3 Growth Companies With High Insider Ownership Growing Earnings At 32%

Reviewed by Simply Wall St

As global markets navigate a landscape of rising inflation and economic uncertainties, U.S. stock indexes are climbing toward record highs, with growth stocks leading the charge over value shares. In this environment, companies that exhibit robust insider ownership and demonstrate strong earnings growth can be particularly appealing to investors seeking resilience and potential upside in their portfolios.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 50.1% |

| Seojin SystemLtd (KOSDAQ:A178320) | 32.1% | 39.9% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 26.2% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Pricol (NSEI:PRICOLLTD) | 25.4% | 25.2% |

| Laopu Gold (SEHK:6181) | 36.4% | 39.1% |

| Plenti Group (ASX:PLT) | 12.7% | 120.1% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 119.4% |

| Fulin Precision (SZSE:300432) | 13.6% | 71% |

| Findi (ASX:FND) | 35.8% | 118.5% |

Let's dive into some prime choices out of the screener.

Jiangsu Azure (SZSE:002245)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Jiangsu Azure Corporation operates in the lithium batteries, LED chips, and metal logistics and distribution sectors both in China and internationally, with a market cap of CN¥15.73 billion.

Operations: The company's revenue segments include lithium batteries, LED chips, and metal logistics and distribution.

Insider Ownership: 14.7%

Earnings Growth Forecast: 32.8% p.a.

Jiangsu Azure's earnings are forecast to grow significantly at 32.83% annually, outpacing the Chinese market average of 25%. However, its revenue growth is expected to be slower than the ideal high-growth threshold at 16.3% per year. Recent leadership changes include Pan Dongyan's election as an independent director. Despite a volatile share price, the company's substantial past earnings growth and insider ownership remain positive indicators for potential investors.

- Dive into the specifics of Jiangsu Azure here with our thorough growth forecast report.

- The valuation report we've compiled suggests that Jiangsu Azure's current price could be inflated.

Hubei DinglongLtd (SZSE:300054)

Simply Wall St Growth Rating: ★★★★☆☆

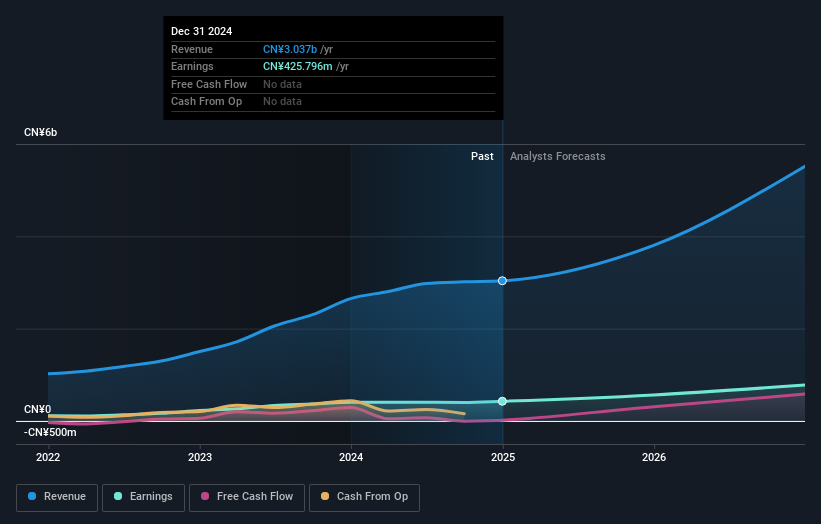

Overview: Hubei Dinglong Co., Ltd. focuses on the research, development, production, and service of circuit design, semiconductor materials, and printing and copying consumables with a market cap of CN¥26.70 billion.

Operations: The company's revenue primarily comes from the Photoelectric Imaging Display and Semiconductor Process Materials Industry, amounting to CN¥3.20 billion.

