- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:8046

High Growth Tech Stocks in Asia for April 2025

Reviewed by Simply Wall St

As global markets navigate through trade uncertainties and economic shifts, the Asian tech sector remains a focal point for investors seeking growth opportunities. With smaller-cap indexes outperforming their larger counterparts and ongoing discussions around trade policies impacting the technology landscape, identifying high-growth tech stocks in Asia involves evaluating companies that can adapt to these dynamic market conditions while maintaining robust innovation and strategic positioning.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Suzhou TFC Optical Communication | 34.26% | 32.04% | ★★★★★★ |

| Zhongji Innolight | 28.24% | 28.10% | ★★★★★★ |

| Fositek | 31.52% | 37.08% | ★★★★★★ |

| Delton Technology (Guangzhou) | 21.21% | 24.38% | ★★★★★★ |

| Shanghai Huace Navigation Technology | 26.47% | 23.71% | ★★★★★★ |

| eWeLLLtd | 24.66% | 25.31% | ★★★★★★ |

| Seojin SystemLtd | 31.68% | 39.34% | ★★★★★★ |

| Nanya New Material TechnologyLtd | 22.72% | 63.29% | ★★★★★★ |

| Suzhou Gyz Electronic TechnologyLtd | 27.52% | 121.67% | ★★★★★★ |

| JNTC | 34.26% | 86.00% | ★★★★★★ |

Here's a peek at a few of the choices from the screener.

Kexing Biopharm (SHSE:688136)

Simply Wall St Growth Rating: ★★★★★☆

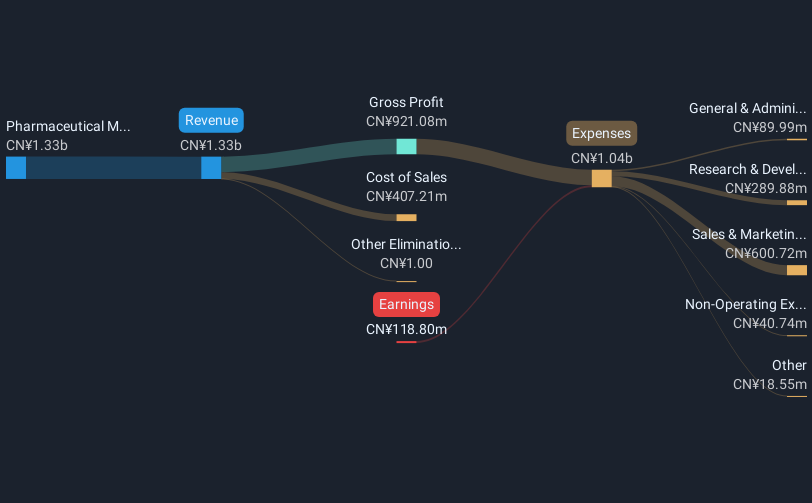

Overview: Kexing Biopharm Co., Ltd. focuses on the research, development, production, and sale of recombinant protein drugs and microbial preparations both in China and internationally, with a market cap of CN¥6.84 billion.

Operations: Kexing Biopharm generates revenue primarily through the sale of recombinant protein drugs and microbial preparations. The company operates both domestically in China and internationally, leveraging its expertise in biotechnology to expand its market presence.

Kexing Biopharm's recent strides in antiviral drug development, marked by the FDA approval of its IND for GB05, underscore its innovative edge in high-growth tech sectors. This breakthrough could revolutionize treatment for pediatric RSV infections, a notable achievement given the global need for effective antivirals. Financially, Kexing has turned a corner with a reported annual revenue jump to CNY 1.41 billion and transitioned from a net loss to a profit of CNY 31.53 million last year. Additionally, its proactive approach is evident in share repurchases up to CNY 60 million aimed at bolstering shareholder value and supporting employee shareholding plans. These moves reflect Kexing's robust growth trajectory and commitment to leveraging cutting-edge science to address pressing health challenges.

- Navigate through the intricacies of Kexing Biopharm with our comprehensive health report here.

Gain insights into Kexing Biopharm's past trends and performance with our Past report.

Flaircomm Microelectronics (SZSE:301600)

Simply Wall St Growth Rating: ★★★★★☆

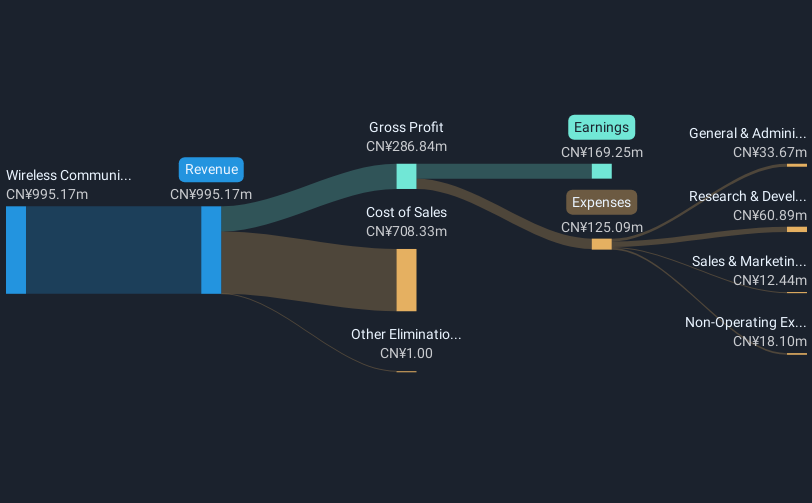

Overview: Flaircomm Microelectronics, Inc. develops and sells wireless communication modules, embedded software, and turnkey system solutions for automotive and M2M applications in China with a market cap of CN¥12.89 billion.

Operations: The company generates revenue primarily from wireless communications equipment, amounting to CN¥995.17 million. The focus is on providing solutions for automotive and M2M applications within China.

Flaircomm Microelectronics, recently added to the S&P Global BMI Index, demonstrates robust growth dynamics within the tech sector. With a revenue increase of 26.7% per year outpacing the Chinese market's 12.6%, and earnings surging by 44.7% last year—significantly above its industry's average—Flaircomm is setting a strong pace. These financial metrics are supported by strategic R&D investments that fuel innovation and maintain competitive advantage in communications technology, ensuring sustained growth and resilience against market volatilities. This performance is underpinned by substantial non-cash earnings, suggesting efficient operations and promising future prospects for continued expansion in high-growth markets.

Nan Ya Printed Circuit Board (TWSE:8046)

