- China

- /

- Transportation

- /

- SHSE:600561

Jiangxi Changyun Co., Ltd.'s (SHSE:600561) Low P/S No Reason For Excitement

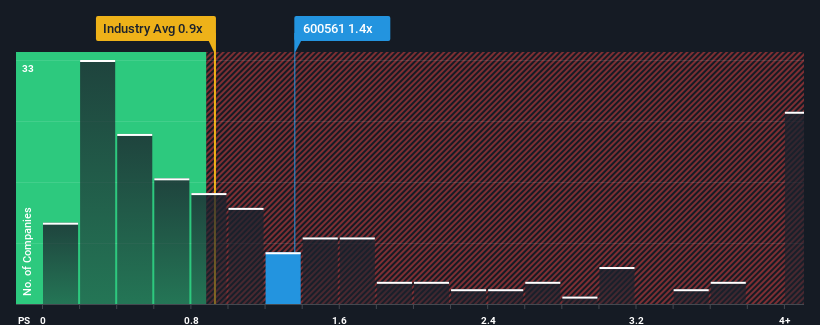

Jiangxi Changyun Co., Ltd.'s (SHSE:600561) price-to-sales (or "P/S") ratio of 1.4x might make it look like a strong buy right now compared to the Transportation industry in China, where around half of the companies have P/S ratios above 4.1x and even P/S above 8x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

Check out our latest analysis for Jiangxi Changyun

What Does Jiangxi Changyun's P/S Mean For Shareholders?

For example, consider that Jiangxi Changyun's financial performance has been pretty ordinary lately as revenue growth is non-existent. It might be that many expect the uninspiring revenue performance to worsen, which has repressed the P/S. Those who are bullish on Jiangxi Changyun will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Jiangxi Changyun's earnings, revenue and cash flow.How Is Jiangxi Changyun's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as depressed as Jiangxi Changyun's is when the company's growth is on track to lag the industry decidedly.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. This isn't what shareholders were looking for as it means they've been left with a 23% decline in revenue over the last three years in total. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

In contrast to the company, the rest of the industry is expected to grow by 6.1% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

In light of this, it's understandable that Jiangxi Changyun's P/S would sit below the majority of other companies. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. Even just maintaining these prices could be difficult to achieve as recent revenue trends are already weighing down the shares.

The Key Takeaway

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Jiangxi Changyun confirms that the company's shrinking revenue over the past medium-term is a key factor in its low price-to-sales ratio, given the industry is projected to grow. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises either. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

Many other vital risk factors can be found on the company's balance sheet. Our free balance sheet analysis for Jiangxi Changyun with six simple checks will allow you to discover any risks that could be an issue.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600561

Jiangxi Changyun

Provides passenger road transportation services in Jiangxi Province.

Mediocre balance sheet and overvalued.

Market Insights

Community Narratives