- China

- /

- Marine and Shipping

- /

- SZSE:000520

Why Investors Shouldn't Be Surprised By Phoenix Shipping (Wuhan) Co., Ltd.'s (SZSE:000520) 25% Share Price Surge

Despite an already strong run, Phoenix Shipping (Wuhan) Co., Ltd. (SZSE:000520) shares have been powering on, with a gain of 25% in the last thirty days. Unfortunately, despite the strong performance over the last month, the full year gain of 4.6% isn't as attractive.

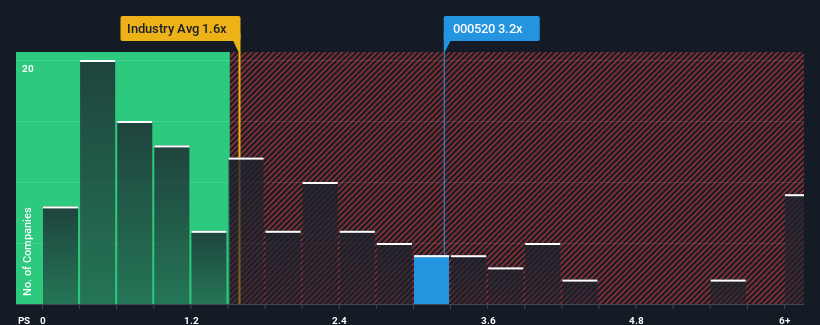

After such a large jump in price, given close to half the companies operating in China's Shipping industry have price-to-sales ratios (or "P/S") below 2.5x, you may consider Phoenix Shipping (Wuhan) as a stock to potentially avoid with its 3.2x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

View our latest analysis for Phoenix Shipping (Wuhan)

How Has Phoenix Shipping (Wuhan) Performed Recently?

For instance, Phoenix Shipping (Wuhan)'s receding revenue in recent times would have to be some food for thought. Perhaps the market believes the company can do enough to outperform the rest of the industry in the near future, which is keeping the P/S ratio high. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Phoenix Shipping (Wuhan) will help you shine a light on its historical performance.Is There Enough Revenue Growth Forecasted For Phoenix Shipping (Wuhan)?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Phoenix Shipping (Wuhan)'s to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 5.1%. This has soured the latest three-year period, which nevertheless managed to deliver a decent 30% overall rise in revenue. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 6.8% shows it's noticeably more attractive.

In light of this, it's understandable that Phoenix Shipping (Wuhan)'s P/S sits above the majority of other companies. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the wider industry.

What Does Phoenix Shipping (Wuhan)'s P/S Mean For Investors?

The large bounce in Phoenix Shipping (Wuhan)'s shares has lifted the company's P/S handsomely. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Phoenix Shipping (Wuhan) maintains its high P/S on the strength of its recent three-year growth being higher than the wider industry forecast, as expected. At this stage investors feel the potential continued revenue growth in the future is great enough to warrant an inflated P/S. If recent medium-term revenue trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

Before you take the next step, you should know about the 2 warning signs for Phoenix Shipping (Wuhan) that we have uncovered.

If these risks are making you reconsider your opinion on Phoenix Shipping (Wuhan), explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000520

Phoenix Shipping (Wuhan)

Provides shipping logistics enterprise services in China.

Mediocre balance sheet with minimal risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026