As global markets navigate a complex landscape marked by mixed earnings reports and economic indicators, small-cap stocks have shown resilience, holding up better than their large-cap counterparts amid cautious market sentiment. With the S&P MidCap 400 Index reaching record highs before a sharp pullback and the Russell 2000 Index posting modest gains, investors are keenly observing potential opportunities in lesser-known stocks that may benefit from current market dynamics. In this environment, identifying promising small-cap stocks involves looking for companies with solid fundamentals and growth potential that can weather economic uncertainties and capitalize on emerging trends.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Ruentex Interior Design | NA | 44.92% | 51.98% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| Procimmo Group | 157.49% | 0.65% | 4.94% | ★★★★☆☆ |

| Arab Banking Corporation (B.S.C.) | 190.18% | 16.52% | 21.58% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Ningxia Western Venture IndustrialLtd (SZSE:000557)

Simply Wall St Value Rating: ★★★★★★

Overview: Ningxia Western Venture Industrial Co., Ltd. operates in various industrial sectors and has a market capitalization of approximately CN¥7.54 billion.

Operations: The company generates revenue from multiple industrial sectors, with a market capitalization of approximately CN¥7.54 billion.

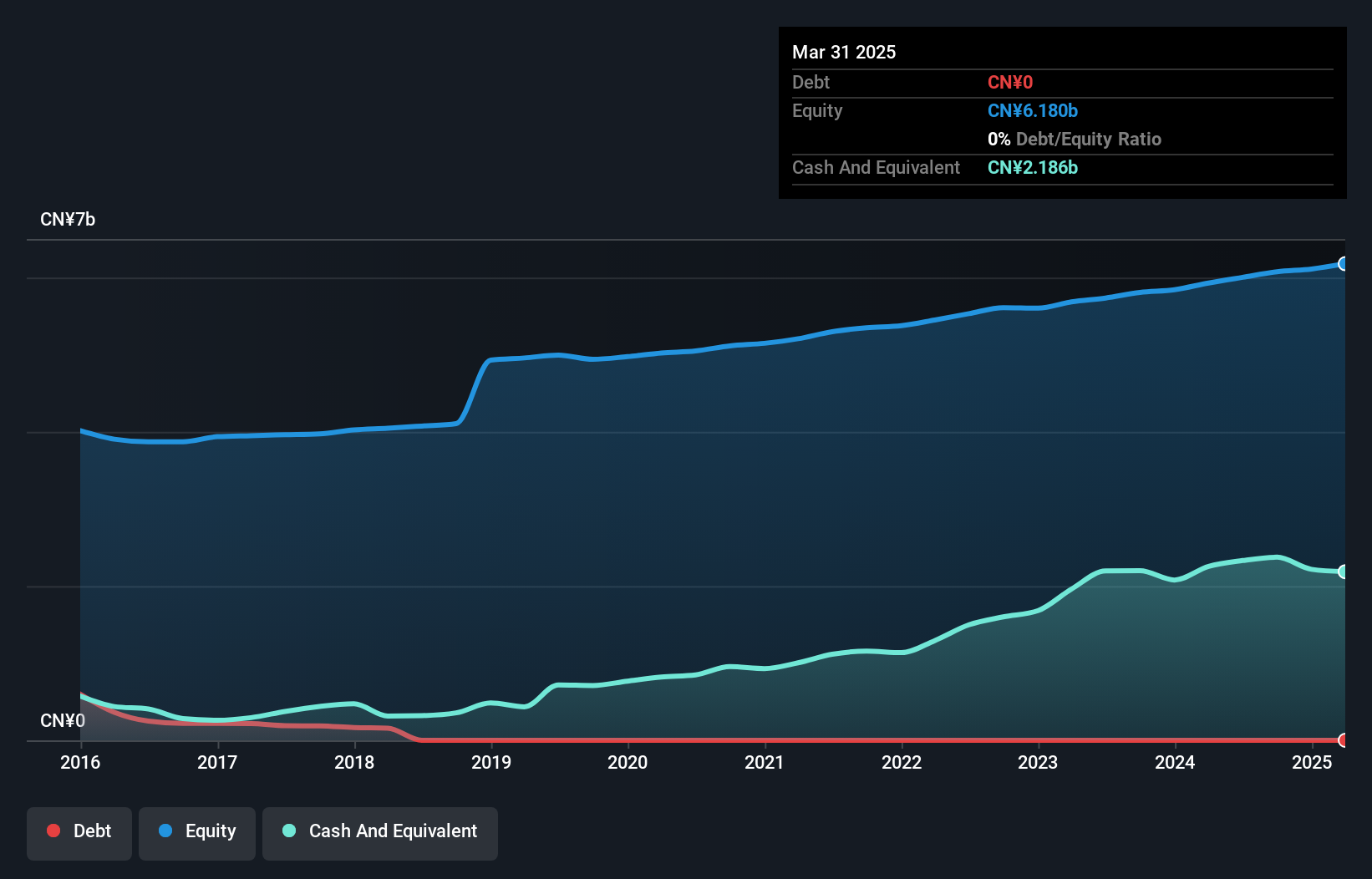

Ningxia Western Venture Industrial, a relatively small player, has shown notable financial resilience. Despite a drop in sales from CNY 1.2 billion to CNY 994.68 million over the past year, net income rose to CNY 224.14 million from CNY 196.79 million, indicating improved profitability with basic earnings per share climbing to CNY 0.1537 from CNY 0.1349 last year. The company operates debt-free and boasts high-quality earnings with a price-to-earnings ratio of 28x, which is below the Chinese market average of 35x, suggesting potential undervaluation in its sector despite recent revenue challenges.

Mitsubishi Logisnext (TSE:7105)

Simply Wall St Value Rating: ★★★★★☆

Overview: Mitsubishi Logisnext Co., Ltd. is involved in the design, development, manufacturing, and sales of forklifts, transportation robots, automated warehouses, electric vehicles, monorails, and logistics equipment in Japan with a market cap of approximately ¥128.40 billion.

Operations: The company generates revenue primarily from its operations in Japan, totaling ¥246.26 billion, and overseas markets, contributing ¥511.26 billion. The net profit margin is a crucial financial metric to consider when evaluating the company's profitability and efficiency in managing expenses relative to its revenue streams.

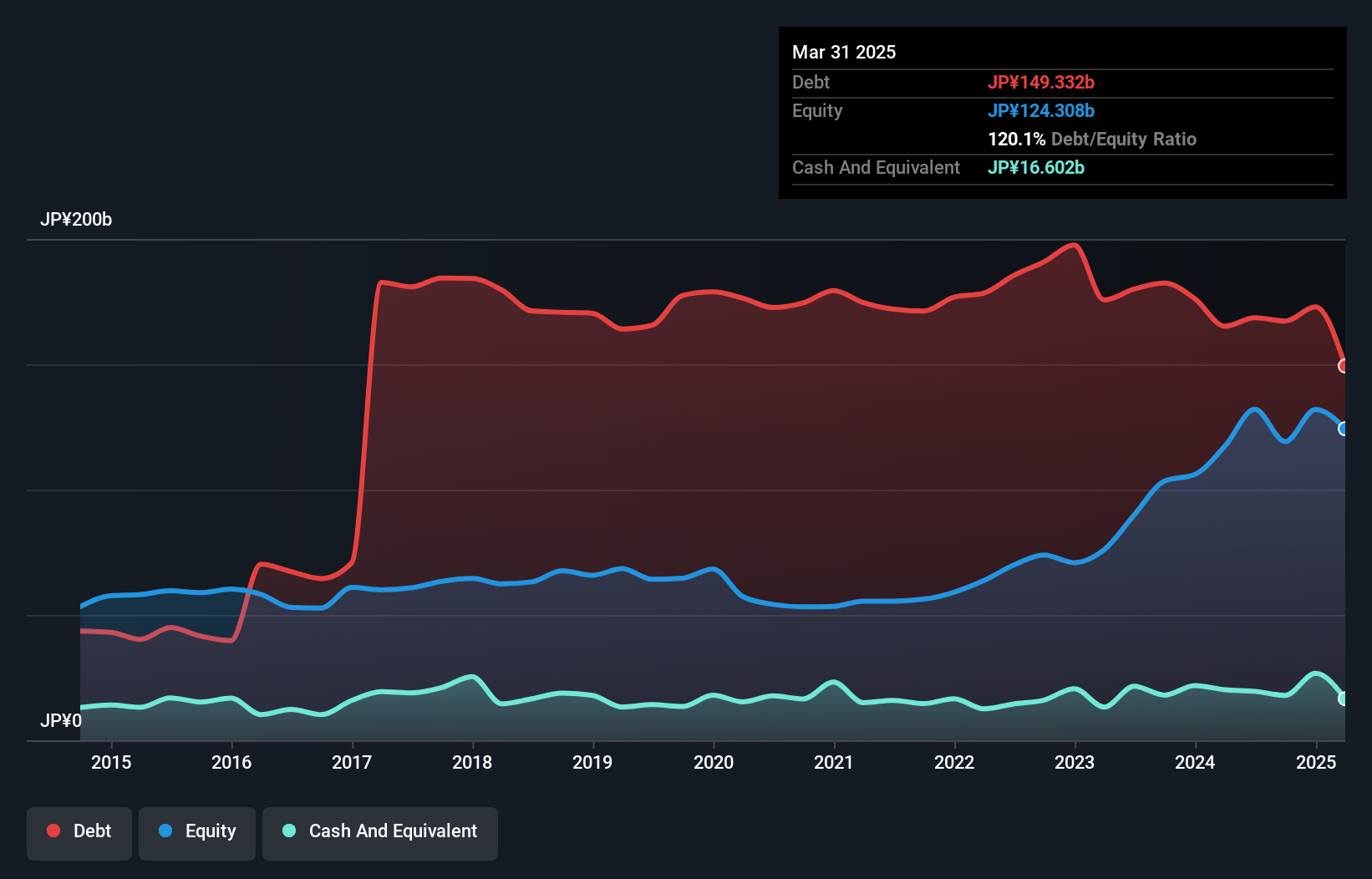

Mitsubishi Logisnext, a notable player in the machinery sector, is showing promising signs with earnings up by 90.5% over the past year, significantly outpacing the industry average of 8.3%. Despite its high net debt to equity ratio of 112.9%, which has improved from 257.7% five years ago, the company ensures interest payments are well covered at a rate of 7.1 times EBIT. Trading at a value estimated to be 39% below fair market price, this entity offers potential for investors seeking undervalued opportunities while maintaining high-quality earnings and positive free cash flow dynamics amidst market volatility.

- Unlock comprehensive insights into our analysis of Mitsubishi Logisnext stock in this health report.

North Pacific BankLtd (TSE:8524)

Simply Wall St Value Rating: ★★★★☆☆

Overview: North Pacific Bank, Ltd. offers a range of banking products and services to individuals and corporations in Japan, with a market capitalization of ¥160.26 billion.

Operations: The bank derives its revenue primarily from interest income, fees, and commissions related to its banking services. It incurs costs associated with interest payments on deposits and other financial liabilities. The net profit margin reflects the efficiency of its operations in generating profit from total revenue.