Simply Wall St Growth Rating: ★★★★☆☆

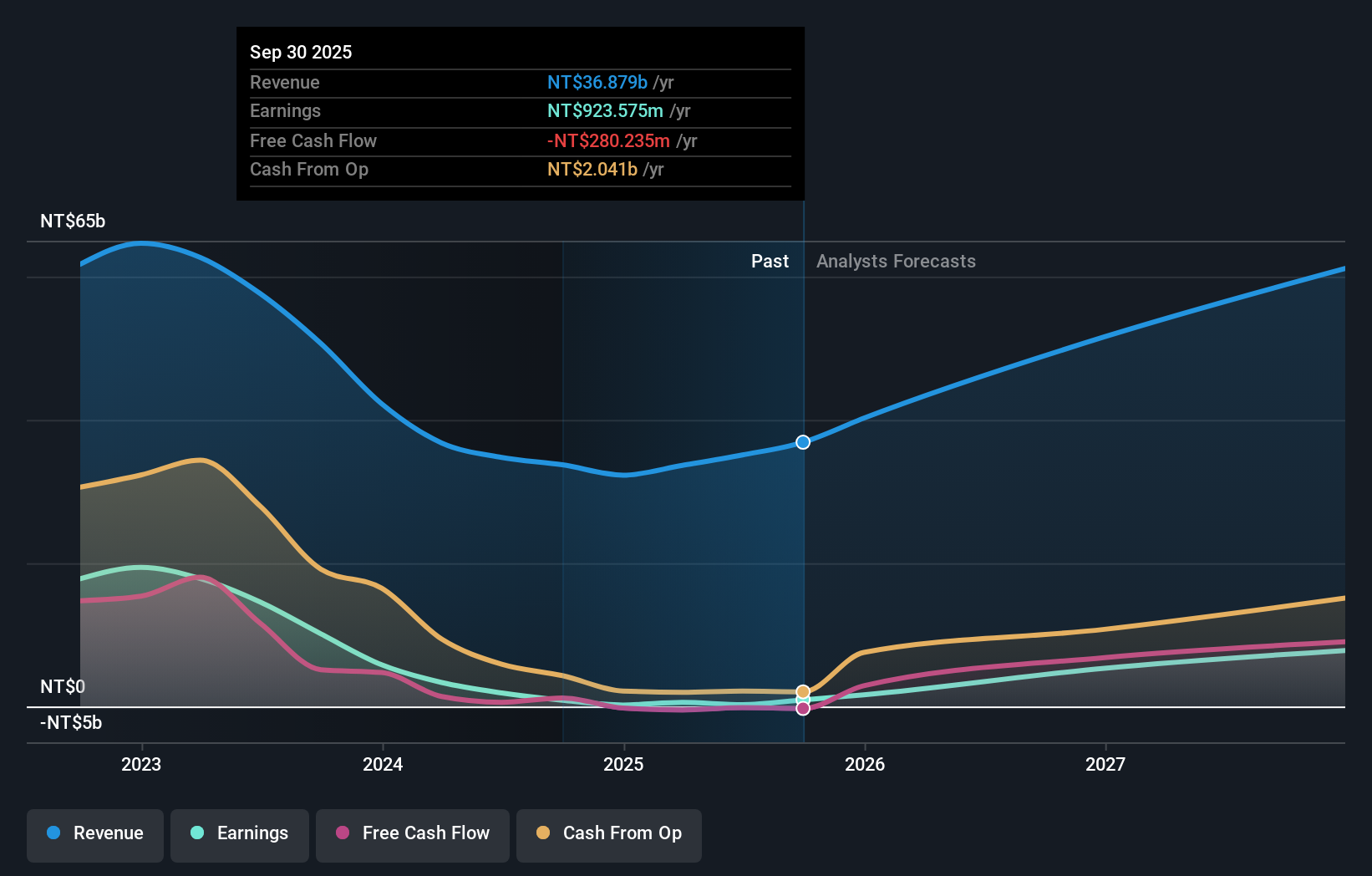

Overview: Nan Ya Printed Circuit Board Corporation manufactures and sells printed circuit boards in Taiwan, the United States, Mainland China, Korea, and internationally with a market cap of NT$57.70 billion.

Operations: The company generates revenue primarily from the sale of printed circuit boards, with significant contributions from Asia (NT$14.51 billion) and domestic markets (NT$21.86 billion). The net profit margin displays a notable trend, reflecting the company's financial efficiency in its operations.

Nan Ya Printed Circuit Board Corporation, amid a challenging year, proposed significant changes to its bylaws and affirmed a TWD 1 per share dividend, reflecting its commitment to shareholder returns despite a sales drop from TWD 42.25 billion to TWD 32.28 billion. The company's earnings plummeted from TWD 5.82 billion to just TWD 203.73 million, underscoring severe profitability challenges. However, with an expected annual earnings growth of 89.3%, Nan Ya appears poised for a robust recovery, outpacing Taiwan's market growth forecast of 14.3%. This potential turnaround is critical as the company navigates through market volatilities and aims for future stability and growth in the tech sector.

Where To Now?

- Unlock more gems! Our Asian High Growth Tech and AI Stocks screener has unearthed 493 more companies for you to explore.Click here to unveil our expertly curated list of 496 Asian High Growth Tech and AI Stocks.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nan Ya Printed Circuit Board might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:8046

Nan Ya Printed Circuit Board

Manufactures and sells printed circuit boards (PCBs) in Taiwan, the United States, Mainland China, Korea, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives