- Hong Kong

- /

- Electronic Equipment and Components

- /

- SEHK:1888

High Growth Tech Stocks to Explore in January 2025

Reviewed by Simply Wall St

As we enter January 2025, global markets are grappling with a mix of economic indicators and geopolitical developments, leading to volatility across major indices. With small-cap stocks underperforming and inflation concerns persisting, investors are keenly observing tech stocks that demonstrate robust growth potential amidst these uncertain conditions.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 21.82% | 25.22% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Medley | 20.97% | 27.22% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1202 stocks from our High Growth Tech and AI Stocks screener.

Let's explore several standout options from the results in the screener.

Kingboard Laminates Holdings (SEHK:1888)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kingboard Laminates Holdings Limited is an investment holding company that manufactures and sells laminates across the People's Republic of China, Europe, other Asian countries, and the United States, with a market capitalization of HK$23.21 billion.

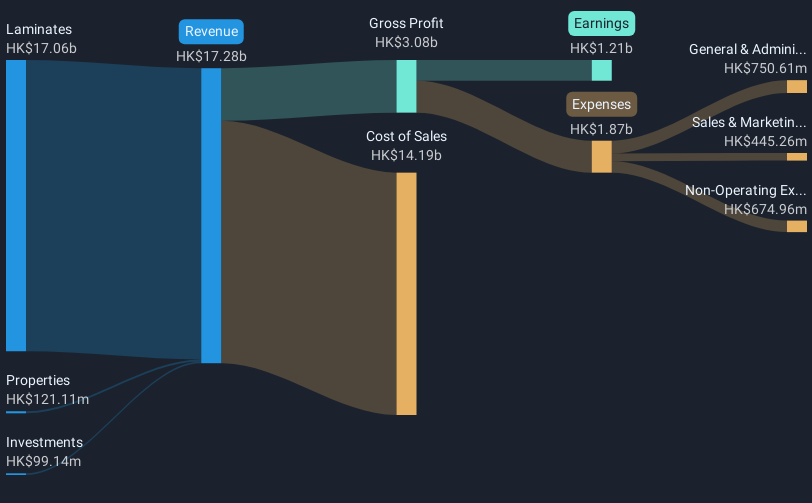

Operations: The company primarily generates revenue from its laminates segment, contributing HK$17.06 billion, with additional income from properties and investments amounting to HK$121.11 million and HK$99.14 million, respectively.

Kingboard Laminates Holdings, a contender in the tech landscape, demonstrates robust financial health with a significant earnings growth of 139.9% over the past year, outpacing the electronics industry's average of 11.7%. Despite revenue growth projections at 12.2% annually—which trails behind high-growth benchmarks—the company's earnings are expected to surge by an impressive 33.67% annually. This growth trajectory is supported by substantial R&D investments aimed at fostering innovation and maintaining competitive advantage in a rapidly evolving sector. With these financial dynamics, Kingboard Laminates is positioned to capitalize on market opportunities even as it navigates the challenges of slower revenue acceleration.

Quectel Wireless Solutions (SHSE:603236)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Quectel Wireless Solutions Co., Ltd. focuses on the research, design, production, and sales of wireless communication modules and solutions globally, with a market capitalization of CN¥18.19 billion.

Operations: Quectel Wireless Solutions specializes in the development and sale of wireless communication modules and solutions across international markets. The company's revenue is derived from its comprehensive portfolio of wireless products, catering to various sectors such as automotive, industrial, and consumer electronics.

