- China

- /

- Electronic Equipment and Components

- /

- SZSE:300811

High Growth Tech Stocks Including POCO Holding And Two Others

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by fluctuating consumer confidence and mixed economic indicators, technology stocks continue to capture investor attention, with the Nasdaq Composite showing notable gains despite recent volatility. In this environment, identifying high-growth tech stocks like POCO Holding requires a focus on companies that demonstrate robust innovation potential and resilience in adapting to shifting market dynamics.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Pharma Mar | 25.43% | 56.19% | ★★★★★★ |

| Medley | 25.57% | 31.67% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| CD Projekt | 24.92% | 27.00% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

Click here to see the full list of 1269 stocks from our High Growth Tech and AI Stocks screener.

We're going to check out a few of the best picks from our screener tool.

POCO Holding (SZSE:300811)

Simply Wall St Growth Rating: ★★★★★☆

Overview: POCO Holding Co., Ltd. specializes in the development, production, and sale of alloy soft magnetic powder and core components for electronic equipment, with a market capitalization of CN¥15.96 billion.

Operations: POCO Holding focuses on alloy soft magnetic powder and core components, catering to electronic equipment manufacturers. The company's revenue is derived from the sale of these specialized materials, which are integral to the functionality of various electronic devices.

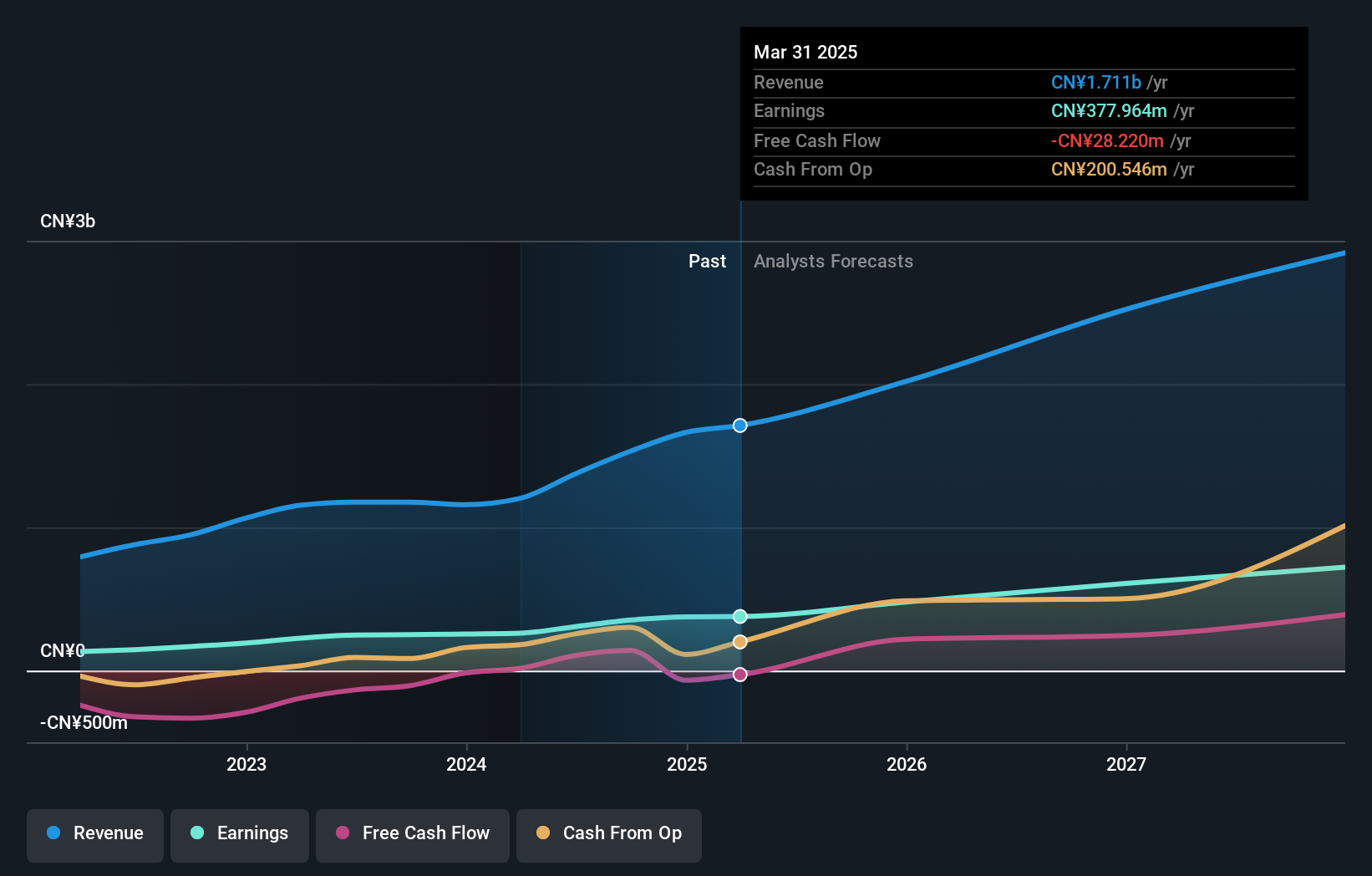

POCO Holding has demonstrated robust growth with a 41% increase in earnings over the past year, significantly outpacing the electronic industry's average of 1.9%. This performance is underpinned by a solid revenue surge to CNY 1.23 billion, up from CNY 854.13 million, reflecting a year-on-year growth of about 25.6%. The company's commitment to innovation is evident in its R&D investments, crucial for sustaining its competitive edge in the rapidly evolving tech landscape. With earnings projected to grow by another 26.6% annually, POCO Holding is not only expanding faster than its market projections but also enhancing shareholder value through strategic reinvestments and robust financial health indicators like positive free cash flow and high-quality earnings.

Runa Smart Equipment (SZSE:301129)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Runa Smart Equipment Co., Ltd. specializes in providing urban smart heating solutions in China and has a market capitalization of CN¥3.94 billion.

Operations: Runa Smart Equipment Co., Ltd. focuses on urban smart heating solutions in China, with revenue primarily derived from the sale and implementation of these systems. The company operates within a market capitalization of approximately CN¥3.94 billion, indicating its significant presence in the industry.

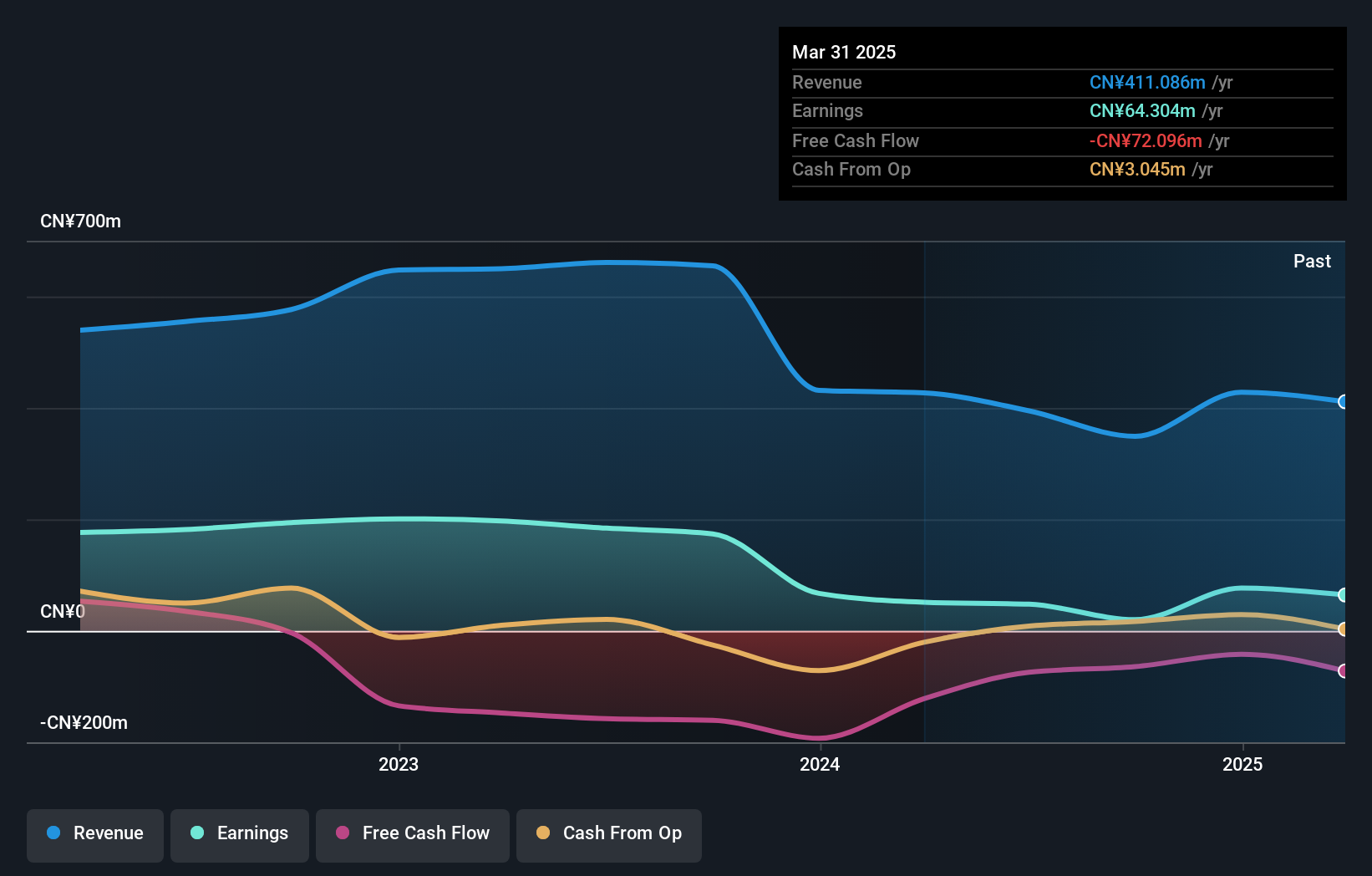

Runa Smart Equipment's recent financial performance reveals a challenging landscape with revenue dropping to CNY 98.33 million from CNY 180.74 million year-over-year and transitioning from a net profit of CNY 8.03 million to a net loss of CNY 39.15 million. Despite these hurdles, the company's commitment to innovation remains robust, as evidenced by an aggressive R&D investment strategy aimed at reinvigorating its product line and market position. This strategic focus is crucial as the company aims to navigate through its current financial volatility and recalibrate for future growth in the highly competitive tech sector, where rapid innovation cycles are often key to sustainability and success.

- Unlock comprehensive insights into our analysis of Runa Smart Equipment stock in this health report.

Nanjing Wavelength Opto-Electronic Science & TechnologyLtd (SZSE:301421)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Nanjing Wavelength Opto-Electronic Science & Technology Co., Ltd. specializes in the development and manufacturing of laser systems and components, with a market capitalization of CN¥6.07 billion.

Operations: The company generates revenue primarily from its laser systems and components segment, amounting to CN¥379.25 million.

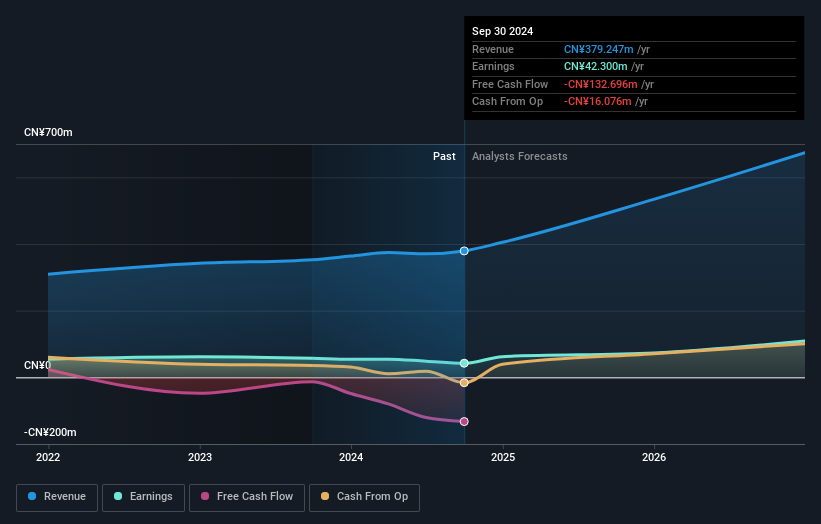

Nanjing Wavelength Opto-Electronic Science & Technology Co., Ltd. has demonstrated a robust growth trajectory with a 26.4% annual increase in revenue, outpacing the broader Chinese market's growth rate of 13.7%. Despite facing challenges such as a decline in net income from CNY 42.64 million to CNY 30.82 million over the past nine months, the company is poised for substantial earnings expansion, projected at an impressive rate of 36.8% per annum. This financial resilience is underpinned by strategic R&D investments that remain integral to its competitive edge in the rapidly evolving tech landscape, especially noted during their recent special shareholders meeting which focused on reallocating funds to fuel these innovations further.

Summing It All Up

- Navigate through the entire inventory of 1269 High Growth Tech and AI Stocks here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300811

POCO Holding

Develops, produces, and sells alloy soft magnetic powder, and alloy soft magnetic core and related inductance components for the downstream users of electricity electronic equipment.

Flawless balance sheet with high growth potential.