- China

- /

- Electric Utilities

- /

- SHSE:600452

Undiscovered Gems In Focus With Chongqing Fuling Electric Power Industrial Plus Two Promising Small Caps

Reviewed by Simply Wall St

As global markets experience a wave of optimism fueled by hopes for softer tariffs and AI advancements, small-cap stocks have been somewhat overshadowed by their larger counterparts. Despite this, the S&P MidCap 400 and Russell 2000 indexes have shown robust gains, highlighting the potential for discovering undervalued opportunities in the small-cap sector. In this context, identifying promising stocks involves looking beyond immediate market trends to find companies with strong fundamentals and growth potential that may not yet be fully recognized by investors.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Tien Phong Plastic | 40.41% | 4.32% | 8.11% | ★★★★★★ |

| Padma Oil | 0.76% | 4.42% | 9.81% | ★★★★★★ |

| Resource Alam Indonesia | 2.66% | 30.36% | 43.87% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Indofood Agri Resources | 34.58% | 4.29% | 50.61% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Citra Tubindo | NA | 11.06% | 31.01% | ★★★★★★ |

| Danang Port | 23.72% | 10.58% | 9.22% | ★★★★★☆ |

| An Phat Bioplastics | 62.46% | 9.85% | 4.38% | ★★★★★☆ |

| Krishana Phoschem | 109.80% | 43.94% | 26.30% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Chongqing Fuling Electric Power Industrial (SHSE:600452)

Simply Wall St Value Rating: ★★★★★★

Overview: Chongqing Fuling Electric Power Industrial Co., Ltd. is a company involved in the electric power industry with a market capitalization of CN¥14.46 billion.

Operations: Fuling Electric Power generates revenue primarily through its electric power operations. The company has a market capitalization of CN¥14.46 billion, reflecting its scale in the industry.

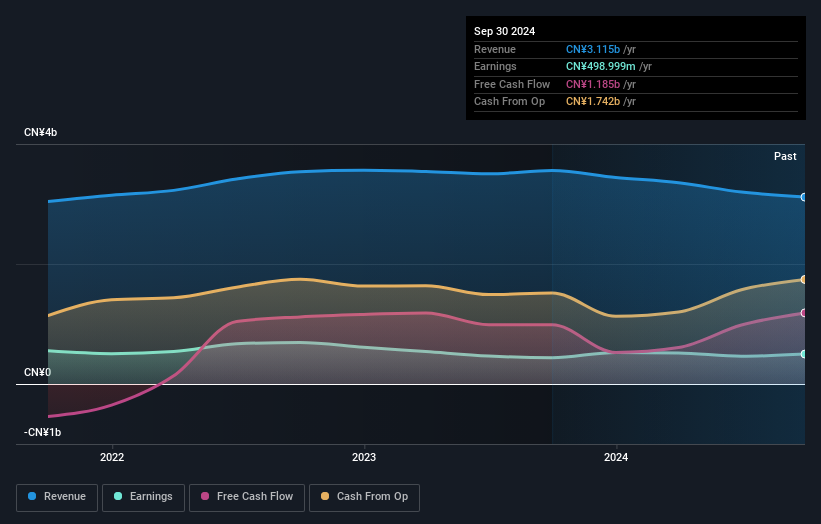

Chongqing Fuling Electric Power Industrial, a promising player in the electric utilities sector, is debt-free, having eliminated its debt from a 71.1% debt-to-equity ratio five years ago. Its earnings have grown by 14% over the past year, surpassing industry growth of 13%, and it trades at 54.4% below estimated fair value. The company has high-quality earnings and is free cash flow positive with recent figures showing CNY1.19 billion in levered free cash flow for Q3 2024. A special shareholders meeting is scheduled for November 28, reflecting active corporate governance engagement.

