As global markets experience varied movements, with the S&P 500 Index advancing and European stocks buoyed by interest rate cuts, investors are keenly observing opportunities across different market segments. Amid this landscape, penny stocks—often misunderstood as outdated—continue to present intriguing prospects for those willing to explore smaller or newer companies. These stocks can offer significant growth potential when backed by strong financials and fundamentals, making them worthy of attention in today's diverse investment climate.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.20 | MYR337.78M | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.595 | MYR2.96B | ★★★★★★ |

| Tristel (AIM:TSTL) | £3.975 | £190.6M | ★★★★★★ |

| Rexit Berhad (KLSE:REXIT) | MYR0.76 | MYR131.64M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.77 | HK$488.79M | ★★★★★★ |

| Zhejiang Giuseppe Garment (SZSE:002687) | CN¥4.28 | CN¥2.1B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.925 | MYR307.05M | ★★★★★★ |

| Hume Cement Industries Berhad (KLSE:HUMEIND) | MYR3.54 | MYR2.57B | ★★★★★☆ |

| Embark Early Education (ASX:EVO) | A$0.80 | A$127.64M | ★★★★☆☆ |

| Next 15 Group (AIM:NFG) | £4.05 | £404.29M | ★★★★☆☆ |

Click here to see the full list of 5,790 stocks from our Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Ausnutria Dairy (SEHK:1717)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Ausnutria Dairy Corporation Ltd is an investment holding company focused on the research and development, production, marketing, processing, packaging, and distribution of dairy and nutrition products with a market cap of HK$3.61 billion.

Operations: The company generates CN¥7.27 billion in revenue from its Dairy and Related Products segment.

