- China

- /

- Communications

- /

- SZSE:301419

Shanghai Allied Industrial Co., Ltd's (SZSE:301419) On An Uptrend But Financial Prospects Look Pretty Weak: Is The Stock Overpriced?

Shanghai Allied Industrial's (SZSE:301419) stock is up by a considerable 26% over the past three months. However, we decided to pay close attention to its weak financials as we are doubtful that the current momentum will keep up, given the scenario. In this article, we decided to focus on Shanghai Allied Industrial's ROE.

Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors’ money. In other words, it is a profitability ratio which measures the rate of return on the capital provided by the company's shareholders.

View our latest analysis for Shanghai Allied Industrial

How Do You Calculate Return On Equity?

Return on equity can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Shanghai Allied Industrial is:

2.7% = CN¥25m ÷ CN¥928m (Based on the trailing twelve months to September 2024).

The 'return' is the amount earned after tax over the last twelve months. That means that for every CN¥1 worth of shareholders' equity, the company generated CN¥0.03 in profit.

Why Is ROE Important For Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

Shanghai Allied Industrial's Earnings Growth And 2.7% ROE

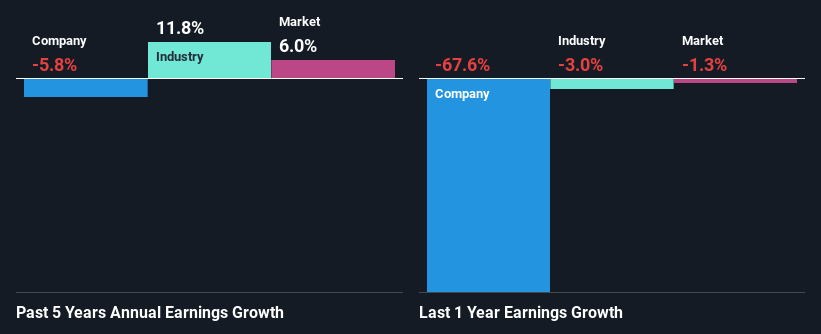

It is hard to argue that Shanghai Allied Industrial's ROE is much good in and of itself. Even compared to the average industry ROE of 5.6%, the company's ROE is quite dismal. For this reason, Shanghai Allied Industrial's five year net income decline of 5.8% is not surprising given its lower ROE. We believe that there also might be other aspects that are negatively influencing the company's earnings prospects. Such as - low earnings retention or poor allocation of capital.

That being said, we compared Shanghai Allied Industrial's performance with the industry and were concerned when we found that while the company has shrunk its earnings, the industry has grown its earnings at a rate of 12% in the same 5-year period.

Earnings growth is a huge factor in stock valuation. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. This then helps them determine if the stock is placed for a bright or bleak future. If you're wondering about Shanghai Allied Industrial's's valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

Is Shanghai Allied Industrial Making Efficient Use Of Its Profits?

Shanghai Allied Industrial's declining earnings is not surprising given how the company is spending most of its profits in paying dividends, judging by its three-year median payout ratio of 69% (or a retention ratio of 31%). With only a little being reinvested into the business, earnings growth would obviously be low or non-existent. You can see the 5 risks we have identified for Shanghai Allied Industrial by visiting our risks dashboard for free on our platform here.

In addition, Shanghai Allied Industrial only recently started paying a dividend so the management probably decided the shareholders prefer dividends even though earnings have been shrinking.

Conclusion

Overall, we would be extremely cautious before making any decision on Shanghai Allied Industrial. The company has seen a lack of earnings growth as a result of retaining very little profits and whatever little it does retain, is being reinvested at a very low rate of return. Until now, we have only just grazed the surface of the company's past performance by looking at the company's fundamentals. You can do your own research on Shanghai Allied Industrial and see how it has performed in the past by looking at this FREE detailed graph of past earnings, revenue and cash flows.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:301419

Shanghai Allied Industrial

Shanghai Allied Industrial Co., Ltd in the research and design, manufacture, and sale of high polymer materials and related products.

Flawless balance sheet moderate.