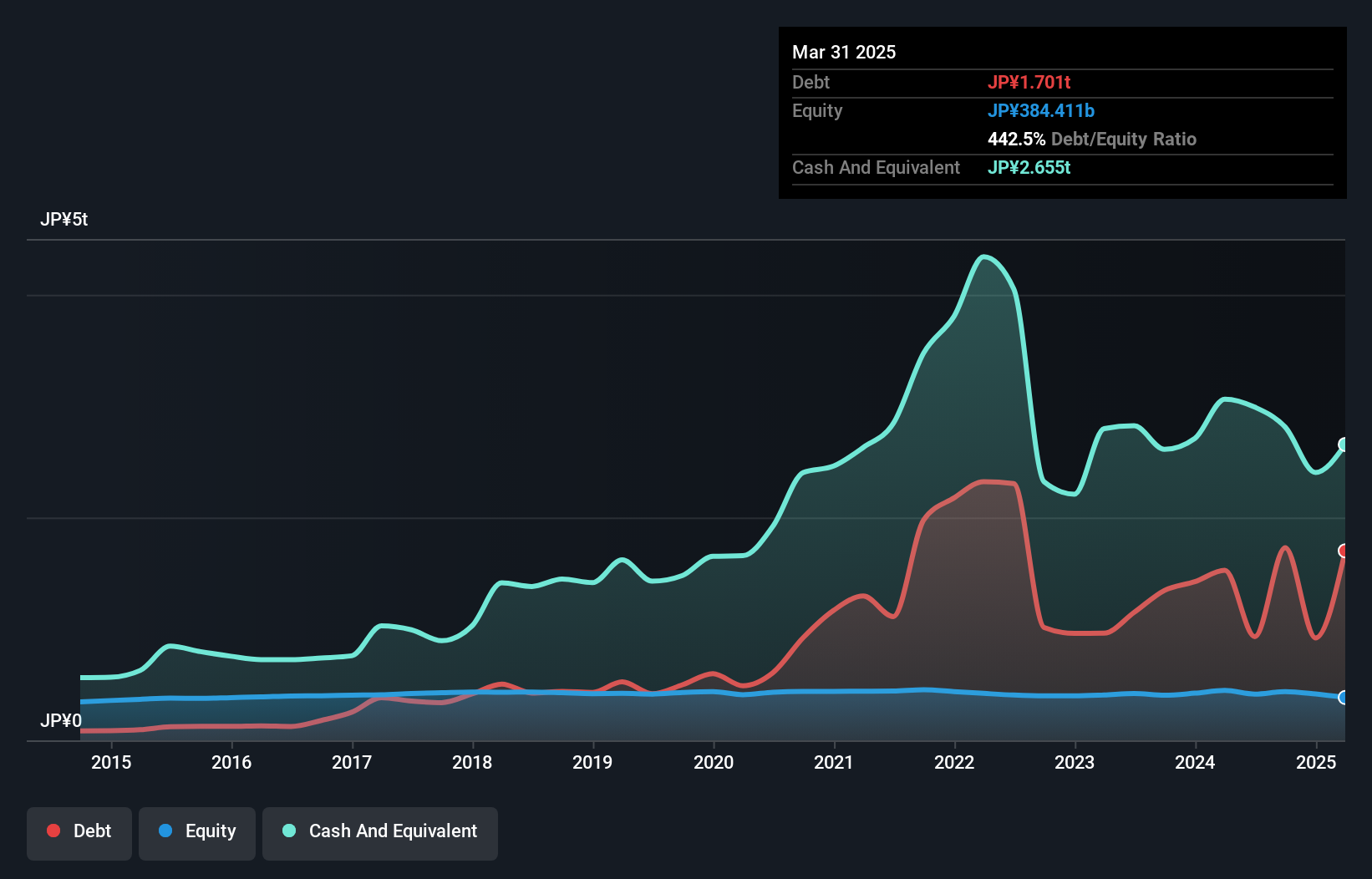

North Pacific Bank boasts total assets of ¥13,292.5 billion and equity of ¥414.9 billion, with deposits reaching ¥11,062.5 billion against loans totaling ¥7,435.0 billion. Despite a net interest margin of 0.6%, the bank's allowance for bad loans is low at 48%, yet it maintains an appropriate level of non-performing loans at 1.3%. Impressively, earnings surged by 94% last year, outpacing the industry average growth rate of 19%. With customer deposits making up 86% of its liabilities—indicating low-risk funding—the bank trades at an attractive valuation below fair value estimates by about 11%.

- Click here to discover the nuances of North Pacific BankLtd with our detailed analytical health report.

Explore historical data to track North Pacific BankLtd's performance over time in our Past section.

Where To Now?

- Access the full spectrum of 4705 Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7105

Mitsubishi Logisnext

Designs, develops, manufactures, and sells electric and engine-powered forklifts, transportation robots, automated warehouses, electric vehicles, monorails, and LAN and other logistics equipment in Japan.

Excellent balance sheet second-rate dividend payer.

Market Insights

Community Narratives