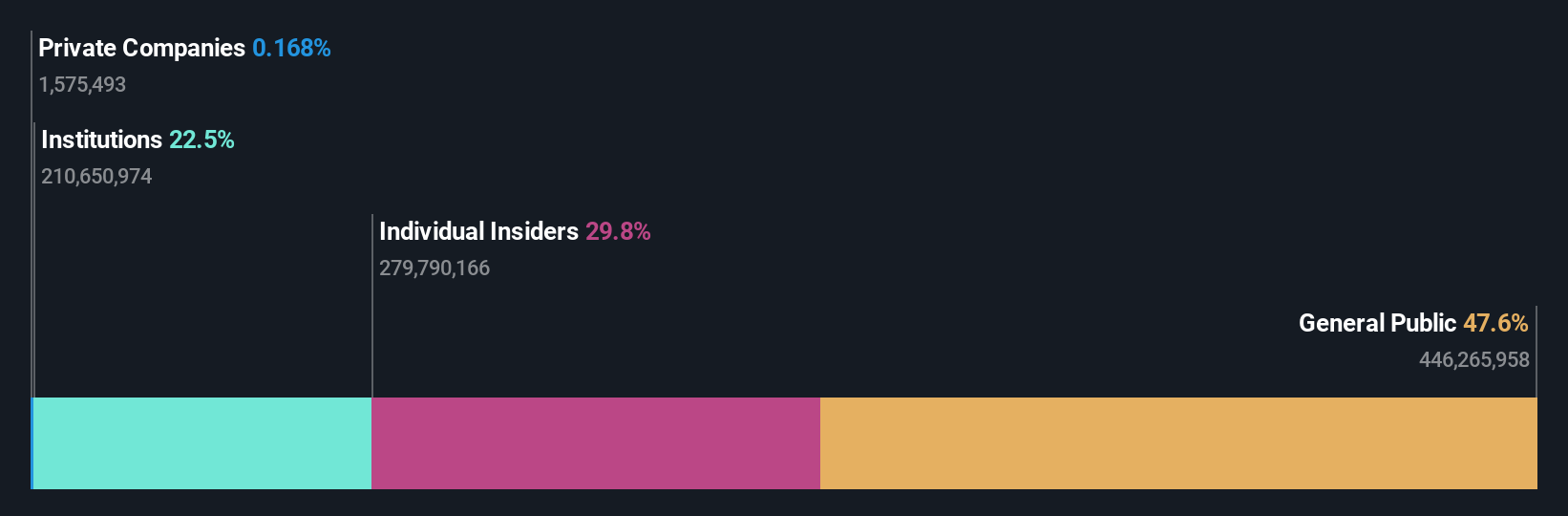

Insider Ownership: 29.9%

Earnings Growth Forecast: 32.4% p.a.

Hubei Dinglong Ltd is poised for significant earnings growth at 32.36% annually, surpassing the Chinese market average of 25%. Although revenue growth is forecasted at a slower pace of 17% per year, it remains above the market's 13.3%. Despite a forecasted low return on equity of 13.9%, substantial insider ownership and past earnings growth of 55.4% bolster its investment appeal amidst stable insider trading activity in recent months.

- Take a closer look at Hubei DinglongLtd's potential here in our earnings growth report.

- Our comprehensive valuation report raises the possibility that Hubei DinglongLtd is priced higher than what may be justified by its financials.

Shenzhen Sinexcel ElectricLtd (SZSE:300693)

Simply Wall St Growth Rating: ★★★★★★

Overview: Shenzhen Sinexcel Electric Co., Ltd. operates as a provider of energy interconnection ecosystems across various continents, with a market cap of CN¥10.87 billion.

Operations: Revenue Segments (in millions of CN¥):

Insider Ownership: 29.1%

Earnings Growth Forecast: 30% p.a.

Shenzhen Sinexcel Electric Ltd. is positioned for robust earnings growth at 30% annually, outpacing the Chinese market's 25%. Revenue is also expected to increase significantly at 30.1% per year. The company recently unveiled its advanced power conversion systems, enhancing its market presence and commitment to green energy solutions. Despite a volatile share price, it trades below estimated fair value and maintains stable insider trading activity, with no substantial sales or purchases reported recently.

- Click to explore a detailed breakdown of our findings in Shenzhen Sinexcel ElectricLtd's earnings growth report.

- According our valuation report, there's an indication that Shenzhen Sinexcel ElectricLtd's share price might be on the cheaper side.

Next Steps

- Get an in-depth perspective on all 1455 Fast Growing Companies With High Insider Ownership by using our screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Hubei DinglongLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300054

Hubei DinglongLtd

Engages in research, development, production, and service of circuit design, semiconductor materials, printing and copying general consumables.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives