- China

- /

- Electronic Equipment and Components

- /

- SZSE:301129

Why Investors Shouldn't Be Surprised By Runa Smart Equipment Co., Ltd.'s (SZSE:301129) P/S

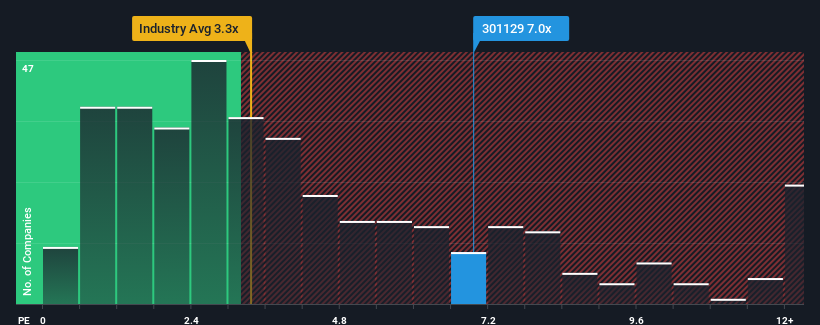

Runa Smart Equipment Co., Ltd.'s (SZSE:301129) price-to-sales (or "P/S") ratio of 7x may look like a poor investment opportunity when you consider close to half the companies in the Electronic industry in China have P/S ratios below 3.3x. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Runa Smart Equipment

How Runa Smart Equipment Has Been Performing

While the industry has experienced revenue growth lately, Runa Smart Equipment's revenue has gone into reverse gear, which is not great. Perhaps the market is expecting the poor revenue to reverse, justifying it's current high P/S.. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Runa Smart Equipment's future stacks up against the industry? In that case, our free report is a great place to start.How Is Runa Smart Equipment's Revenue Growth Trending?

Runa Smart Equipment's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Retrospectively, the last year delivered a frustrating 40% decrease to the company's top line. The last three years don't look nice either as the company has shrunk revenue by 9.6% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 245% during the coming year according to the one analyst following the company. Meanwhile, the rest of the industry is forecast to only expand by 26%, which is noticeably less attractive.

With this in mind, it's not hard to understand why Runa Smart Equipment's P/S is high relative to its industry peers. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On Runa Smart Equipment's P/S

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our look into Runa Smart Equipment shows that its P/S ratio remains high on the merit of its strong future revenues. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

Don't forget that there may be other risks. For instance, we've identified 4 warning signs for Runa Smart Equipment (1 is significant) you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:301129

High growth potential with excellent balance sheet.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026