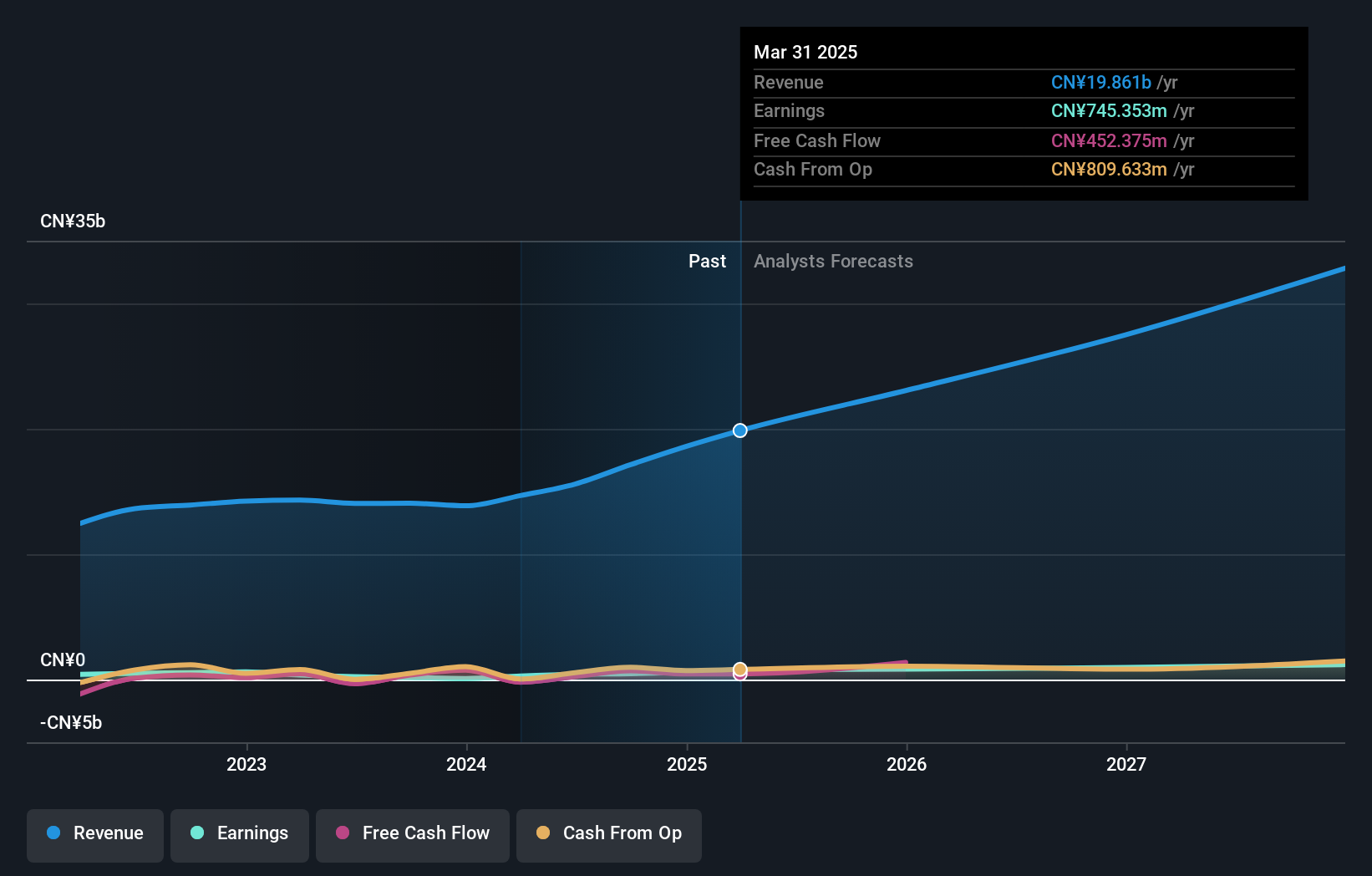

Quectel Wireless Solutions is carving out a significant niche in the tech industry with its recent unveiling of innovative modules at CES 2025. The company's strategic focus on R&D, as evidenced by their latest GNSS module, LS550G, underscores their commitment to precision and efficiency in high-performance environments. This dedication is further highlighted by a robust annualized revenue growth of 19.0% and an impressive earnings increase of 31.6%. Quectel's investment in technology development not only enhances its product offerings but also solidifies its position in the competitive landscape of wireless communication solutions for IoT applications across various sectors.

- Click here to discover the nuances of Quectel Wireless Solutions with our detailed analytical health report.

Learn about Quectel Wireless Solutions' historical performance.

Flaircomm Microelectronics (SZSE:301600)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Flaircomm Microelectronics, Inc. focuses on developing and selling wireless communication modules, embedded software, and turnkey system solutions for automotive and M2M applications in China, with a market cap of CN¥16.49 billion.

Operations: Flaircomm Microelectronics generates revenue primarily from its wireless communications equipment segment, totaling approximately CN¥995.17 million. The company's operations are centered on providing solutions for automotive and machine-to-machine (M2M) applications within China.

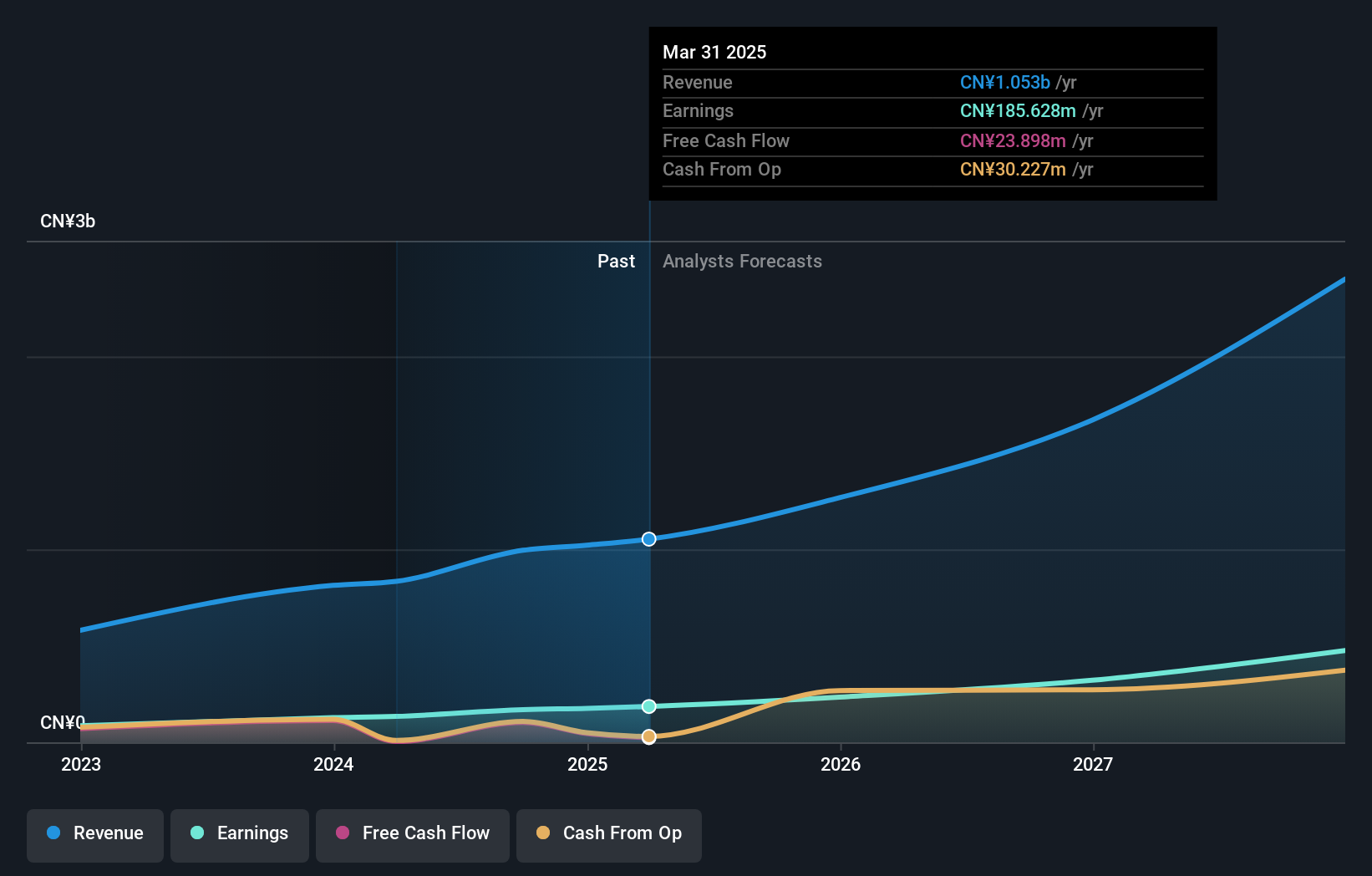

Flaircomm Microelectronics has demonstrated a robust growth trajectory, with sales surging to CNY 734.85 million and net income reaching CNY 134.87 million over the last nine months, marking significant year-over-year increases of 32.9% and 44.7%, respectively. This performance is underpinned by a solid annualized revenue growth rate of 26.7% and an earnings growth forecast of 30.8% per year, positioning it well above the Chinese market average. The company's commitment to innovation is evident in its strategic R&D investments, crucial for sustaining its competitive edge in the rapidly evolving tech landscape. Despite its high volatility in share price, Flaircomm's financial health remains strong with positive free cash flow and a low but improving Return on Equity forecast at 17.2%. The firm's ability to outpace industry earnings growth significantly suggests resilience and adaptability in a challenging market environment. Moving forward, these factors may continue to influence Flaircomm’s position within the high-growth tech sector, although careful navigation will be required given the broader economic pressures impacting global markets.

Taking Advantage

- Unlock our comprehensive list of 1202 High Growth Tech and AI Stocks by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kingboard Laminates Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1888

Kingboard Laminates Holdings

An investment holding company, manufactures and sells laminates in the People's Republic of China, Europe, other Asian countries, and the United States.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives