- China

- /

- Communications

- /

- SZSE:301600

Discover 3 Undiscovered Gems To Enhance Your Investment Strategy

Reviewed by Simply Wall St

In the current global market landscape, investors are navigating a complex environment marked by tariff uncertainties and mixed economic signals, with major indices like the S&P 500 experiencing slight declines amid these challenges. As manufacturing shows signs of recovery but job growth cools, small-cap stocks present unique opportunities for those looking to diversify their portfolios. In this context, identifying undiscovered gems—stocks that offer potential growth despite broader market volatility—can be an effective strategy to enhance your investment approach.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| SALUS Ljubljana d. d | 13.55% | 13.11% | 9.95% | ★★★★★★ |

| Changjiu Holdings | NA | 11.84% | 2.46% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tchaikapharma High Quality Medicines AD | 9.38% | 6.91% | 31.36% | ★★★★★★ |

| Yulie Sekuritas Indonesia | NA | 18.62% | 9.58% | ★★★★★★ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| Standard Chartered Bank Kenya | 9.32% | 12.22% | 22.08% | ★★★★☆☆ |

| Song Hong Garment | 62.50% | 3.80% | -5.84% | ★★★★☆☆ |

| Central Cooperative Bank AD | 4.88% | 37.94% | 537.05% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Guangxi Wuzhou Communications (SHSE:600368)

Simply Wall St Value Rating: ★★★★★☆

Overview: Guangxi Wuzhou Communications Co., Ltd. operates toll roads and has a market capitalization of CN¥7.15 billion.

Operations: The company generates revenue primarily from operating toll roads. Its financial performance is influenced by its cost structure, which includes expenses related to road maintenance and operations. The net profit margin shows an interesting trend, reflecting the company's efficiency in managing costs relative to its revenue.

Guangxi Wuzhou Communications, a smaller player in the infrastructure sector, presents an intriguing financial profile. The company's net debt to equity ratio stands at a satisfactory 28.1%, down significantly from 147.3% over five years, indicating improved financial health. Its earnings have grown modestly by 1.3% annually over the past five years but lagged behind industry growth last year with only a 0.7% increase compared to the sector's 4%. Trading at a price-to-earnings ratio of 11x, it offers value against the broader CN market average of 36.7x, suggesting potential upside for investors seeking undervalued opportunities.

- Take a closer look at Guangxi Wuzhou Communications' potential here in our health report.

Gain insights into Guangxi Wuzhou Communications' past trends and performance with our Past report.

EST Tools (SZSE:300488)

Simply Wall St Value Rating: ★★★★★☆

Overview: EST Tools Co., Ltd. focuses on the research, development, manufacture, and sale of cutting tools and precision spline gauges both in China and internationally, with a market cap of CN¥5.25 billion.

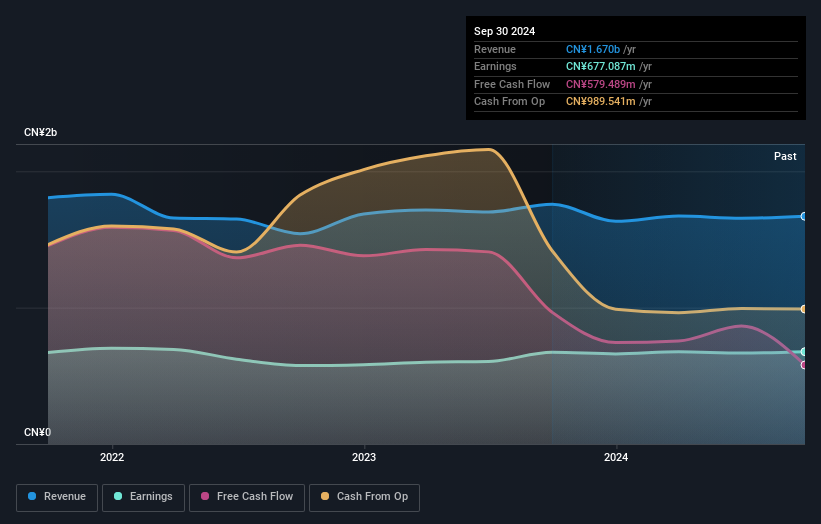

Operations: EST Tools generates revenue primarily from the sale of cutting tools and precision spline gauges. The company has experienced fluctuations in its net profit margin, reflecting variations in cost management and pricing strategies.

EST Tools, a promising player in its sector, has demonstrated robust earnings growth of 33.9% over the past year, outpacing the broader Machinery industry's -0.06%. The company’s debt-to-equity ratio has risen from 5.8% to 38.2% across five years but remains manageable with interest payments well-covered at an EBIT coverage of 18.9x. Notably, EST Tools completed a significant share buyback program repurchasing nearly three million shares for CNY 56.83 million as of January 2025, reflecting confidence in its financial health and future prospects despite recent share price volatility.

- Get an in-depth perspective on EST Tools' performance by reading our health report here.

Understand EST Tools' track record by examining our Past report.

Flaircomm Microelectronics (SZSE:301600)

Simply Wall St Value Rating: ★★★★★★

Overview: Flaircomm Microelectronics, Inc. develops and sells wireless communication modules, embedded software, and turnkey system solutions for automotive and M2M applications in China with a market cap of CN¥12.73 billion.

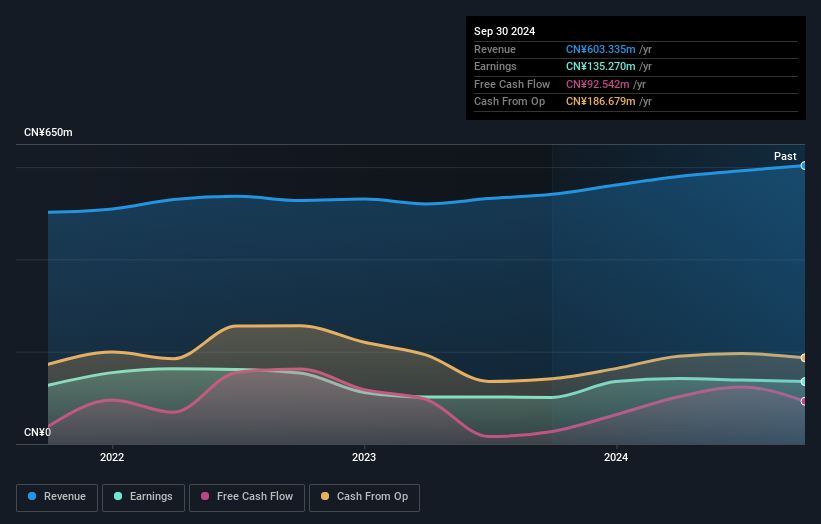

Operations: Flaircomm Microelectronics generates revenue primarily from its wireless communications equipment segment, totaling CN¥995.17 million. The company's financial performance is influenced by its cost structure and the dynamics of the wireless communication market in China.

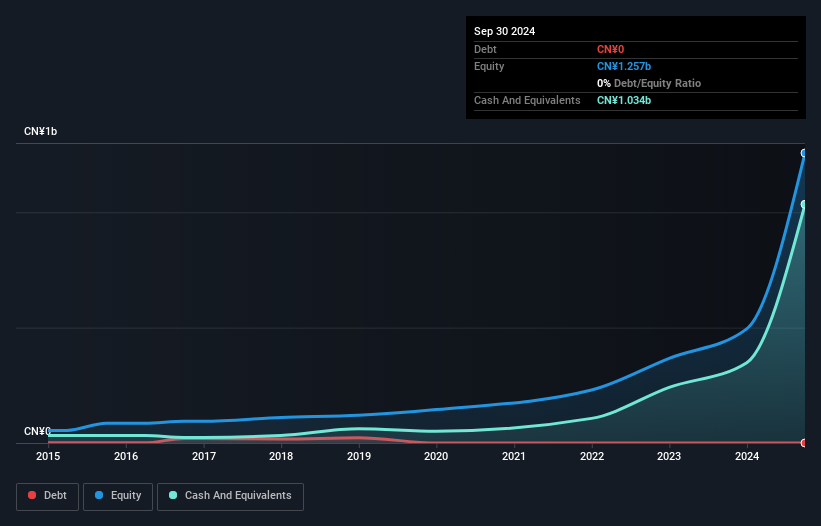

Flaircomm Microelectronics, a nimble player in its field, showcases impressive financial health with no debt on its books and a robust earnings growth of 44.7% last year, outpacing the Communications industry by a wide margin. The company is free cash flow positive, reporting US$102.59 million recently, which highlights operational efficiency. Despite this financial prowess, share price volatility over the past three months might concern some investors. High levels of non-cash earnings suggest quality in reported profits while future earnings are expected to grow at an annual rate of 30.78%, positioning Flaircomm for potential expansion in its market segment.

Seize The Opportunity

- Unlock more gems! Our Undiscovered Gems With Strong Fundamentals screener has unearthed 4689 more companies for you to explore.Click here to unveil our expertly curated list of 4692 Undiscovered Gems With Strong Fundamentals.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301600

Flaircomm Microelectronics

Develops and sells wireless communication modules, embedded software, and turnkey system solutions for automotive and M2M applications in China.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives