- China

- /

- Communications

- /

- SZSE:301165

Improved Revenues Required Before Ruijie Networks Co., Ltd. (SZSE:301165) Stock's 54% Jump Looks Justified

Despite an already strong run, Ruijie Networks Co., Ltd. (SZSE:301165) shares have been powering on, with a gain of 54% in the last thirty days. The last month tops off a massive increase of 111% in the last year.

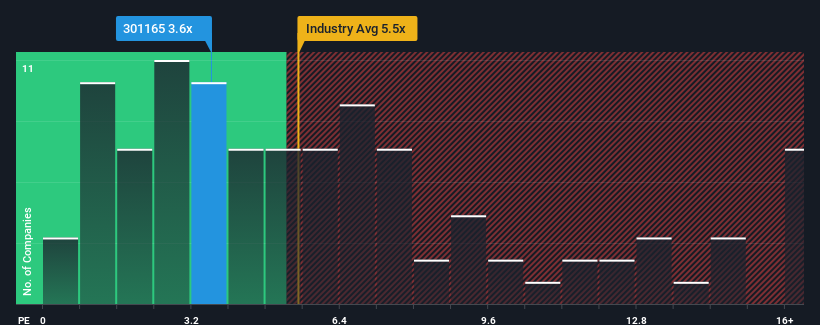

Although its price has surged higher, Ruijie Networks may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 3.6x, since almost half of all companies in the Communications industry in China have P/S ratios greater than 5.5x and even P/S higher than 9x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for Ruijie Networks

What Does Ruijie Networks' Recent Performance Look Like?

With revenue growth that's inferior to most other companies of late, Ruijie Networks has been relatively sluggish. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Keen to find out how analysts think Ruijie Networks' future stacks up against the industry? In that case, our free report is a great place to start.How Is Ruijie Networks' Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as Ruijie Networks' is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. Although pleasingly revenue has lifted 30% in aggregate from three years ago, notwithstanding the last 12 months. So while the company has done a solid job in the past, it's somewhat concerning to see revenue growth decline as much as it has.

Looking ahead now, revenue is anticipated to climb by 19% during the coming year according to the seven analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 36%, which is noticeably more attractive.

With this information, we can see why Ruijie Networks is trading at a P/S lower than the industry. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What We Can Learn From Ruijie Networks' P/S?

The latest share price surge wasn't enough to lift Ruijie Networks' P/S close to the industry median. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Ruijie Networks maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Ruijie Networks (1 can't be ignored) you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:301165

Ruijie Networks

Engages in the research and development, design, and sales of network equipment, network security products, and cloud desktop solutions in China and internationally.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)