Market Cap: HK$3.61B

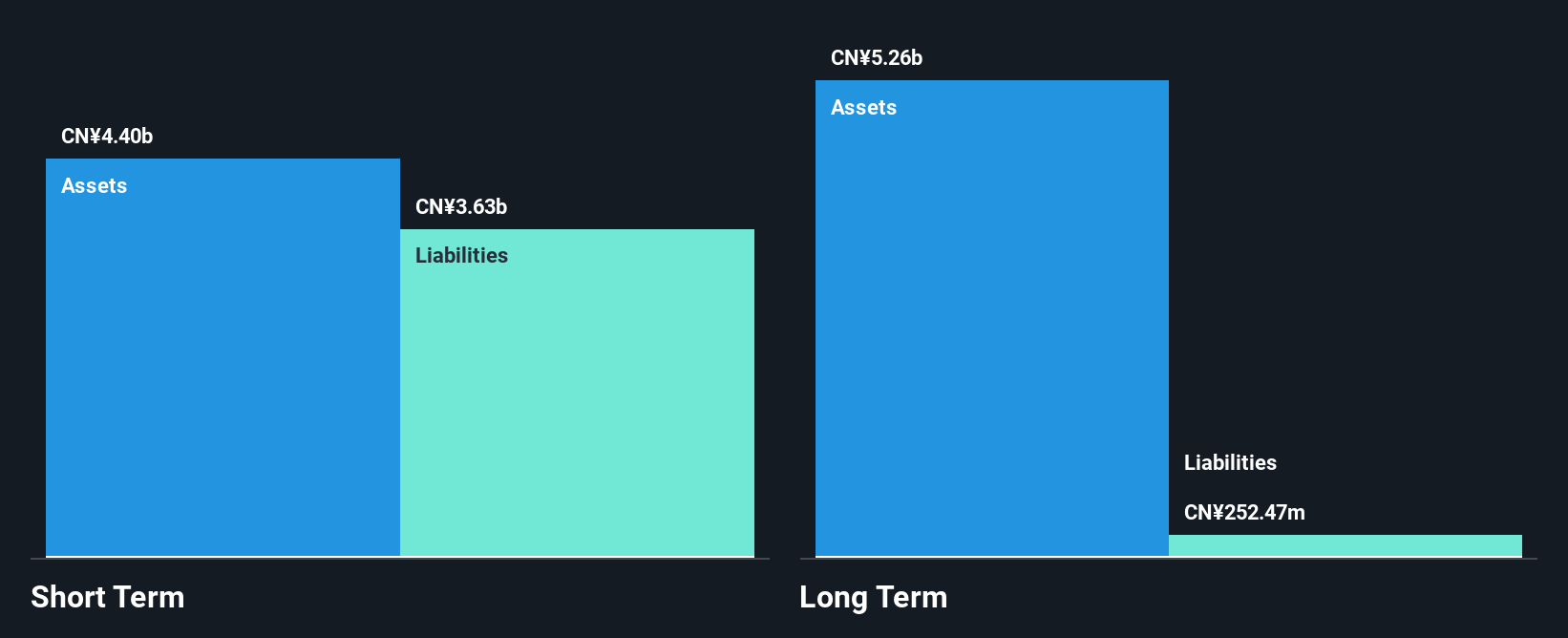

Ausnutria Dairy Corporation Ltd has faced challenges with declining profits, evidenced by a 30.8% drop in earnings over the past year and a net profit margin decrease from 2.6% to 1.8%. Despite stable weekly volatility and satisfactory debt levels, the company reported a significant one-off loss of CN¥38.9 million impacting its recent financial results. Recent board changes bring experienced industry professionals, potentially offering strategic advantages. The company's share repurchase program may enhance shareholder value by increasing net asset value and earnings per share, though it was recently dropped from the S&P Global BMI Index, indicating potential investor concerns.

- Click here and access our complete financial health analysis report to understand the dynamics of Ausnutria Dairy.

- Gain insights into Ausnutria Dairy's outlook and expected performance with our report on the company's earnings estimates.

Changshu Fengfan Power Equipment (SHSE:601700)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Changshu Fengfan Power Equipment Co., Ltd. operates in the power equipment industry and has a market cap of approximately CN¥5.03 billion.

Operations: No specific revenue segments have been reported for the company.

Market Cap: CN¥5.03B

Changshu Fengfan Power Equipment has demonstrated robust earnings growth, with a significant 603.1% increase over the past year, surpassing both its historical average and industry benchmarks. Despite low return on equity at 5.3%, the company maintains high-quality earnings and improved net profit margins from 0.7% to 3%. Financial stability is supported by short-term assets exceeding liabilities and satisfactory net debt to equity ratio of 34%. However, negative operating cash flow indicates challenges in covering debt obligations. Recent results show increased sales and revenue for the first half of 2024, reflecting strong performance momentum amidst stable weekly volatility.

- Dive into the specifics of Changshu Fengfan Power Equipment here with our thorough balance sheet health report.

- Review our historical performance report to gain insights into Changshu Fengfan Power Equipment's track record.

NET263 (SZSE:002467)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: NET263 Ltd. provides cloud services, including virtual private network services, data centers, real-time audio and video transmission networks, 5G communication services, corporate live streaming, enterprise emails, video conferencing, teleconferences, and call centers; the company has a market cap of CN¥5.54 billion.

Operations: The company's revenue is primarily derived from its Corporate Business segment at CN¥652.26 million, followed by the Personal Business segment at CN¥225.12 million.

Market Cap: CN¥5.54B

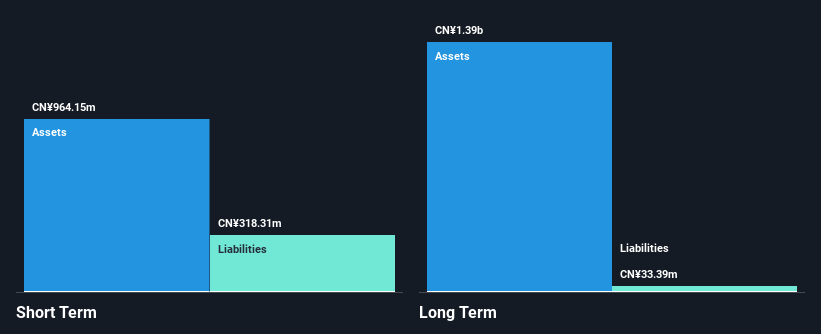

NET263 Ltd. faces challenges as it remains unprofitable, with earnings declining significantly over the past five years. Despite this, the company benefits from a debt-free balance sheet and experienced management and board teams, which may provide stability. Recent financials show a slight revenue increase to CN¥468.5 million for the first half of 2024, though net income decreased to CN¥51.31 million compared to last year. The company's short-term assets comfortably cover both short- and long-term liabilities, indicating solid liquidity positions amidst stable weekly volatility in its stock performance.

- Click to explore a detailed breakdown of our findings in NET263's financial health report.

- Understand NET263's track record by examining our performance history report.

Next Steps

- Get an in-depth perspective on all 5,790 Penny Stocks by using our screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1717

Ausnutria Dairy

An investment holding company, primarily engages in the research and development, production, marketing, processing, packaging, and distribution of dairy and related products, and nutrition products.

Excellent balance sheet and fair value.