- China

- /

- Telecom Services and Carriers

- /

- SHSE:603220

What You Can Learn From China Bester Group Telecom Co., Ltd.'s (SHSE:603220) P/EAfter Its 29% Share Price Crash

China Bester Group Telecom Co., Ltd. (SHSE:603220) shareholders won't be pleased to see that the share price has had a very rough month, dropping 29% and undoing the prior period's positive performance. Still, a bad month hasn't completely ruined the past year with the stock gaining 91%, which is great even in a bull market.

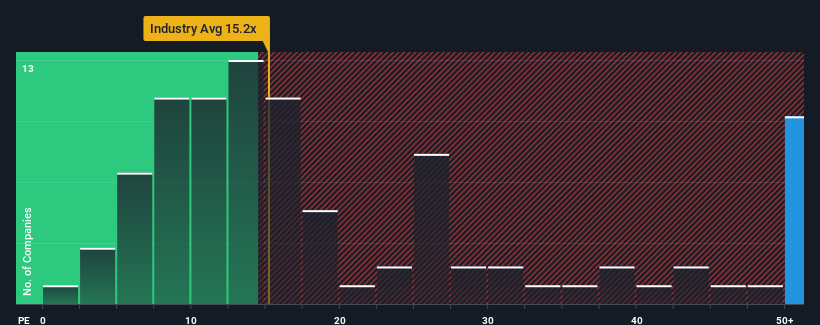

Although its price has dipped substantially, China Bester Group Telecom may still be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 60.2x, since almost half of all companies in China have P/E ratios under 29x and even P/E's lower than 18x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

China Bester Group Telecom could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. It might be that many expect the dour earnings performance to recover substantially, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for China Bester Group Telecom

Is There Enough Growth For China Bester Group Telecom?

In order to justify its P/E ratio, China Bester Group Telecom would need to produce outstanding growth well in excess of the market.

Retrospectively, the last year delivered a frustrating 3.8% decrease to the company's bottom line. Even so, admirably EPS has lifted 51% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Turning to the outlook, the next year should generate growth of 68% as estimated by the one analyst watching the company. That's shaping up to be materially higher than the 36% growth forecast for the broader market.

In light of this, it's understandable that China Bester Group Telecom's P/E sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On China Bester Group Telecom's P/E

Even after such a strong price drop, China Bester Group Telecom's P/E still exceeds the rest of the market significantly. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that China Bester Group Telecom maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with China Bester Group Telecom (at least 2 which are a bit unpleasant), and understanding these should be part of your investment process.

If these risks are making you reconsider your opinion on China Bester Group Telecom, explore our interactive list of high quality stocks to get an idea of what else is out there.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603220

China Bester Group Telecom

Engages in the planning, design, construction, maintenance, and optimization of communications networks for telecom operators in China.

Second-rate dividend payer with low risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)