- China

- /

- Renewable Energy

- /

- SHSE:600821

Cautious Investors Not Rewarding NYOCOR Co., Ltd.'s (SHSE:600821) Performance Completely

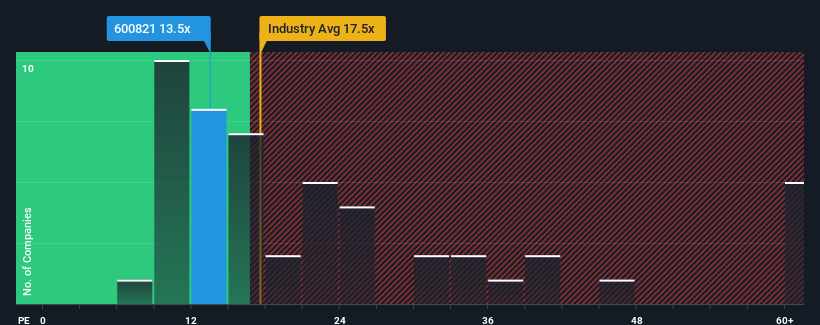

With a price-to-earnings (or "P/E") ratio of 13.5x NYOCOR Co., Ltd. (SHSE:600821) may be sending very bullish signals at the moment, given that almost half of all companies in China have P/E ratios greater than 37x and even P/E's higher than 72x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

NYOCOR's negative earnings growth of late has neither been better nor worse than most other companies. One possibility is that the P/E is low because investors think the company's earnings may begin to slide even faster. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. At the very least, you'd be hoping that earnings don't fall off a cliff if your plan is to pick up some stock while it's out of favour.

See our latest analysis for NYOCOR

Is There Any Growth For NYOCOR?

NYOCOR's P/E ratio would be typical for a company that's expected to deliver very poor growth or even falling earnings, and importantly, perform much worse than the market.

Retrospectively, the last year delivered a frustrating 2.3% decrease to the company's bottom line. Still, the latest three year period has seen an excellent 36% overall rise in EPS, in spite of its unsatisfying short-term performance. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Turning to the outlook, the next year should generate growth of 40% as estimated by the three analysts watching the company. That's shaping up to be similar to the 38% growth forecast for the broader market.

In light of this, it's peculiar that NYOCOR's P/E sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

The Key Takeaway

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that NYOCOR currently trades on a lower than expected P/E since its forecast growth is in line with the wider market. When we see an average earnings outlook with market-like growth, we assume potential risks are what might be placing pressure on the P/E ratio. It appears some are indeed anticipating earnings instability, because these conditions should normally provide more support to the share price.

We don't want to rain on the parade too much, but we did also find 1 warning sign for NYOCOR that you need to be mindful of.

You might be able to find a better investment than NYOCOR. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if NYOCOR might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600821

NYOCOR

Engages in the development, investment, construction, and operation of new energy power plants in China.

Average dividend payer and fair value.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026