- China

- /

- Telecom Services and Carriers

- /

- SHSE:603322

Investors Give Super Telecom Co.,Ltd (SHSE:603322) Shares A 28% Hiding

Super Telecom Co.,Ltd (SHSE:603322) shareholders won't be pleased to see that the share price has had a very rough month, dropping 28% and undoing the prior period's positive performance. Longer-term, the stock has been solid despite a difficult 30 days, gaining 23% in the last year.

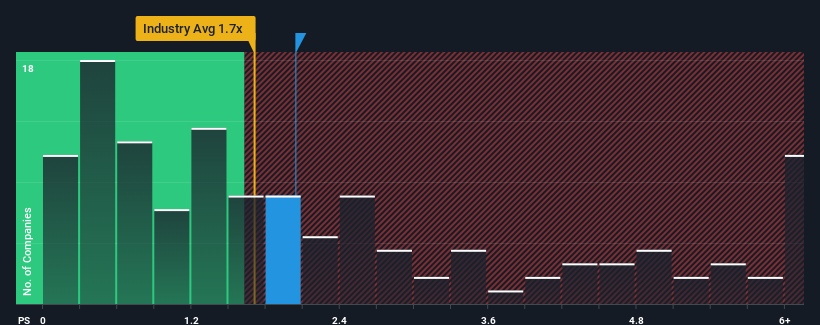

Since its price has dipped substantially, considering around half the companies operating in China's Telecom industry have price-to-sales ratios (or "P/S") above 3.5x, you may consider Super TelecomLtd as an solid investment opportunity with its 2x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for Super TelecomLtd

How Has Super TelecomLtd Performed Recently?

Recent times have been advantageous for Super TelecomLtd as its revenues have been rising faster than most other companies. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Keen to find out how analysts think Super TelecomLtd's future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For Super TelecomLtd?

The only time you'd be truly comfortable seeing a P/S as low as Super TelecomLtd's is when the company's growth is on track to lag the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 33%. The strong recent performance means it was also able to grow revenue by 72% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 27% during the coming year according to the one analyst following the company. That's shaping up to be materially higher than the 20% growth forecast for the broader industry.

With this information, we find it odd that Super TelecomLtd is trading at a P/S lower than the industry. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Bottom Line On Super TelecomLtd's P/S

Super TelecomLtd's P/S has taken a dip along with its share price. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Super TelecomLtd's analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

A lot of potential risks can sit within a company's balance sheet. Our free balance sheet analysis for Super TelecomLtd with six simple checks will allow you to discover any risks that could be an issue.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603322

Mediocre balance sheet low.