As global markets experience fluctuations driven by cooling inflation and strong bank earnings, investors are increasingly focused on identifying growth opportunities amidst these shifting conditions. In this context, companies with high insider ownership can be particularly appealing as they often indicate a strong alignment between management and shareholder interests, which can be crucial for navigating the current economic landscape.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Duc Giang Chemicals Group (HOSE:DGC) | 31.4% | 23.8% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.9% | 39.9% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.2% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 26.2% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.3% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 135% |

| Fulin Precision (SZSE:300432) | 13.6% | 66.7% |

| Findi (ASX:FND) | 35.8% | 110.9% |

Here we highlight a subset of our preferred stocks from the screener.

VusionGroup (ENXTPA:VU)

Simply Wall St Growth Rating: ★★★★★★

Overview: VusionGroup S.A. offers digitalization solutions for commerce across Europe, Asia, and North America with a market capitalization of €2.69 billion.

Operations: The company's revenue is primarily generated from installing and maintaining electronic shelf labels, amounting to €830.16 million.

Insider Ownership: 13.4%

VusionGroup is poised for significant growth, with revenue expected to increase by 23.5% annually, outpacing the French market's 5.5%. Analysts predict a 21% rise in stock price, and the company is trading at nearly 12% below its fair value estimate. Despite recent share price volatility, VusionGroup's strategic partnership with The Fresh Market marks its first North American rollout of Vusion 360 technology, enhancing inventory management and efficiency across all U.S. locations.

- Click to explore a detailed breakdown of our findings in VusionGroup's earnings growth report.

- The valuation report we've compiled suggests that VusionGroup's current price could be quite moderate.

Jiangsu Azure (SZSE:002245)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Jiangsu Azure Corporation operates in lithium batteries, LED chips, and metal logistics and distribution sectors both in China and internationally, with a market cap of CN¥13.81 billion.

Operations: The company's revenue is derived from its operations in lithium batteries, LED chips, and metal logistics and distribution businesses.

Insider Ownership: 14.7%

Jiangsu Azure's recent earnings report highlights robust growth, with net income rising to CNY 281.86 million from CNY 103.16 million year-on-year, driven by a significant increase in sales to CNY 4.84 billion. Despite high share price volatility and low forecasted return on equity of 8.8%, the company's earnings are expected to grow at a substantial rate of 31.78% annually, surpassing the broader Chinese market's growth expectations for both revenue and profit over the next three years.

- Take a closer look at Jiangsu Azure's potential here in our earnings growth report.

- Our valuation report here indicates Jiangsu Azure may be overvalued.

Hubei DinglongLtd (SZSE:300054)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hubei Dinglong CO.,Ltd. focuses on the research, development, production, and service of circuit design, semiconductor materials, and printing and copying general consumables with a market cap of CN¥25.13 billion.

Operations: The company's revenue from the Photoelectric Imaging Display and Semiconductor Process Materials Industry is CN¥3.20 billion.

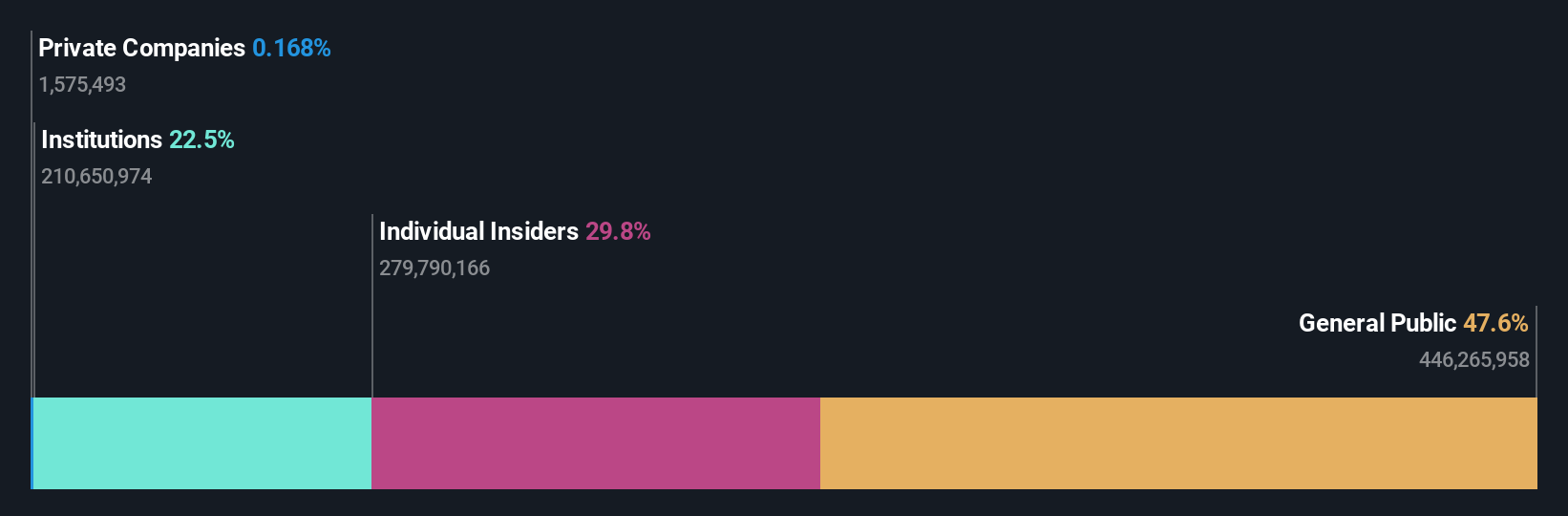

Insider Ownership: 29.9%

Hubei Dinglong Ltd. demonstrates strong growth potential with earnings forecasted to increase by 32.36% annually, outpacing the Chinese market's expected profit growth of 25.2%. Recent financial results show net income rising to CNY 376.32 million from CNY 176.26 million year-on-year, supported by sales of CNY 2.43 billion up from CNY 1.87 billion previously. Analysts anticipate a stock price rise of 22%, although future return on equity is projected at a modest 13.9%.

- Click here and access our complete growth analysis report to understand the dynamics of Hubei DinglongLtd.

- Insights from our recent valuation report point to the potential overvaluation of Hubei DinglongLtd shares in the market.

Make It Happen

- Discover the full array of 1466 Fast Growing Companies With High Insider Ownership right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Hubei DinglongLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300054

Hubei DinglongLtd

Engages in research, development, production, and service of circuit design, semiconductor materials, printing and copying general consumables.

Solid track record with excellent balance sheet.