- China

- /

- Transportation

- /

- SZSE:001202

Guangdong Jushen Logistics Co., Ltd.'s (SZSE:001202) Business And Shares Still Trailing The Market

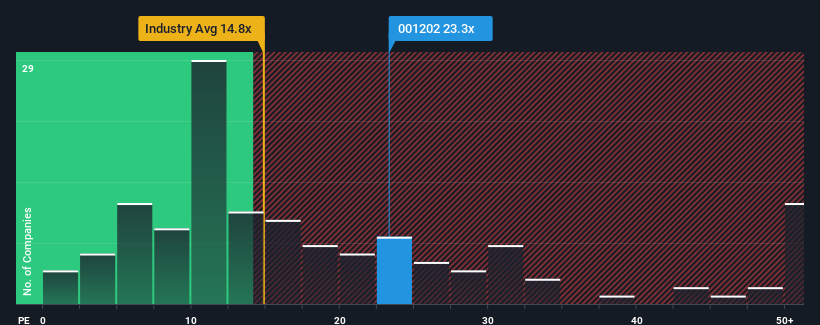

Guangdong Jushen Logistics Co., Ltd.'s (SZSE:001202) price-to-earnings (or "P/E") ratio of 23.3x might make it look like a buy right now compared to the market in China, where around half of the companies have P/E ratios above 30x and even P/E's above 54x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

With earnings growth that's exceedingly strong of late, Guangdong Jushen Logistics has been doing very well. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

See our latest analysis for Guangdong Jushen Logistics

What Are Growth Metrics Telling Us About The Low P/E?

In order to justify its P/E ratio, Guangdong Jushen Logistics would need to produce sluggish growth that's trailing the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 55% last year. Still, incredibly EPS has fallen 47% in total from three years ago, which is quite disappointing. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

In contrast to the company, the rest of the market is expected to grow by 38% over the next year, which really puts the company's recent medium-term earnings decline into perspective.

With this information, we are not surprised that Guangdong Jushen Logistics is trading at a P/E lower than the market. However, we think shrinking earnings are unlikely to lead to a stable P/E over the longer term, which could set up shareholders for future disappointment. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

The Final Word

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Guangdong Jushen Logistics revealed its shrinking earnings over the medium-term are contributing to its low P/E, given the market is set to grow. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

Before you settle on your opinion, we've discovered 2 warning signs for Guangdong Jushen Logistics (1 is significant!) that you should be aware of.

If these risks are making you reconsider your opinion on Guangdong Jushen Logistics, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:001202

Guangdong Jushen Logistics

Provides integrated supply chain logistics services.

Excellent balance sheet with proven track record.