- China

- /

- Consumer Durables

- /

- SZSE:002351

Exploring Undiscovered Gems with Strong Potential In December 2024

Reviewed by Simply Wall St

As global markets continue to reach record highs, with the Russell 2000 Index hitting a new peak, small-cap stocks are gaining attention amid shifting domestic policies and geopolitical developments. In this dynamic environment, identifying undiscovered gems requires a keen eye for companies that demonstrate resilience and growth potential despite broader economic uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Eagle Financial Services | 170.75% | 12.30% | 1.92% | ★★★★★★ |

| Morris State Bancshares | 17.84% | 4.83% | 6.58% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Nanjing Well Pharmaceutical GroupLtd | 25.29% | 10.45% | 0.43% | ★★★★★☆ |

| Sinomag Technology | 46.22% | 16.92% | 3.72% | ★★★★★☆ |

| Transnational Corporation of Nigeria | 45.51% | 31.42% | 58.48% | ★★★★★☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Guangzhou Guangri StockLtd (SHSE:600894)

Simply Wall St Value Rating: ★★★★★☆

Overview: Guangzhou Guangri Stock Co., Ltd. is a Chinese company that manufactures and sells elevators and related parts, with a market cap of CN¥11.02 billion.

Operations: The company's primary revenue streams are derived from the manufacturing and sale of elevators and related parts. It has a market capitalization of CN¥11.02 billion, indicating its significant presence in the industry.

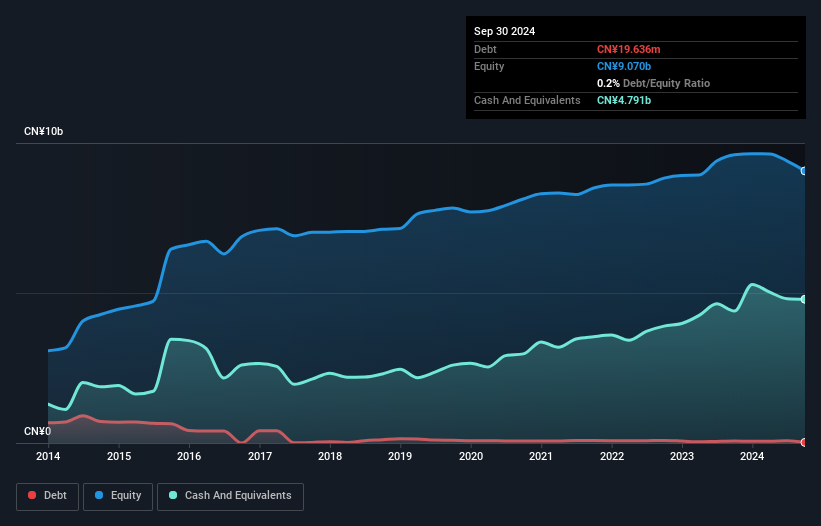

Guangzhou Guangri, a notable player in the machinery sector, showcases impressive earnings growth of 38.1% over the past year, outpacing the industry's -0.4%. Despite a dip in sales to CNY 4.94 billion from CNY 5.36 billion last year, net income rose to CNY 545 million from CNY 500 million, reflecting its high-quality earnings. The company repurchased shares worth CNY 56 million recently and trades at about 5.8% below estimated fair value, indicating potential for investors seeking undervalued opportunities. Its debt-to-equity ratio has significantly improved from 1.2 to just 0.2 over five years, highlighting financial prudence.

- Click to explore a detailed breakdown of our findings in Guangzhou Guangri StockLtd's health report.

Edifier Technology (SZSE:002351)

Simply Wall St Value Rating: ★★★★★★

Overview: Edifier Technology Co., Ltd. designs, produces, and sells audio equipment in China with a market cap of CN¥14.32 billion.