Morinaga&Co (TSE:2201)

Simply Wall St Value Rating: ★★★★★☆

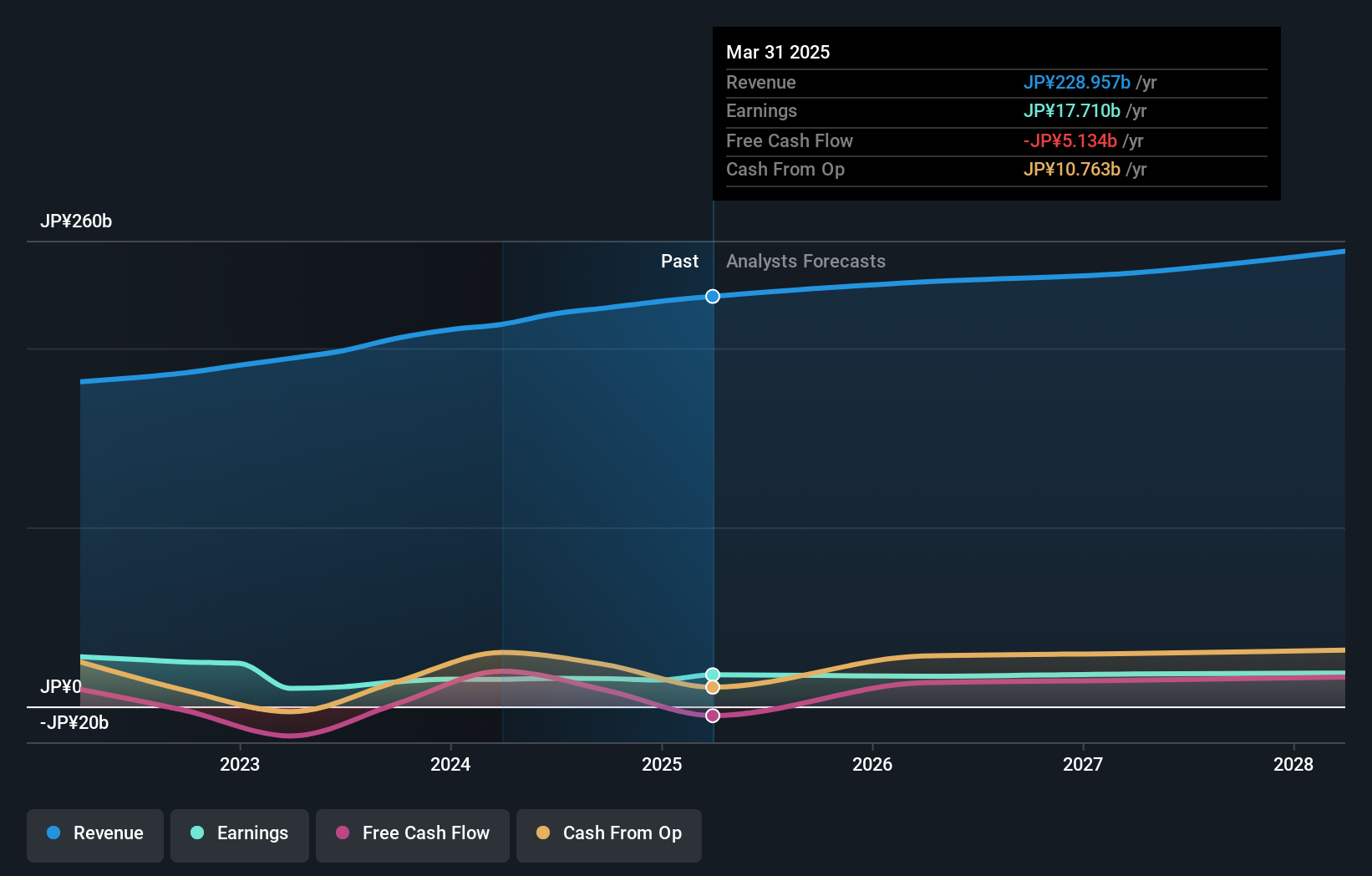

Overview: Morinaga&Co., Ltd. is a company engaged in the manufacturing, purchasing, and selling of confectionaries, foodstuffs, frozen desserts, and health products both in Japan and internationally, with a market capitalization of ¥230.19 billion.

Operations: Morinaga&Co. generates revenue primarily from food manufacturing, which contributes ¥212.44 billion, and food wholesale, adding ¥7.77 billion. The company also earns from real estate and services with a revenue of ¥1.89 billion.

Morinaga&Co., a notable player in the food industry, is trading at 45.7% below its estimated fair value, presenting an attractive valuation compared to peers. Over the past five years, earnings have grown at 5.9% annually, although recent growth of 13% lagged behind the broader industry's 20.3%. The company has repurchased 3,858,700 shares for ¥9.99 billion as part of its capital efficiency strategy. Despite a rise in debt to equity from 10.5% to 13.8%, Morinaga maintains more cash than total debt and generates positive free cash flow, underscoring financial stability and quality earnings potential moving forward.

- Delve into the full analysis health report here for a deeper understanding of Morinaga&Co.

Examine Morinaga&Co's past performance report to understand how it has performed in the past.

INTAGE HOLDINGS (TSE:4326)

Simply Wall St Value Rating: ★★★★★★

Overview: INTAGE HOLDINGS Inc. is a marketing research company with operations in Japan and internationally, and it has a market capitalization of ¥59.33 billion.

Operations: INTAGE HOLDINGS generates revenue primarily from its Business Intelligence, Marketing Support (Health Care), and Marketing Support (Consumer Goods and Service) segments, with the latter contributing ¥42.23 billion.

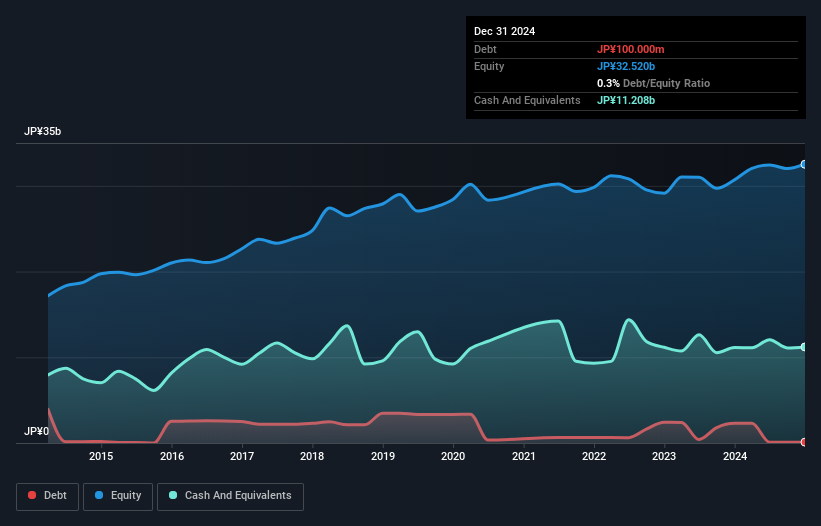

INTAGE HOLDINGS, a smaller player in the market, has shown impressive financial resilience. Over the past year, earnings surged by 16%, outpacing the media industry's 7.3% growth rate. The firm boasts a significant reduction in its debt-to-equity ratio from 12.1% to just 0.3% over five years, reflecting robust financial management and strategic debt reduction efforts. However, recent results were influenced by a one-off gain of ¥1.7 billion (approx US$15 million), which may not reflect ongoing performance trends as earnings are expected to decline by an average of 4.2% annually over the next three years.

- Dive into the specifics of INTAGE HOLDINGS here with our thorough health report.

Review our historical performance report to gain insights into INTAGE HOLDINGS''s past performance.

Make It Happen

- Discover the full array of 4684 Undiscovered Gems With Strong Fundamentals right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600452

Chongqing Fuling Electric Power Industrial

Chongqing Fuling Electric Power Industrial Co., Ltd.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives