way to benefit from the stock market is to buy an index fund. But many of us dare to dream of bigger returns, and build a portfolio ourselves. For example, the Harbin Hatou Investment Co.,Ltd (SHSE:600864) share price is up 23% in the last three years, clearly besting the market decline of around 18% (not including dividends).

Since the stock has added CN¥1.3b to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

Check out our latest analysis for Harbin Hatou InvestmentLtd

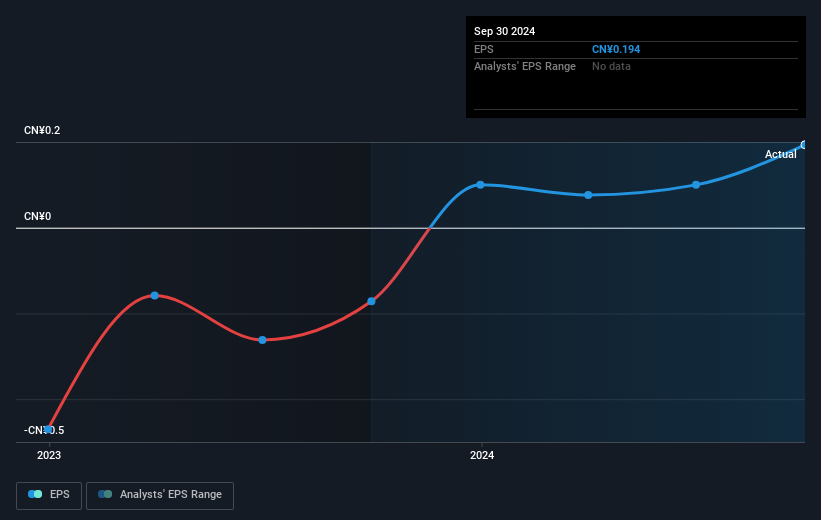

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During three years of share price growth, Harbin Hatou InvestmentLtd moved from a loss to profitability. That would generally be considered a positive, so we'd expect the share price to be up.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. It might be well worthwhile taking a look at our free report on Harbin Hatou InvestmentLtd's earnings, revenue and cash flow.

A Different Perspective

We're pleased to report that Harbin Hatou InvestmentLtd shareholders have received a total shareholder return of 21% over one year. That gain is better than the annual TSR over five years, which is 1.6%. Therefore it seems like sentiment around the company has been positive lately. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - Harbin Hatou InvestmentLtd has 2 warning signs (and 1 which is significant) we think you should know about.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Harbin Hatou InvestmentLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600864

Harbin Hatou InvestmentLtd

Produces and supplies heat and thermal power in the People’s Republic of China.

Excellent balance sheet and slightly overvalued.