- China

- /

- Communications

- /

- SZSE:301600

Shenzhen Dynanonic And 2 Other Growth Stocks With Strong Insider Commitment

Reviewed by Simply Wall St

Amidst a backdrop of tariff uncertainties and mixed economic signals, global markets have experienced fluctuations, with U.S. indices ending the week lower while European stocks showed resilience. As investors navigate these complexities, companies with strong insider ownership can often signal confidence in their growth potential and alignment of interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.2% |

| Seojin SystemLtd (KOSDAQ:A178320) | 32.1% | 39.9% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 26.2% |

| Laopu Gold (SEHK:6181) | 36.4% | 36.9% |

| Pricol (NSEI:PRICOLLTD) | 25.4% | 25.2% |

| Plenti Group (ASX:PLT) | 12.7% | 120.1% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.1% | 135% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 119.4% |

| Fulin Precision (SZSE:300432) | 13.6% | 71% |

| Findi (ASX:FND) | 35.8% | 111.4% |

We'll examine a selection from our screener results.

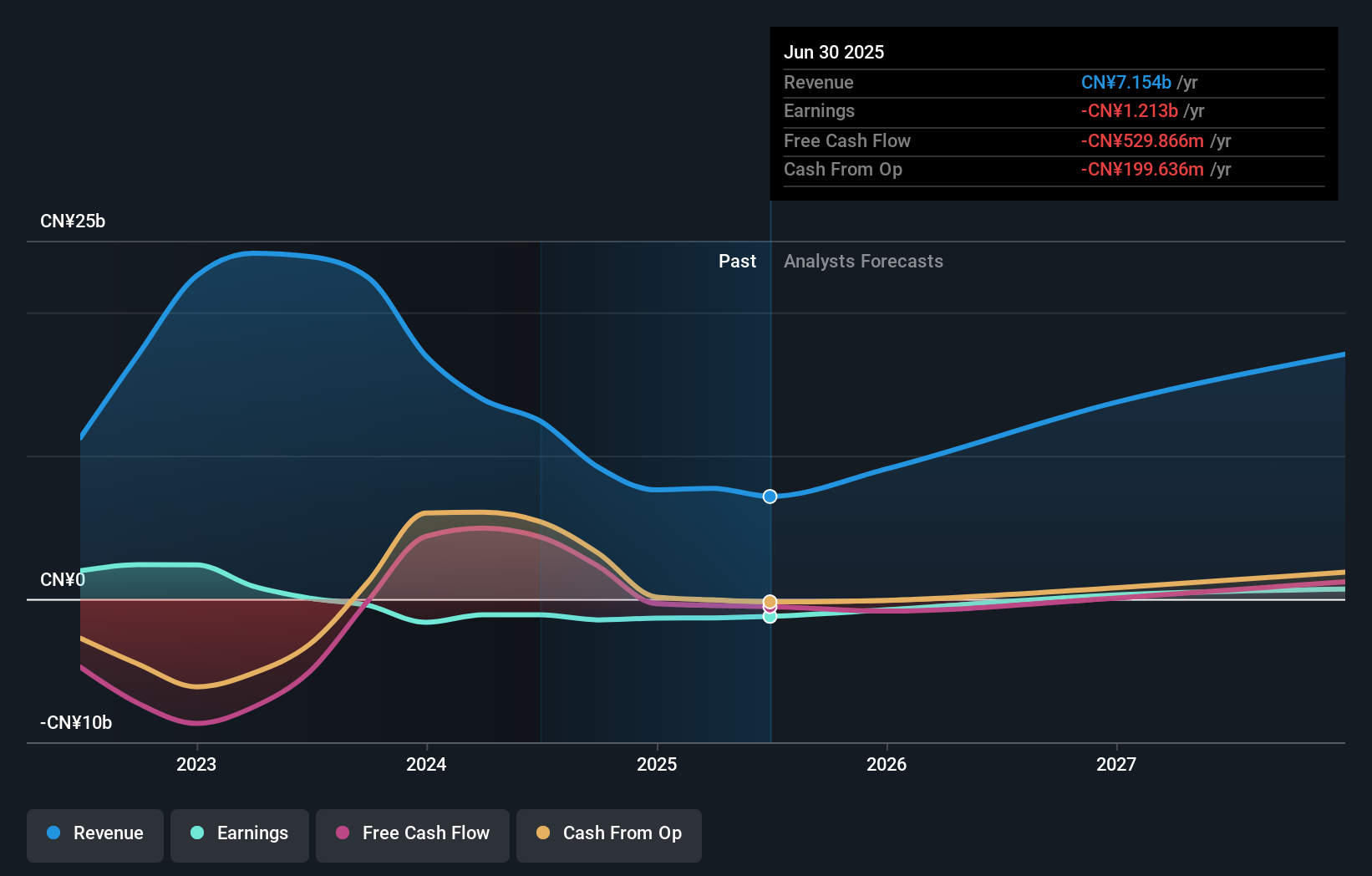

Shenzhen Dynanonic (SZSE:300769)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen Dynanonic Co., Ltd is engaged in the research, development, manufacture, and sale of materials for lithium-ion batteries in China, with a market cap of approximately CN¥9.47 billion.

Operations: The company's revenue segment primarily consists of the research, production, and sales of Nano-Lithium Iron Phosphate, totaling approximately CN¥7.78 billion.

Insider Ownership: 30.2%

Earnings Growth Forecast: 115.8% p.a.

Shenzhen Dynanonic is positioned for significant growth, with revenue projected to increase by 34.8% annually, outpacing the broader Chinese market. The company is expected to achieve profitability within three years, surpassing average market growth rates. Despite recent volatility in its share price and a low forecasted return on equity of 5.5%, it remains attractively valued compared to peers. A strategic joint venture with ICL Group aims to establish a European production facility for lithium iron phosphate cathode materials, enhancing its market presence in Europe.

- Take a closer look at Shenzhen Dynanonic's potential here in our earnings growth report.

- Our expertly prepared valuation report Shenzhen Dynanonic implies its share price may be lower than expected.

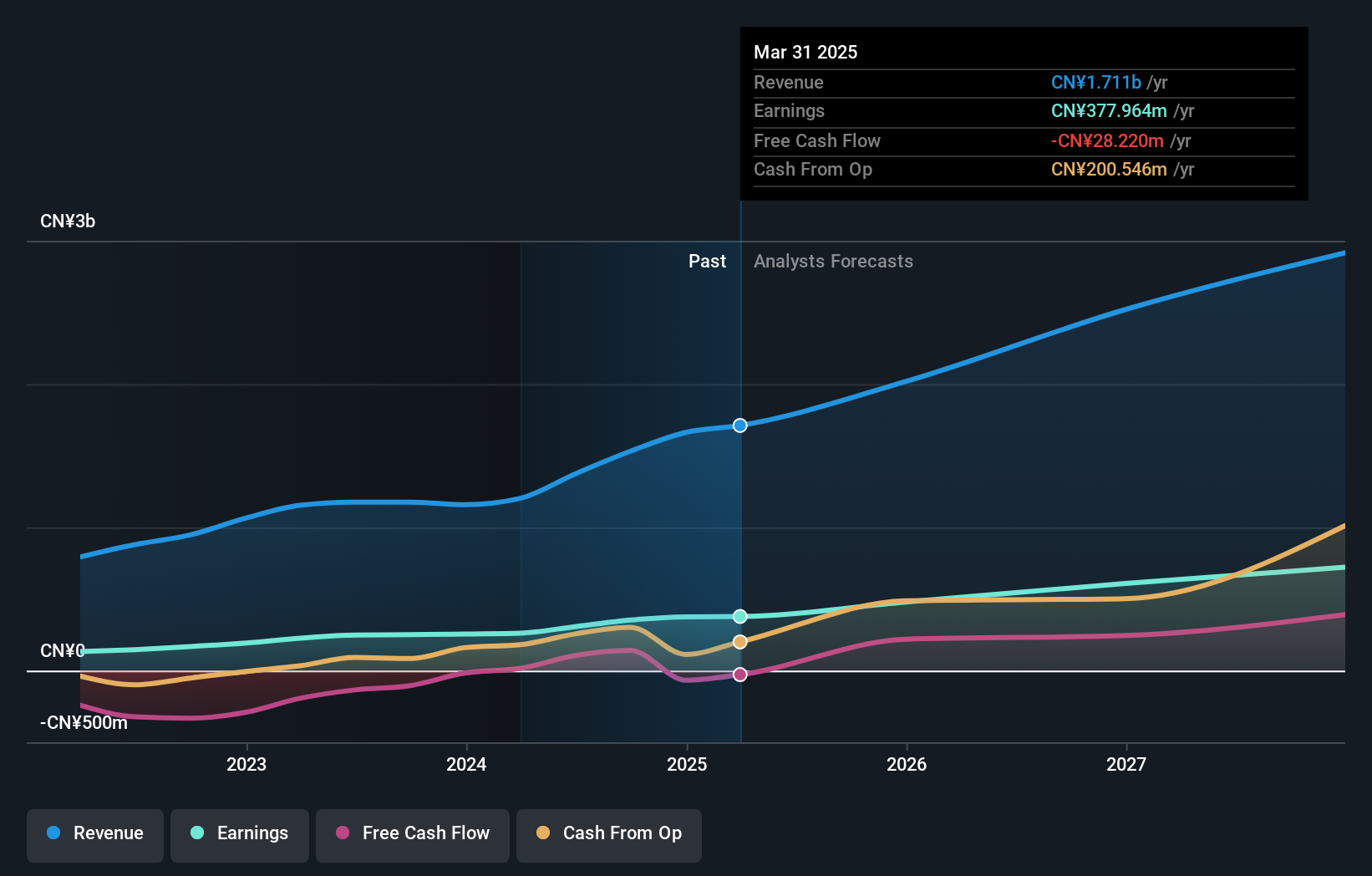

POCO Holding (SZSE:300811)

Simply Wall St Growth Rating: ★★★★★☆

Overview: POCO Holding Co., Ltd. specializes in the development, production, and sale of alloy soft magnetic powder and related components for electronic equipment, with a market cap of CN¥14.42 billion.

Operations: POCO Holding's revenue segments include the development, production, and sale of alloy soft magnetic powder, alloy soft magnetic core, and related inductance components for users in the electrical electronic equipment sector.

Insider Ownership: 24.8%

Earnings Growth Forecast: 26.6% p.a.

POCO Holding is set for robust expansion, with revenue expected to grow by 25.6% annually, outstripping the broader Chinese market. Its earnings growth forecast of 26.6% per year also exceeds market averages. Although its return on equity is projected to be modest at 19.7%, the company remains attractively valued with a price-to-earnings ratio below the industry average, indicating potential for investors seeking growth opportunities despite no recent insider trading activity reported.

- Delve into the full analysis future growth report here for a deeper understanding of POCO Holding.

- According our valuation report, there's an indication that POCO Holding's share price might be on the expensive side.