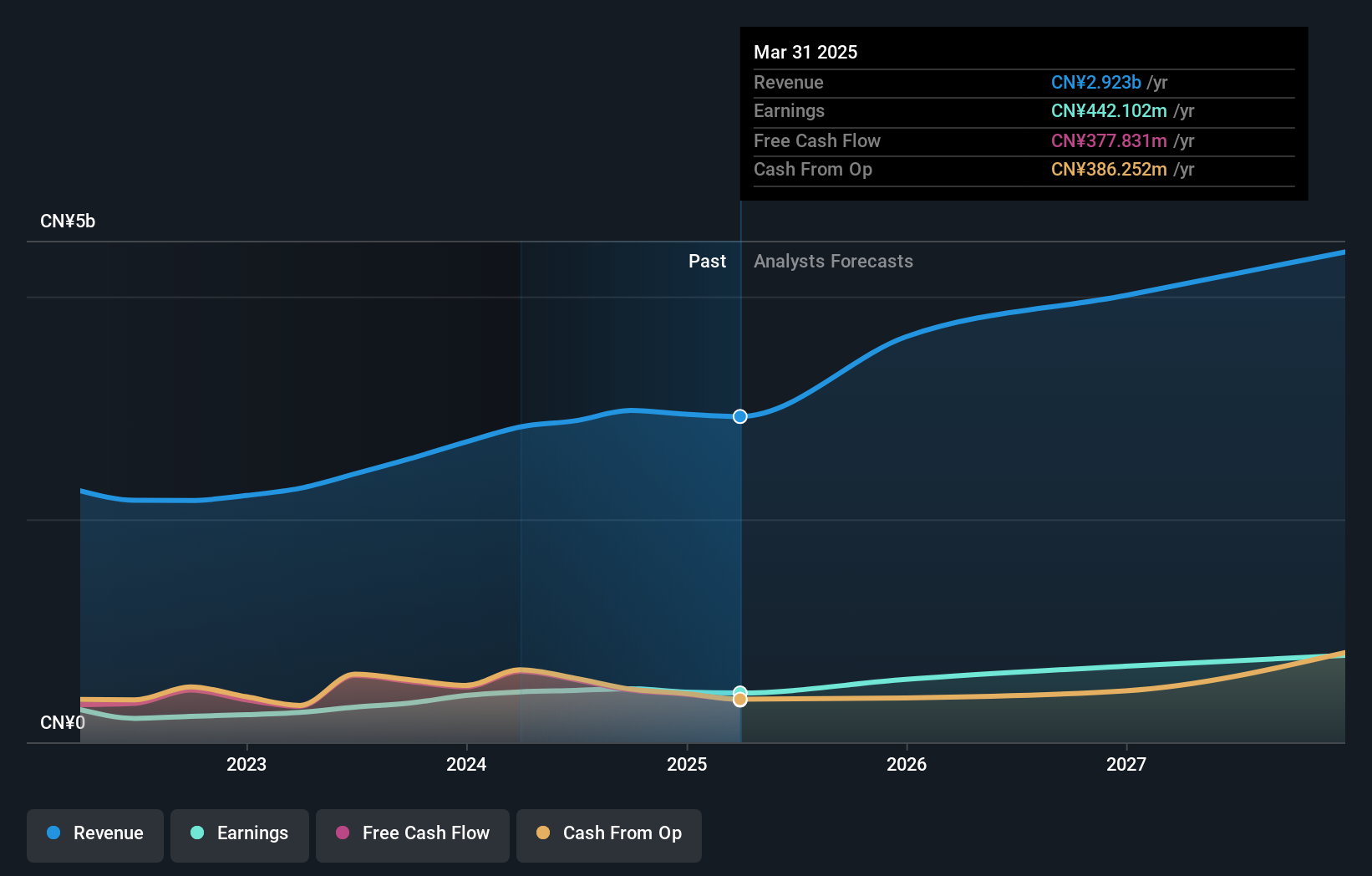

Operations: Edifier Technology generates revenue primarily from its E-Pneumatic segment, which recorded CN¥2.98 billion. The company's financial performance is characterized by its market cap of CN¥14.32 billion.

Edifier Technology, a promising player in the tech scene, has shown impressive financial health with a debt-to-equity ratio dropping from 0.7% to 0.4% over five years, indicating prudent financial management. The company reported earnings growth of 36.4%, outpacing the Consumer Durables industry which saw a -0.2% change, and maintains high-quality earnings with free cash flow staying positive at CNY 636.72 million as of June 2024. Recent product launches like the M60 speakers highlight innovation and market responsiveness, while share buybacks totaling CNY 60.24 million reflect confidence in its valuation below the CN market average P/E ratio of 36x at just 31x.

- Take a closer look at Edifier Technology's potential here in our health report.

Understand Edifier Technology's track record by examining our Past report.

Flaircomm Microelectronics (SZSE:301600)

Simply Wall St Value Rating: ★★★★★★

Overview: Flaircomm Microelectronics, Inc. focuses on developing and selling wireless communication modules, embedded software, and turnkey system solutions for automotive and M2M applications in China with a market cap of CN¥5.18 billion.

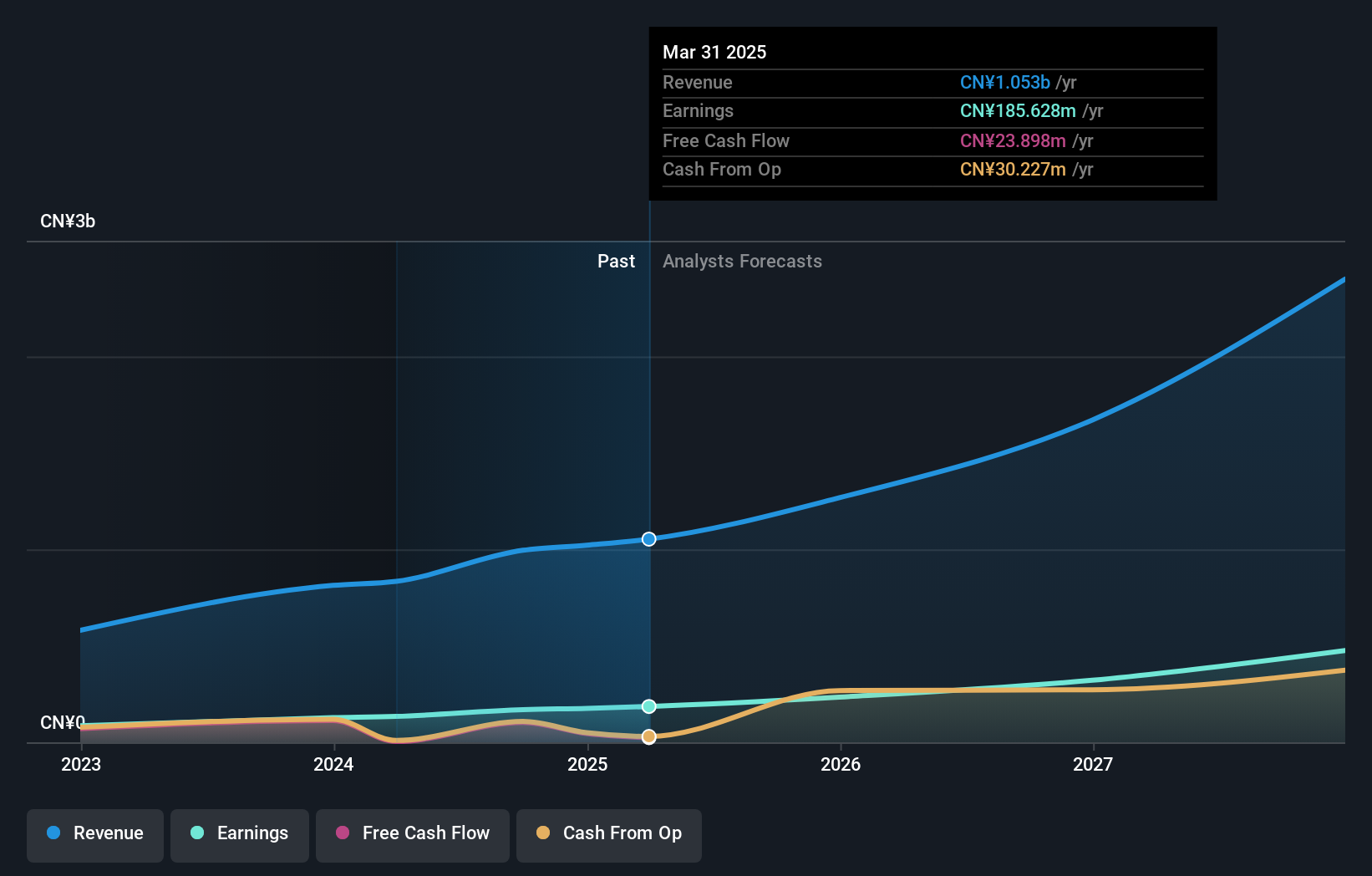

Operations: The primary revenue stream for Flaircomm Microelectronics comes from its wireless communications equipment, generating CN¥995.17 million. The company's financial performance is notably marked by a focus on this segment, contributing significantly to its overall market presence.

Flaircomm Microelectronics, a nimble player in the tech space, has been making waves with its impressive earnings growth of 44.7% over the past year, outpacing the broader Communications industry which saw a dip of 3%. The company's recent IPO raised CNY 699 million, showcasing investor confidence. With sales climbing to CNY 734.85 million for the first nine months of 2024 from CNY 552.83 million last year and net income rising to CNY 134.87 million from CNY 93.19 million, Flaircomm is on a solid trajectory despite share price volatility in recent months and no debt concerns on its balance sheet.

Taking Advantage

- Discover the full array of 4630 Undiscovered Gems With Strong Fundamentals right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Edifier Technology, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Edifier Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002351

Edifier Technology

Designs, produces, and sells audio equipment in China.

Flawless balance sheet with solid track record and pays a dividend.