- China

- /

- Transportation

- /

- SZSE:000008

Revenues Tell The Story For China High-Speed Railway Technology Co., Ltd. (SZSE:000008)

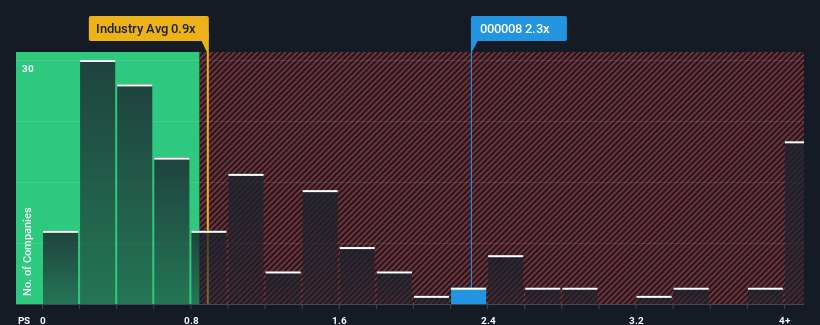

With a median price-to-sales (or "P/S") ratio of close to 2x in the Transportation industry in China, you could be forgiven for feeling indifferent about China High-Speed Railway Technology Co., Ltd.'s (SZSE:000008) P/S ratio of 2.3x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for China High-Speed Railway Technology

How China High-Speed Railway Technology Has Been Performing

The revenue growth achieved at China High-Speed Railway Technology over the last year would be more than acceptable for most companies. It might be that many expect the respectable revenue performance to wane, which has kept the P/S from rising. If that doesn't eventuate, then existing shareholders probably aren't too pessimistic about the future direction of the share price.

Although there are no analyst estimates available for China High-Speed Railway Technology, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is China High-Speed Railway Technology's Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like China High-Speed Railway Technology's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a decent 14% gain to the company's revenues. The latest three year period has also seen a 16% overall rise in revenue, aided somewhat by its short-term performance. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

It's interesting to note that the rest of the industry is similarly expected to grow by 6.1% over the next year, which is fairly even with the company's recent medium-term annualised growth rates.

In light of this, it's understandable that China High-Speed Railway Technology's P/S sits in line with the majority of other companies. It seems most investors are expecting to see average growth rates continue into the future and are only willing to pay a moderate amount for the stock.

The Key Takeaway

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we've seen, China High-Speed Railway Technology's three-year revenue trends seem to be contributing to its P/S, given they look similar to current industry expectations. Currently, with a past revenue trend that aligns closely wit the industry outlook, shareholders are confident the company's future revenue outlook won't contain any major surprises. Given the current circumstances, it seems improbable that the share price will experience any significant movement in either direction in the near future if recent medium-term revenue trends persist.

We don't want to rain on the parade too much, but we did also find 1 warning sign for China High-Speed Railway Technology that you need to be mindful of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000008

China High-Speed Railway Technology

Engages in the railway business in China and internationally.

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success