- China

- /

- Infrastructure

- /

- SZSE:002023

Market is not liking Sichuan Haite High-techLtd's (SZSE:002023) earnings decline as stock retreats 5.0% this week

While not a mind-blowing move, it is good to see that the Sichuan Haite High-tech Co.,Ltd (SZSE:002023) share price has gained 26% in the last three months. But that doesn't help the fact that the three year return is less impressive. After all, the share price is down 23% in the last three years, significantly under-performing the market.

Given the past week has been tough on shareholders, let's investigate the fundamentals and see what we can learn.

See our latest analysis for Sichuan Haite High-techLtd

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

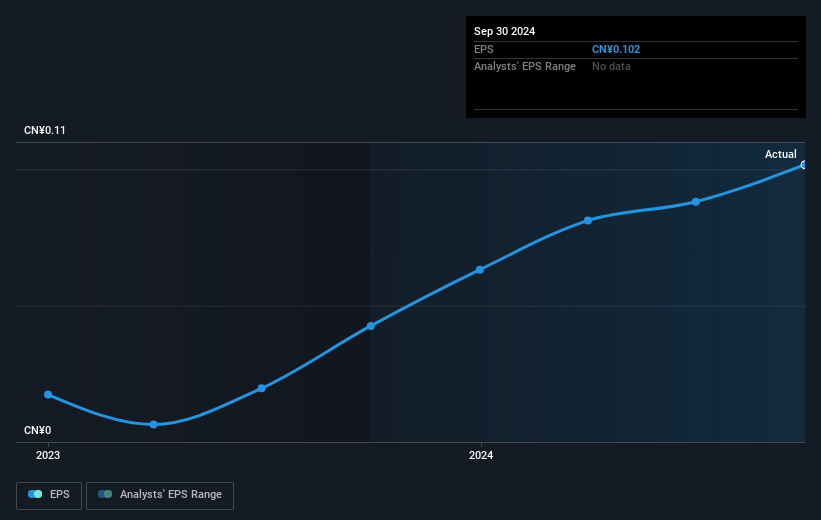

During the three years that the share price fell, Sichuan Haite High-techLtd's earnings per share (EPS) dropped by 53% each year. This fall in the EPS is worse than the 8% compound annual share price fall. So the market may not be too worried about the EPS figure, at the moment -- or it may have previously priced some of the drop in. This positive sentiment is also reflected in the generous P/E ratio of 102.93.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. Dive deeper into the earnings by checking this interactive graph of Sichuan Haite High-techLtd's earnings, revenue and cash flow.

A Different Perspective

It's good to see that Sichuan Haite High-techLtd has rewarded shareholders with a total shareholder return of 17% in the last twelve months. And that does include the dividend. There's no doubt those recent returns are much better than the TSR loss of 2% per year over five years. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. It's always interesting to track share price performance over the longer term. But to understand Sichuan Haite High-techLtd better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 1 warning sign with Sichuan Haite High-techLtd , and understanding them should be part of your investment process.

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002023

Sichuan Haite High-techLtd

Provides aircraft airborne equipment maintenance services in China.

Proven track record with adequate balance sheet.

Market Insights

Community Narratives