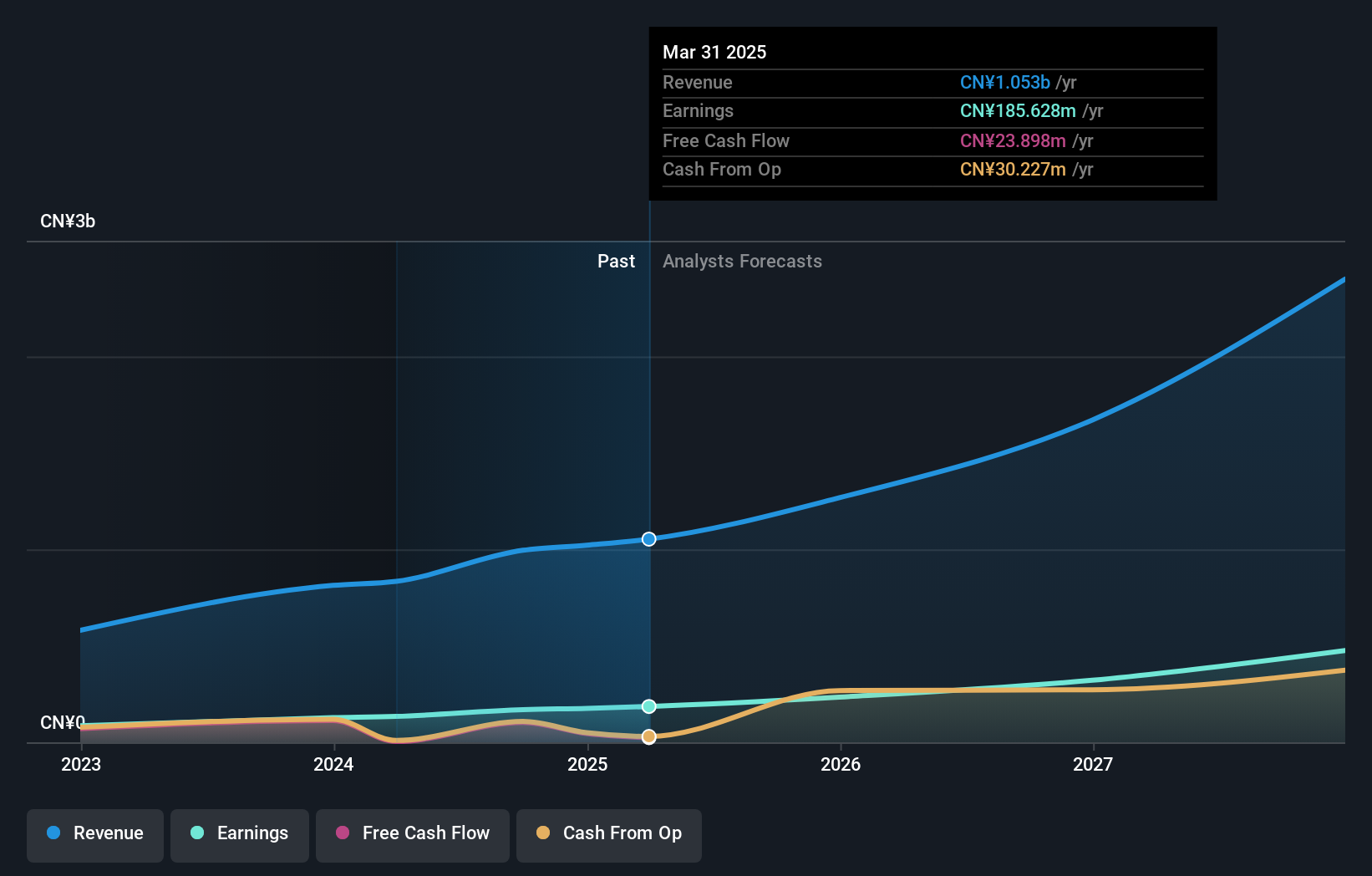

Flaircomm Microelectronics (SZSE:301600)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Flaircomm Microelectronics, Inc. specializes in developing and selling wireless communication modules, embedded software, and turnkey system solutions for automotive and M2M applications in China, with a market cap of CN¥12.73 billion.

Operations: The company's revenue primarily comes from its Wireless Communications Equipment segment, which generated CN¥995.17 million.

Insider Ownership: 35.5%

Earnings Growth Forecast: 30.8% p.a.

Flaircomm Microelectronics is poised for substantial growth, with earnings expected to rise by 30.8% annually, surpassing the broader Chinese market. Revenue forecasts of 26.7% per year also indicate robust expansion potential. Despite a low projected return on equity of 17.2%, the company's growth prospects remain compelling due to its strong revenue and profit trajectory, although recent insider trading data is unavailable and its share price has been highly volatile recently.

- Dive into the specifics of Flaircomm Microelectronics here with our thorough growth forecast report.

- Upon reviewing our latest valuation report, Flaircomm Microelectronics' share price might be too optimistic.

Key Takeaways

- Unlock our comprehensive list of 1442 Fast Growing Companies With High Insider Ownership by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301600

Flaircomm Microelectronics

Develops and sells wireless communication modules, embedded software, and turnkey system solutions for automotive and M2M applications in China.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives