- China

- /

- Marine and Shipping

- /

- SHSE:600179

3 Promising Penny Stocks With Market Caps Under US$900M

Reviewed by Simply Wall St

As global markets continue to react positively to recent political developments and economic indicators, major indices like the S&P 500 have reached record highs amid optimism surrounding AI investments and potential trade deals. For investors willing to explore beyond the well-known large-cap stocks, penny stocks—often representing smaller or newer companies—remain an intriguing area of investment. Despite being a somewhat outdated term, these stocks can still offer growth opportunities when backed by strong financials, making them viable options for those seeking promising prospects in under-the-radar sectors.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.525 | MYR2.59B | ★★★★★★ |

| Tristel (AIM:TSTL) | £3.70 | £176.46M | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.395 | MYR1.1B | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.75 | HK$43.09B | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.825 | £465.11M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.88 | MYR285.47M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.72 | MYR423.03M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.10 | £791.31M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$1.11 | HK$704.62M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.77 | A$141.28M | ★★★★☆☆ |

Click here to see the full list of 5,716 stocks from our Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Meriaura Group Oyj (OM:MERIS)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Meriaura Group Oyj, with a market cap of SEK524.41 million, operates in the design and delivery of solar thermal systems both in Europe and internationally through its subsidiaries.

Operations: The company generates revenue from its Building Materials - HVAC Equipment segment, amounting to €77.81 million.

Market Cap: SEK524.41M

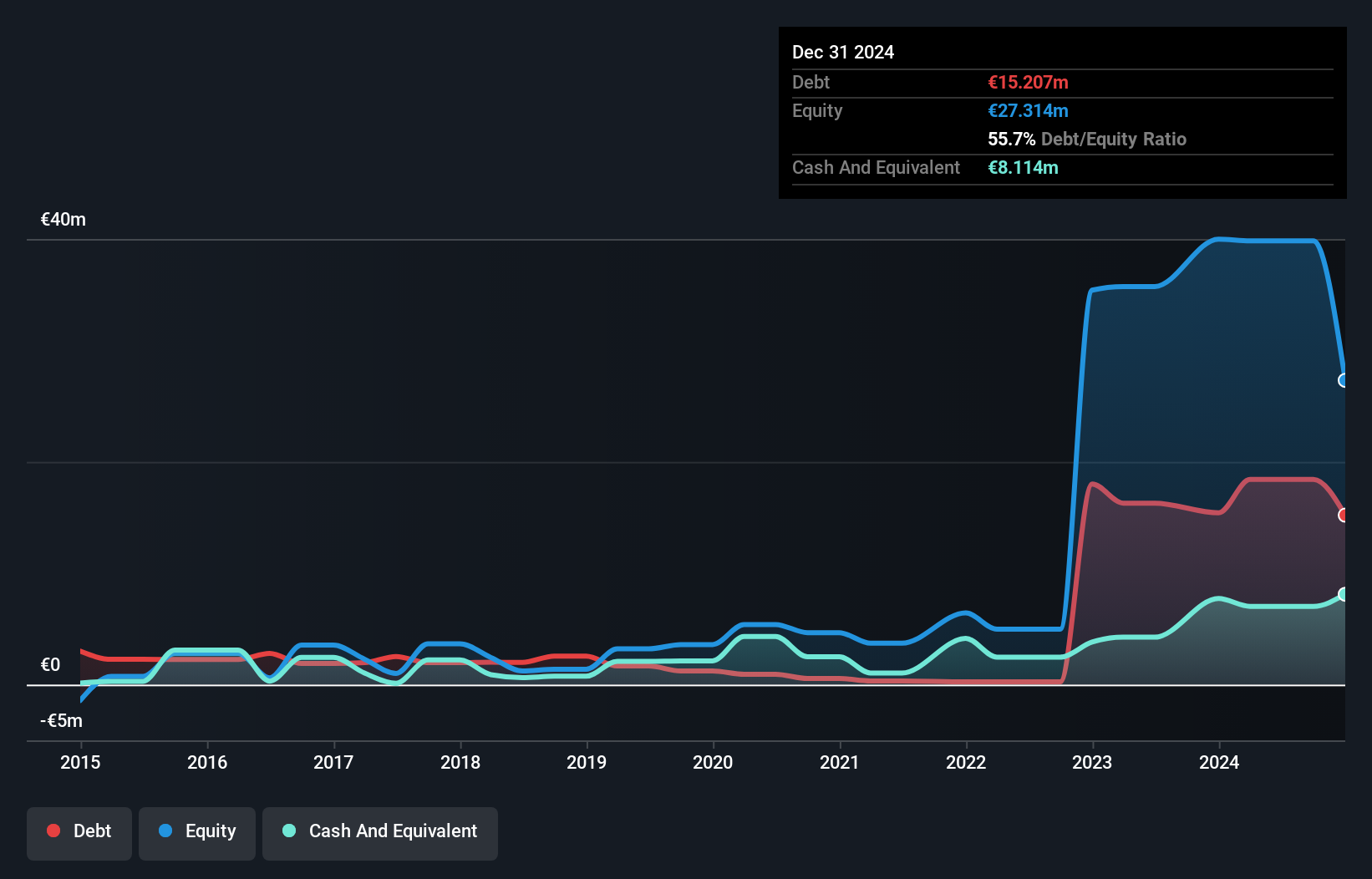

Meriaura Group Oyj, with a market cap of SEK524.41 million, operates in the solar thermal systems sector and has shown revenue growth, reporting €18.82 million in sales for Q3 2024, up from €15.67 million the previous year. Despite this growth, the company remains unprofitable with a net loss of €3.77 million for Q3 2024 and an increased debt to equity ratio over five years from 34.1% to 46.2%. Its short-term assets exceed both short-term and long-term liabilities, indicating some financial stability amidst high share price volatility and an inexperienced board of directors averaging a tenure of 1.7 years.

- Click to explore a detailed breakdown of our findings in Meriaura Group Oyj's financial health report.

- Review our growth performance report to gain insights into Meriaura Group Oyj's future.

Sansiri (SET:SIRI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Sansiri Public Company Limited, along with its subsidiaries, operates in the property development sector in Thailand and has a market capitalization of THB30.23 billion.

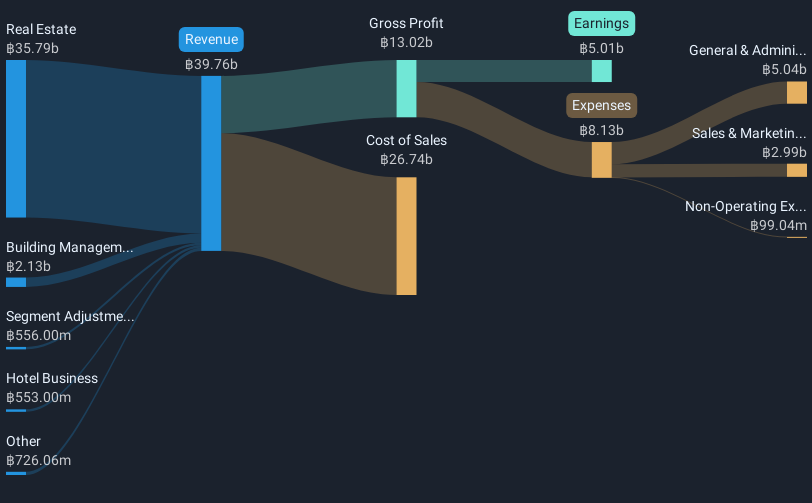

Operations: The company generates revenue primarily from Real Estate at THB35.79 billion, supplemented by Building Management, Project Management and Real Estate Brokerage at THB2.13 billion, and its Hotel Business contributing THB553 million.

Market Cap: THB30.23B

Sansiri Public Company Limited, with a market cap of THB30.23 billion, has faced recent challenges despite its strong asset position. The company's earnings have declined over the past year, with Q3 2024 net income dropping to THB1.31 billion from THB1.56 billion the previous year, and profit margins decreasing from 16.7% to 12.6%. While its short-term assets significantly exceed liabilities and debt levels have improved over five years, the high net debt to equity ratio of 159.3% remains a concern. Recent business expansions via new subsidiaries indicate strategic growth efforts in property development amidst these financial pressures.

- Click here and access our complete financial health analysis report to understand the dynamics of Sansiri.

- Learn about Sansiri's future growth trajectory here.

Antong Holdings (SHSE:600179)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Antong Holdings Co., Ltd. operates in the container shipping and transport logistics sector in China with a market cap of CN¥10.79 billion.

Operations: Antong Holdings Co., Ltd. does not report distinct revenue segments.

Market Cap: CN¥10.79B

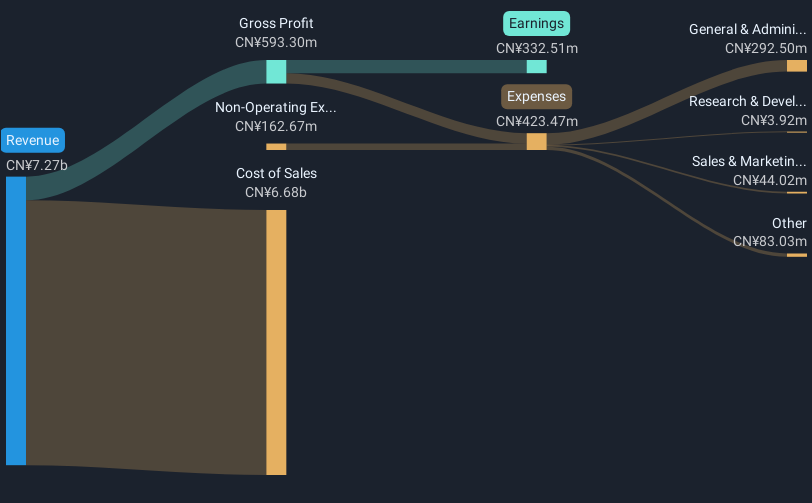

Antong Holdings Co., Ltd. operates with a market cap of CN¥10.79 billion in the container shipping and logistics sector, showing mixed financial signals typical for smaller stocks. The company has seen its debt to equity ratio significantly decrease from 113.9% to 6.1% over five years, indicating improved financial health, while short-term assets cover both short and long-term liabilities comfortably. However, recent earnings growth is negative at -69.5%, influenced by large one-off gains of CN¥261.2 million impacting past results, and profit margins have declined from 13.8% to 4.6%, reflecting operational challenges despite stable weekly volatility at 6%.

- Unlock comprehensive insights into our analysis of Antong Holdings stock in this financial health report.

- Examine Antong Holdings' past performance report to understand how it has performed in prior years.

Taking Advantage

- Unlock more gems! Our Penny Stocks screener has unearthed 5,713 more companies for you to explore.Click here to unveil our expertly curated list of 5,716 Penny Stocks.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600179

Antong Holdings

Engages in the container shipping and transport logistics business in China.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives