Investors Appear Satisfied With Jiangsu Azure Corporation's (SZSE:002245) Prospects As Shares Rocket 43%

Despite an already strong run, Jiangsu Azure Corporation (SZSE:002245) shares have been powering on, with a gain of 43% in the last thirty days. The last 30 days bring the annual gain to a very sharp 42%.

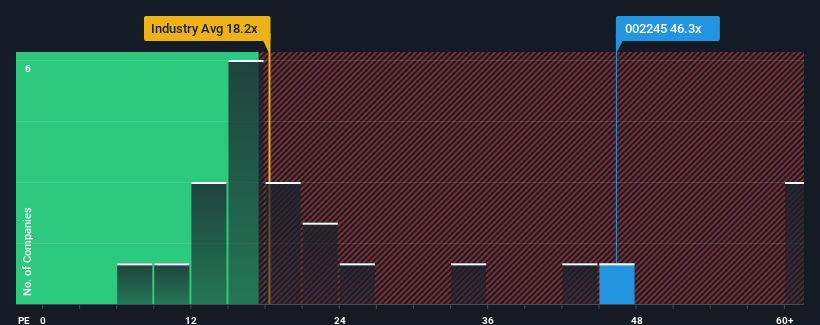

Since its price has surged higher, given around half the companies in China have price-to-earnings ratios (or "P/E's") below 35x, you may consider Jiangsu Azure as a stock to potentially avoid with its 46.3x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

Recent times have been pleasing for Jiangsu Azure as its earnings have risen in spite of the market's earnings going into reverse. The P/E is probably high because investors think the company will continue to navigate the broader market headwinds better than most. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for Jiangsu Azure

Does Growth Match The High P/E?

There's an inherent assumption that a company should outperform the market for P/E ratios like Jiangsu Azure's to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 311% last year. Still, incredibly EPS has fallen 54% in total from three years ago, which is quite disappointing. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Turning to the outlook, the next year should generate growth of 77% as estimated by the seven analysts watching the company. Meanwhile, the rest of the market is forecast to only expand by 39%, which is noticeably less attractive.

With this information, we can see why Jiangsu Azure is trading at such a high P/E compared to the market. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

The large bounce in Jiangsu Azure's shares has lifted the company's P/E to a fairly high level. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Jiangsu Azure's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless these conditions change, they will continue to provide strong support to the share price.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Jiangsu Azure you should know about.

Of course, you might also be able to find a better stock than Jiangsu Azure. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002245

Jiangsu Azure

Engages in lithium batteries, LED chips, and metal logistics and distribution businesses in China and internationally.

Flawless balance sheet with solid track record.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Mastersystem Infotama will achieve 18.9% revenue growth as fair value hits IDR1,650

Insiders Sell, Investors Watch: What’s Going On at PG?

Waiting for the Inevitable

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026