- China

- /

- Infrastructure

- /

- SHSE:600279

Further Upside For Chongqing Port Co.,Ltd. (SHSE:600279) Shares Could Introduce Price Risks After 34% Bounce

The Chongqing Port Co.,Ltd. (SHSE:600279) share price has done very well over the last month, posting an excellent gain of 34%. Taking a wider view, although not as strong as the last month, the full year gain of 13% is also fairly reasonable.

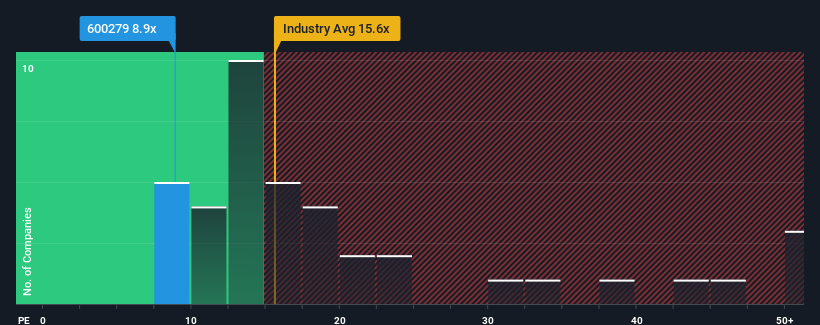

Although its price has surged higher, Chongqing PortLtd's price-to-earnings (or "P/E") ratio of 8.9x might still make it look like a strong buy right now compared to the market in China, where around half of the companies have P/E ratios above 32x and even P/E's above 62x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

With earnings growth that's exceedingly strong of late, Chongqing PortLtd has been doing very well. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

See our latest analysis for Chongqing PortLtd

Does Growth Match The Low P/E?

In order to justify its P/E ratio, Chongqing PortLtd would need to produce anemic growth that's substantially trailing the market.

If we review the last year of earnings growth, the company posted a terrific increase of 241%. The latest three year period has also seen an excellent 984% overall rise in EPS, aided by its short-term performance. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

This is in contrast to the rest of the market, which is expected to grow by 37% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this information, we find it odd that Chongqing PortLtd is trading at a P/E lower than the market. It looks like most investors are not convinced the company can maintain its recent growth rates.

The Final Word

Even after such a strong price move, Chongqing PortLtd's P/E still trails the rest of the market significantly. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Chongqing PortLtd currently trades on a much lower than expected P/E since its recent three-year growth is higher than the wider market forecast. When we see strong earnings with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. At least price risks look to be very low if recent medium-term earnings trends continue, but investors seem to think future earnings could see a lot of volatility.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Chongqing PortLtd that you should be aware of.

Of course, you might also be able to find a better stock than Chongqing PortLtd. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

If you're looking to trade Chongqing PortLtd, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600279

Chongqing PortLtd

Engages in the port transit transportation business in China.

Adequate balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives