- China

- /

- Consumer Durables

- /

- SZSE:002981

Undiscovered Gems With Strong Fundamentals For February 2025

Reviewed by Simply Wall St

As global markets navigate through a period of uncertainty, marked by tariff tensions and mixed economic indicators, small-cap stocks have been experiencing varied impacts. Despite the challenges, the S&P 600 for small-cap stocks has shown resilience, prompting investors to seek out companies with solid fundamentals that can weather these turbulent times. In this context, identifying stocks with strong financial health and growth potential becomes crucial for those looking to capitalize on market opportunities amidst broader volatility.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Marítima de Inversiones | NA | 82.67% | 21.14% | ★★★★★★ |

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Oakworth Capital | 31.49% | 14.78% | 4.46% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| Aesler Grup Internasional | NA | -17.61% | -40.21% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 11.69% | 30.36% | ★★★★★☆ |

| Watt's | 70.56% | 7.69% | -0.53% | ★★★★★☆ |

| BOSQAR d.d | 94.35% | 39.11% | 23.56% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Risuntek (SZSE:002981)

Simply Wall St Value Rating: ★★★★★☆

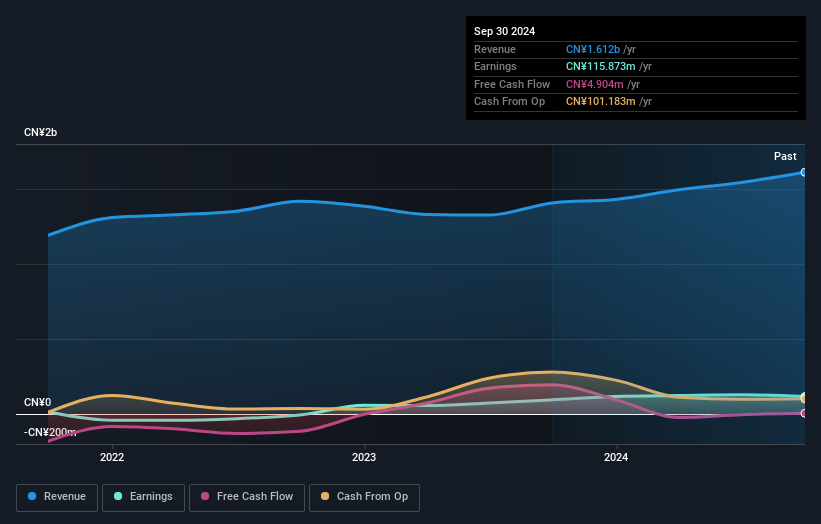

Overview: Risuntek Inc. engages in the research, development, manufacturing, and sale of electroacoustic products and components in China with a market cap of CN¥3.33 billion.

Operations: Risuntek generates revenue primarily from the sale of electroacoustic products and components. The company's net profit margin was 5.2% in the most recent reporting period.

Risuntek's Price-To-Earnings ratio of 28.8x is attractively below the CN market average of 36.7x, suggesting potential value. The company's earnings growth in the past year reached 22.8%, outpacing the Consumer Durables industry's -1.9%. Its net debt to equity ratio stands at a satisfactory 3.1%, indicating prudent financial management, although this has increased from 3.4% to 15.6% over five years, which could imply rising leverage concerns over time. With high-quality earnings and positive free cash flow, Risuntek seems well-positioned within its industry context for continued stability and potential growth opportunities ahead.

- Take a closer look at Risuntek's potential here in our health report.

Assess Risuntek's past performance with our detailed historical performance reports.

G.Tech Technology (SZSE:301503)

Simply Wall St Value Rating: ★★★★★★

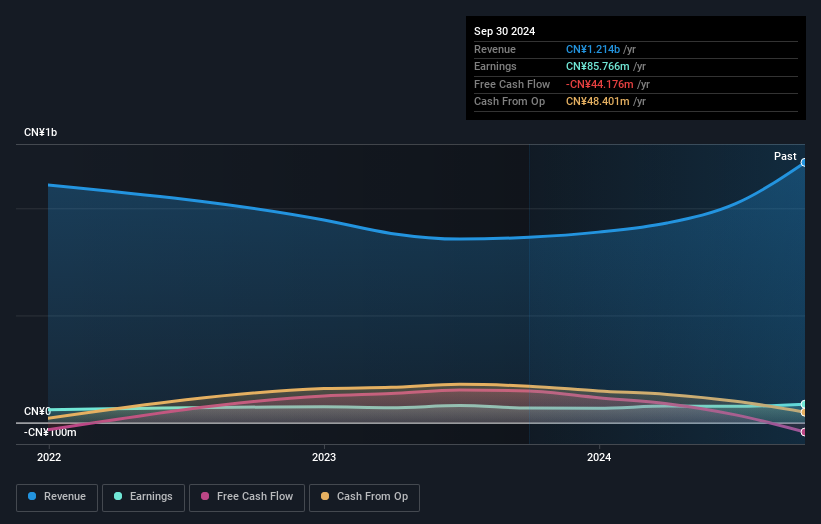

Overview: G.Tech Technology Ltd. develops, manufactures, and sells computer peripheral products in China with a market cap of CN¥3.30 billion.

Operations: G.Tech Technology generates revenue primarily from its computer peripherals segment, amounting to CN¥1.21 billion. The company's financial performance is influenced by its cost structure and market dynamics within the technology sector in China.

G.Tech Technology, a nimble player in the tech sector, showcases robust growth with earnings surging 26% last year, outpacing the industry's 3%. Its price-to-earnings ratio stands at 38.5x, favorably below the industry average of 60.2x. Despite high non-cash earnings and no debt burden over five years, G.Tech's free cash flow turned negative recently at US$44 million due to significant capital expenditure of US$93 million. Recent board changes might signal strategic shifts as new directors and supervisors have been elected. These dynamics position G.Tech as an intriguing prospect amidst its challenges and opportunities in a competitive landscape.

Cyber Power Systems (TWSE:3617)

Simply Wall St Value Rating: ★★★★★★

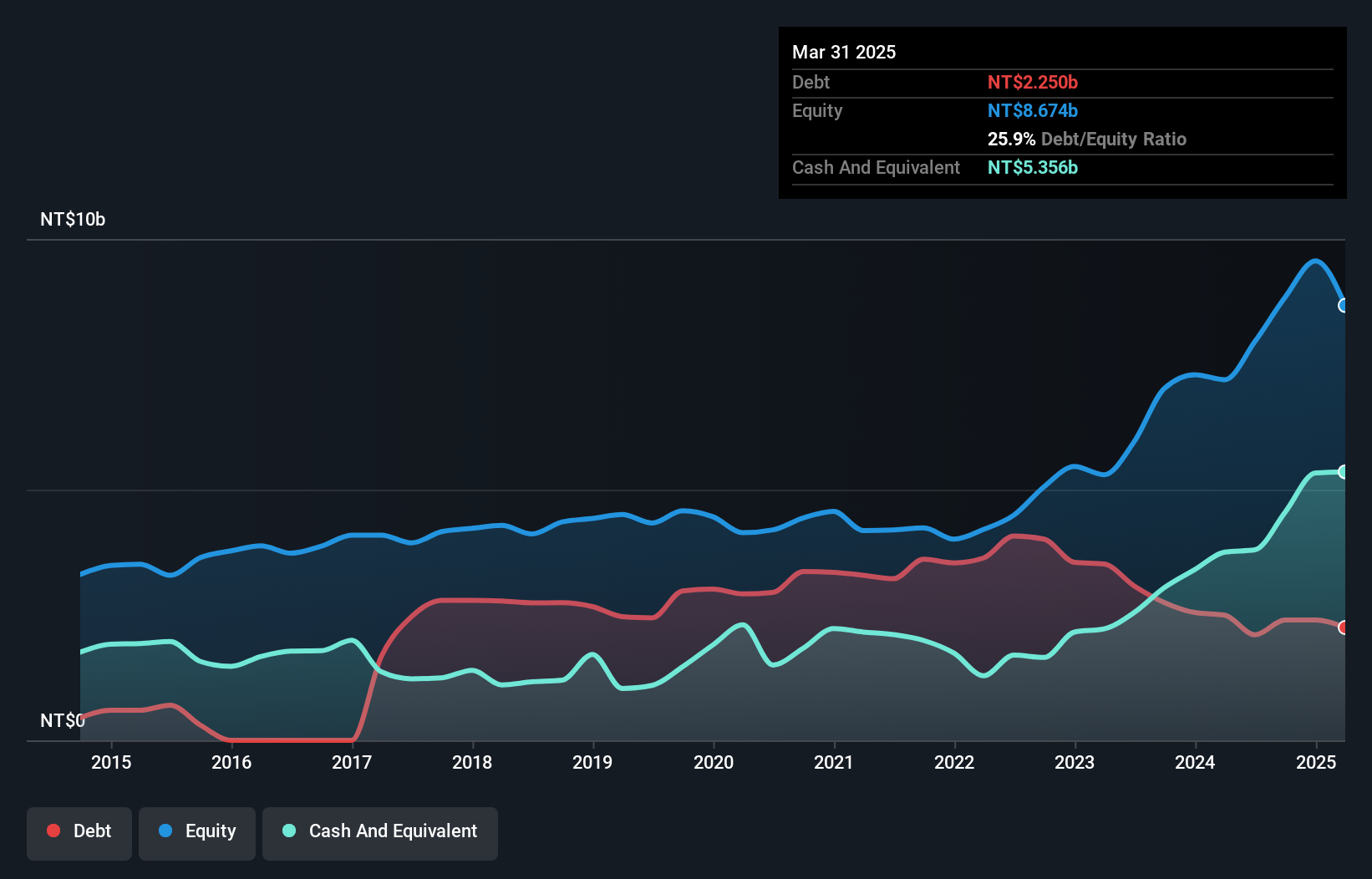

Overview: Cyber Power Systems, Inc. is a global company that designs, manufactures, and sells power protection products and computer peripheral accessories with a market cap of NT$31.50 billion.

Operations: The company generates revenue primarily from its Electric Equipment segment, amounting to NT$12.10 billion.

Cyber Power Systems is making waves with its impressive earnings growth of 39.3% over the past year, outpacing the Electrical industry’s 7.3%. This performance suggests high-quality earnings and positions it as a potential value play, trading at 37.2% below estimated fair value. The company has effectively managed its debt, reducing the debt-to-equity ratio from 65.1% to 27.1% in five years and generating positive free cash flow of TWD 2,098 million recently. Despite a volatile share price in recent months, Cyber Power's fundamentals appear robust with net income for Q3 rising to TWD 494 million from TWD 485 million last year.

- Click here and access our complete health analysis report to understand the dynamics of Cyber Power Systems.

Evaluate Cyber Power Systems' historical performance by accessing our past performance report.

Make It Happen

- Investigate our full lineup of 4697 Undiscovered Gems With Strong Fundamentals right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002981

Risuntek

Researches, develops, manufactures, and sells electroacoustic products and components in China.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives