Earnings Tell The Story For Jiangsu Azure Corporation (SZSE:002245) As Its Stock Soars 36%

Jiangsu Azure Corporation (SZSE:002245) shareholders have had their patience rewarded with a 36% share price jump in the last month. Unfortunately, despite the strong performance over the last month, the full year gain of 7.0% isn't as attractive.

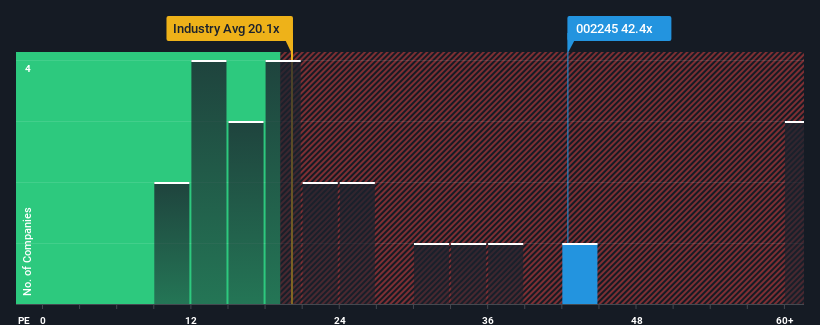

Since its price has surged higher, Jiangsu Azure may be sending bearish signals at the moment with its price-to-earnings (or "P/E") ratio of 42.4x, since almost half of all companies in China have P/E ratios under 33x and even P/E's lower than 20x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/E.

Jiangsu Azure certainly has been doing a good job lately as its earnings growth has been positive while most other companies have been seeing their earnings go backwards. It seems that many are expecting the company to continue defying the broader market adversity, which has increased investors’ willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for Jiangsu Azure

Does Growth Match The High P/E?

There's an inherent assumption that a company should outperform the market for P/E ratios like Jiangsu Azure's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 285% gain to the company's bottom line. Despite this strong recent growth, it's still struggling to catch up as its three-year EPS frustratingly shrank by 57% overall. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Shifting to the future, estimates from the six analysts covering the company suggest earnings should grow by 39% per annum over the next three years. Meanwhile, the rest of the market is forecast to only expand by 19% per year, which is noticeably less attractive.

In light of this, it's understandable that Jiangsu Azure's P/E sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

The large bounce in Jiangsu Azure's shares has lifted the company's P/E to a fairly high level. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Jiangsu Azure maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless these conditions change, they will continue to provide strong support to the share price.

Before you take the next step, you should know about the 1 warning sign for Jiangsu Azure that we have uncovered.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002245

Jiangsu Azure

Engages in lithium batteries, LED chips, and metal logistics and distribution businesses in China and internationally.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives